Permanent housing solution needs action across the board

Chief Executive Carrie Lam Cheng Yuet-ngor will soon deliver her first Policy Address; the housing issue will be an important part of the policy paper.

Hong Kong's housing issue comprises three aspects. One is land supply - increasing land supply will help bring housing prices down as land price is a decisive factor in housing prices; housing prices cannot be cut without lowering land prices first. Another aspect is more public housing, including public rental housing and subsidized housing. A third aspect is suppressing the market price of private housing to let more Hong Kong residents, especially young people, who do not qualify for either public or subsidized housing to realize their dream of becoming homeowners sooner rather than later.

There are two other housing matters Hong Kong needs to address. One is to readjust the industrial structure to ease the economy's overreliance on the real-estate industry; the other is that the government needs to expand its sources of revenue to reduce its reliance on land sales and profits from real-estate-related businesses.

The fourth-term special administrative region government only carried out some policies designed to address the housing issue itself but not other matters related to housing-shortage resolutions, or wanted to but could not. Even in addressing the housing issue itself the fourth-term administration overlooked a very important point - it approached the above-mentioned three aspects separately instead of treating them as a coherent mechanism. Specifically, while increasing land supply and public housing separately, it did not cut the link between the free-market housing price and public housing rent and/or subsidized housing price.

Currently an existing policy allows public rental housing occupants to own their housing units after completing certain procedures, meaning they can put their public housing units on the free market as private property once they have satisfied the financial and legal requirements. Meanwhile, both public housing rent and subsidized housing price reference their counterparts on the free market. At a time when free-market housing rent and price keep rising, so do public housing rent and subsidized housing prices, defeating the purpose of public housing.

For example, the Hong Kong Housing Society is scheduled to sell two subsidized housing development projects, in Tseung Kwan O and Tuen Mun respectively, with 620 units measuring between 280 and 600 square feet each. Those units will sell at about 70 percent of the free-market price. The larger than 600 square foot units can cost HK$5 million each. It is hard to imagine any family qualified for subsidized housing can afford one.

That is why the government must stop referencing free-market prices and rents when deciding public housing rents and subsidized housing prices, or there is no way to really help families in need move into decent apartments and become homeowners eventually.

As such it is certainly good news that the fifth-term CE will unveil a plan to build residential units exclusively for Hong Kong permanent residents new to the homeownership game. Lam last week said the new "locals first" subsidized housing scheme is designed to help mainly young couples who are not qualified for the existing subsidized housing scheme become homeowners for the first time. People familiar with the plan say the new units would not follow the existing scheme, priced at 70 percent of free-market price. However, because the units under the new scheme will cost less than 70 percent of market price, there will be more limits on the future owners' ability to resell them when they become legal owners, such as a ban on free-market resale.

It is predicted the first-time homebuyers subsidized housing scheme (Starter Home scheme) will be very popular among qualified families, which is why the government needs to consider the next step toward resolving Hong Kong's housing issue once and for all by addressing the three key aspects and two related factors mentioned above with a multi-pronged comprehensive policy solution.

It is hoped the Task Force on Land Supply which Lam appointed will reach consensus on land-supply solutions sooner rather than later so Hong Kong's land-supply situation will improve for real.

Increasing land supply alone won't be enough to cut home prices. To cut housing prices, Hong Kong needs to speed up the structural transformation of local industries.

Hong Kong's private housing prices have reached new highs repeatedly in recent years, mainly because of persistent low interest rates and the local economy's overreliance on the real-estate industry for GDP growth, making the property market a de facto "oligopoly".

Low interest rates are a result of persistent excessive liquidity in the global financial market and the fact Hong Kong's banking system has more savings than loans because of a lack of new economic hot spots, forcing banks to maintain low rates in order to make more loans, sometimes even after the United States Federal Reserve raised its basic interest rates. That means Hong Kong must step up its economic restructuring by adding new growth engines to reduce its heavy reliance on the property market.

(HK Edition 09/13/2017 page5)

Today's Top News

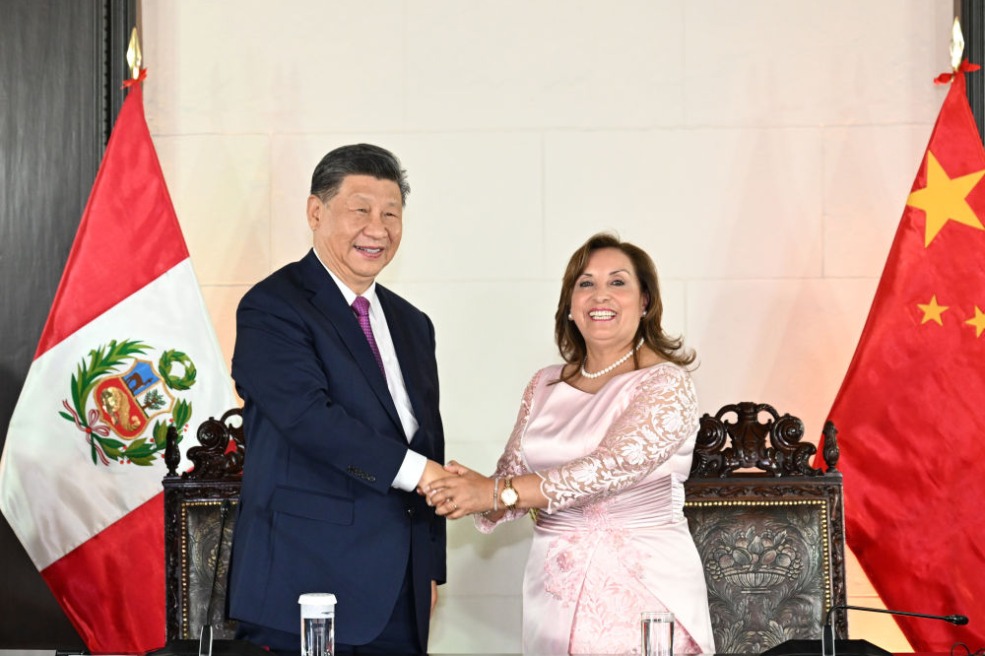

- China, Peru to deepen comprehensive strategic partnership

- Preferential tax policy implemented to spur residential property sector

- Xi, Peruvian President Boluarte attend opening ceremony of Chancay Port via video

- Guideline to help 2025 grads find jobs

- US firms bullish on China's industrial transformation

- Global solidarity badly needed in fight against climate change