'Sweet science' audience grows

Even without HBO on board, the ring is undergoing a seismic shift in terms of television coverage

ATLANTIC CITY, New Jersey-Dmitry Bivol knew where he wanted to go in his boxing career-straight to the top of one of the HBO cards he used to watch replays of while growing up in Russia.

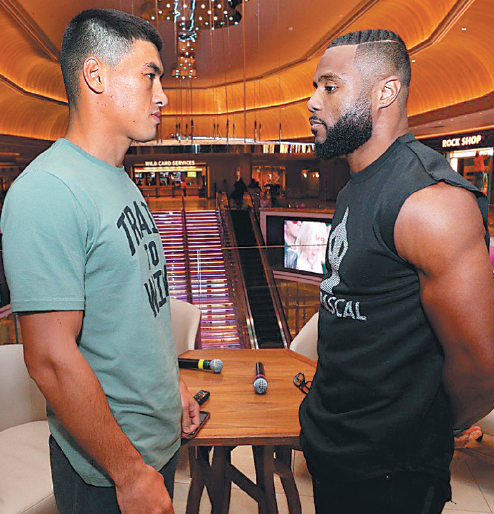

Now Bivol (14-0, 11 KO) is the WBA's light heavyweight world champion, and on Saturday he'll headline HBO's final World Championship Boxing telecast when he meets former champ Jean Pascal of Canada in Atlantic City.

The fight is big for Bivol, but for boxing fans the occasion is bittersweet.

After 45 years, HBO is pulling the plug on its premium coverage of the "sweet science."

First, though, Bivol gets his shot to shine.

"It was my dream to do this," Bivol said on Thursday. "We had a couple of offers to fight on another channel, another platform. But I took this chance to realize my dream."

HBO-which launched its boxing coverage with George Foreman taking the world heavyweight title from Joe Frazier in 1973-said it is abandoning the ring because research shows the sport doesn't increase subscriptions to the premium network.

Boxing fans need not worry, though, because plenty of others are entering the mix.

There's a seismic shift in the sport, which for years relied on HBO and Showtime for top fights, and pay-per-view for the biggest fights. HBO is leaving, but other networks and platforms are rushing to fill the gap.

That includes longtime rival Showtime, which is looking for ways to expand its boxing offerings.

"We know it drives business, we know it attracts ratings," said Stephen Espinoza, president of Showtime Sports.

"We have a long history in the sport and believe in it. If anything, we're becoming more active and looking for more fights."

Indeed, the demand for live programming is prompting a lot of broadcasters to take a look at boxing once again. And they're making plans to show fights on everything from free television to subscription streaming apps.

Superstar middleweight Canelo Alvarez, who had been a big attraction for HBO, last month signed a deal to fight exclusively on the streaming service DAZN through 2023.

Though all details weren't revealed, the contract is believed to be an 11-fight deal worth a staggering minimum of $365 million for Alvarez, whose last fight with Gennady Golovkin was televised on HBO pay-per-view.

Instead of paying $85 for one pay-per-view fight, fans can buy DAZN for a monthly fee of $9.99. The service has also locked up British world heavyweight champion Anthony Joshua, along with a number of other fighters from Oscar De La Hoya's Golden Boy Promotions and Joshua's British promoter, Matchroom Sport.

"This is huge for boxing, huge for Canelo and huge for Golden Boy," De La Hoya said when the deal was announced. "Golden Boy is at the forefront of something very monumental for the sport of boxing."

Here's a look at some of the ways boxing will be presented-and sold-in the coming months:

SHOWTIME: The premium cable network was Floyd Mayweather's television partner for the biggest grossing fights of his career and is aggressively pursuing top fights.

One of those takes place on Dec 1 when WBA heavyweight champion Deontay Wilder defends his crown against former champ Tyson Fury, while Manny Pacquiao returns in January to fight Adrien Broner. Both will be pay-per-view events.

ESPN: The biggest sports network is so bullish on boxing it tore up a four-year deal with Top Rank signed last year and replaced it with a new seven-year pact.

ESPN has agreed to televise 54 live boxing events a year in addition to other ring-related programming. Some of the fights will be on ESPN, building on the success of its Saturday night fight series, while others will be on the ESPN+ streaming app.

FOX: Fox agreed last month to a four-year multiplatform deal with Premier Boxing Champions that will feature 10 "marquee fight nights" annually on the Fox network, with 12 more cards to air on Fox Sports 1 and Fox Deportes each year.

The network recently announced it will also hold its first boxing pay-per-view, with Mikey Garcia meeting Errol Spence on March 16 at AT&T Stadium in Texas.

DAZN: The streaming service, which launched in the US in September, inked its first deal with Matchroom Sport, which promotes Joshua and other top British fighters. It upped the ante with the Alvarez signing, with his first fight set for Dec 15 against Rocky Fielding.

DAZN (pronounced 'Da Zone') will also be televising a weeknight baseball cut-in show under a recently announced $100 million a year deal with MLB.

NBC: The network is expected to announce a deal with promoter Main Events to broadcast fights both on the main network and the NBC sports network.

The explosion of new deals means boxing will be available in more places and more ways than ever before.

Some of it will be on free TV, though the new streaming models will cost monthly fees and some of the biggest fights will still only be on pay-per-view.

Boxing fans can look forward to many more hours of their favorite sport on TV, though some of the bigger fights might be more difficult to make because fighters are tied to different networks and promoters.

There's also the risk that there will be so much televised boxing that the fights will look like filler material, though Espinoza believes there is room for everyone at the table.

"I think it's good for the health of the sport to have multiple networks and platforms to be on," he said.

So far, the fighters themselves seem to agree with that. Bivol certainly does, as he looks forward to the bidding for his talents after he headlines the final HBO card.

"I'm glad there are many platforms going to show boxing. It's good for our sport," he said.

"We now have some offers from other platforms and after the fight we'll decide which one to pick."

Most Popular

- Chinese table tennis stars Fan and Chen quit world rankings

- Embiid stands tall against Celtics, despite pregame fall

- Wemby scores 42 in a memorable Xmas debut, but Spurs fall short

- Mahomes throws 3 TDs as Chiefs clinch top seed

- Littler is a big deal

- Thohir determined to take Indonesia back to World Cup