Revised threshold will do little to combat high prices and inflation, Yu Ran reports from Shanghai.

Zhao Hengming, who works in a Nanjing factory, is a frugal man. He welcomes changes to the income tax that will put more money in his pocket, but the way he manages his money will remain unchanged.

|

|

Zhao Hengming, who works half-days at a machinery factory, sets out every afternoon for nearby markets in Nanjing, Jiangsu province. He usually compares prices at several markets to be sure he gets the best bargain.?[Photo / China Daily] |

A monthly income of about 4,500 yuan ($704) is enough to support his wife and son - and allow him to put away 2,500 yuan every month.

The State Council in April proposed raising the income tax threshold from 2,000 yuan to 3,000 yuan in a bid to boost consumer spending and ease the tax burden on low-wage earners. In June it decided to raise the proposed threshold to 3,500 yuan a month.

It also reduced the tax rate for the lowest income earners from 5 percent to 3 percent.

The adjustment takes effect on Sept 1 and will cut the number of taxpayers from 84 million to 24 million.

The government expects to take in 160 billion yuan less in income tax annually.

"Under the new amendment, about 7.7 percent of wage earners will have to pay tax, down from the current 28 percent," said Zhang Bin, a professor at the Institute of Finance and Trade Economics, Chinese Academy of Social Sciences.

Zhang said income taxes are designed to narrow wealth gaps but that in reality, middle- and low-income earners feel the impact of taxes more than higher earners. He said the tax threshold needed to be raised to make it fairer.

China introduced the personal income tax in 1980, requiring payment by everyone earning at least 800 yuan a month. The threshold was raised to 1,600 yuan in 2006 and to 2,000 yuan in 2008.

Part of the State Council's goal, an increase in consumer spending, has already occurred. According to the National Bureau of Statistics, retail sales in the first six months of this year reached 8.58 trillion yuan, up 16.8 percent from last year.

But inflation has increased, too. The bureau reported this month that the country's Consumer Price Index, a main gauge of inflation, hit 6.5 percent in July, up from 3.3 percent a year earlier and from a three-year high of 6.4 percent in June.

Since most people's wages have not increased accordingly, "the tax policy will have certain limited effects on a few people, but won't change the lives of residents tremendously," Zhang said.

How they manage

|

|

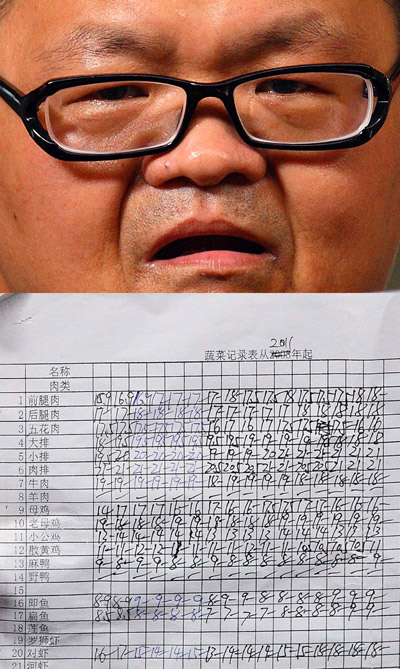

Zhao notes the prices of vegetables every day. He will benefit when changes in the personal income tax begin Sept 1.[Photo/China Daily] |

Zhao, in Nanjing, is a prime example. His family can expect to pay about 150 yuan less in income tax next month, but he will hold to a routine that works for him.

"The best time for buying vegetables is before 8 am or after 8 pm in the supermarket, where sales are available. And it's better to buy meat after 4 pm at a food market where you can bargain with the sellers," he said.

Zhao, 50, started working half-days six years ago when production slowed at the machinery plant. Because his afternoons are free, he can compare the prices of food and daily products in different markets to make sure that what he buys is the cheapest.

He stays alert to information about discounts, and notices when prices change on everything from food and small commodities to clothes and appliances. He started eating more chicken than pork when the price of pork jumped nearly 60 percent early this year.

