Helping mainland firms expand in Africa

The project is of great significance for promoting local economic growth and improving people's livelihoods.

In June, China's Silk Road Fund, a State-owned investment fund established to facilitate the Belt and Road Initiative, signed an agreement to purchase a 49-percent stake in ACWA Power Renewable Energy Holding Ltd. This renewable energy platform of ACWA Power has a massive pipeline of renewable energy projects across the region.

The BRI, together with China's rising middle-income group, joint ventures and new infrastructure projects, are expected to be key drivers of bilateral trade and investment between China and the United Arab Emirates, said Hamad Buamim, president and CEO of the Dubai Chamber of Commerce and Industry, in an interview with China Daily earlier this year.

Bilateral trade between the two countries is estimated to reach $70 billion by 2020, up from $45.92 billion in 2018.

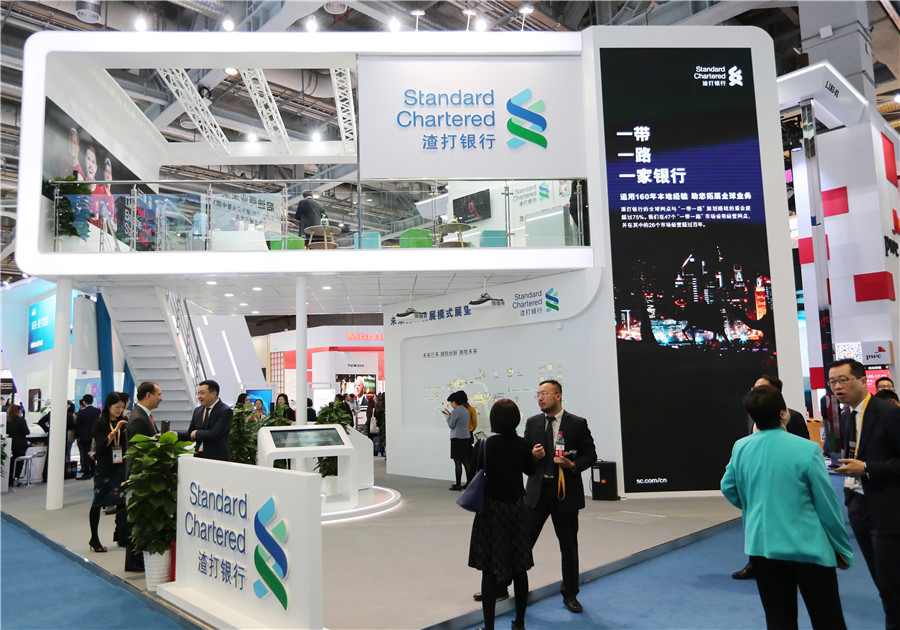

Since the BRI started, Standard Chartered has increased its partnerships with Chinese banks and companies to drive the initiative.

"As a bank, we believe in responsible business. We focus on environmentally sustainable principles and ensure that our partners also do the same ... Our partnership is beyond just transactions. It also includes shared values and principles of banking," said Bola Adesola, senior vice-chairman for Africa at Standard Chartered.

With outlets in 47 BRI markets, the bank has operated in 26 of them for more than 100 years. It has set up China Desks providing 24/7 Mandarin language banking services in up to 20 BRI economies to support the business expansion of Chinese companies.

The BRI has created huge opportunities for countries in the Middle East and Africa. Most of the airports in Africa have been renovated - in some cases, built afresh or expanded - by Chinese companies.

"It used to take more than 2.5 hours to get from the airport to the city center of Kampala, the capital of Uganda, until China Communications Construction Company built an expressway from the airport to the city center, which has cut the commuting time down to 30 minutes," said Tejinder Singh, regional head of global subsidiaries in Africa at Standard Chartered.

In Kenya, it was difficult to travel from Nairobi to the coastal city of Mombasa. Therefore, a lot of the tourism was focused on overseas tourists coming into the country as opposed to domestic tourists. With the completion of a 457-km standard-gauge railway, of which the prime contractor was China Road and Bridge Corporation, one can now go from Nairobi to Mombasa in 4.5 hours.

Standard Chartered offered the project participants a range of solutions including issuance of performance guarantees, collection and payment solutions, and digital banking platforms.

"A lot of domestic Kenyans are now traveling to the coast, which has also provided a huge lift to the economy of that particular coastal region. Today, hotels are full and we are seeing a lot more infrastructure development taking place along the coast, thanks to the communication links and affordable travel having been enabled," Singh said.

Despite the risks of investing in emerging markets, such as the risks associated with policy, geopolitics and foreign exchange, Standard Chartered still encourages its clients to take a long-term view in the countries where they operate.

"What we do is, we partner with the clients end-to-end once they enter a market - from contract negotiations all the way to repatriation of investments. We help them identify and mitigate the risks, and clarify rules and policies that apply to the business for them," said Adesola.

"We found that Chinese companies do not just come in and go out. When they come into a country and are involved in a project, they are there for the long term. The longer they are in that type of situation, the more they benefit the community and uplift livelihoods in those countries."