"Neither inflation nor the better personal tax policy will change my attitude toward saving money," Zhao said. "It is most essential for a family to keep and make good use of its fortune."

Kang Shiyang, 24, who teaches at a college in Shanghai, earns 2,500 yuan a month, which means he will directly benefit from the changes. Under normal circumstances, he is able to save about 500 yuan each month.

However, he said, "The new personal tax policy will not ease the high pressure from inflation and dramatically increasing consumption in the city, where it's nearly impossible for low-income people to survive.

"I've never expected that the improved tax policy will increase the amount in my saving account, so I have to be thrifty by eating less and riding bicycles instead of taking more expensive transportation," Kang said.

"I try to avoid going out for social activities with friends after work or during the weekend to save money for dating my girlfriend and preparing for a future family."

Ji Yanhong, 43, a cleaner at a commercial building in Shanghai, didn't know where her income put her on the tax tables. The hours and shifts she works change frequently, so her monthly pay varies, too. "I didn't notice how much had been deducted as personal tax."

After being told that her take-home pay will increase slightly next month, Ji felt delighted. She can save a few hundred yuan more to buy snacks for her children.

"More money is better than nothing, so I recognize it as a piece of good news for me," Ji said. "Hopefully there will be more benefits offered to us low-income workers in the future."

Chen Yang, a 25-year-old salesman, moved to Shanghai from Hubei province more than a year ago. He sees the 300 or so yuan he won't pay in tax every month as a drop in the bucket.

"My current monthly salary is 2,500 yuan including a bonus, and the basic expenses of rent, food and transportation nearly cost 2,000 yuan if I don't go out for any activities or short-distance travel."

To save money and send some to his parents, Chen chose to minimize his cost of rent and food as the main method to cut expenses.

He lives in a 5-square-meter room in a four-room apartment, sharing the bathroom and kitchen with 10 other people, and his rent and other bills run to 850 yuan a month. "The living conditions are much better than I used to have, when I had to share a tiny room with two other roommates."

'Double renting'

|

|

Zhao notes the prices of vegetables every day. He will benefit when changes in the personal income tax begin Sept 1.[Photo/China Daily] |

Some middle-class white-collar workers who earn higher incomes and own property have found a creative way to save money. "There has been an obvious increase in 'secondhand landlords'," said Ying Jie, a sales manager for a property agency in Shenzhen.

If a single person owns a three-bedroom apartment in downtown Shenzhen and puts it up for rent, Ying said, he will receive at least 8,000 yuan as monthly rent income. He can rent a one-bedroom apartment to live in outside downtown for about 3,000 yuan, which means he can earn 5,000 yuan from his own property.

"Most of these clients told me they had to take all their chances to make profits and save money in order to pay increasingly higher taxes for everything and handle severe inflation," Ying said.

Doubts, expectations

Data from the Ministry of Finance show that total national tax revenue for the first six months this year exceeded 5 trillion yuan, which was 29.6 percent higher than a year earlier. That includes the value-added tax, which is included in the price of many items, in addition to personal income tax.

Residents doubt that the coming reduction in the tax on salaries will come close to compensating for the high VAT they pay in daily life, said Ma Hongman, an economist at the Shanghai Academy of Social Sciences.

Ma also said the income threshold is too low to benefit most residents of first-tier cities, such as Beijing, Shanghai and Guangzhou. Their salaries are higher because they live in places where the living costs are high.

Liu Zi, a sales assistant at a cinema in Chengdu, Sichuan province, does not expect the higher taxation threshold to keep middle- and low-income citizens from poverty.

"When people buy goods in supermarkets and restaurants, they pay a lot in taxes without being aware of it, which is what burdens low-income families in real life." Liu said the value-added taxes on food, medicine, clothes and other daily necessities should be cut along with the income taxes.

Experts also suggested that the income levels and living standards in different cities throughout China should be considered to provide a more balanced tax policy.

"Overall," Zhang said, "the coming amendment of personal tax policies is a good sign that China is making the first move toward tax reform, which obviously will lead to a more complete and comprehensive plan to benefit citizens."