Brand-building in the time of trade row

Local labels work on their visibility, strive to go global despite competition

Huawei, Xiaomi, Haier, TCL, DJI, Vivo, Oppo, OnePlus, ICBC, Air China, Tsingtao, UnionPay-the list of internationally known Chinese brands is getting longer as more and more successful domestic companies expand by going global, in the process realizing that top-notch branding is not a nice-to-have option anymore but the key to survival.

If global brands such as Apple, Adidas, Nike, Uniqlo, Zara, and Converse could capture consumer imagination and loyalty in China, isn't it time that Chinese brands, too, should go global to command similar adulation in overseas markets?

Driven by such sentiments, Chinese companies, marketing gurus aver, are pulling out all the stops to complement their tangible strengths-massive scale of manufacturing, financial muscle, innovation capability and the mega opportunity to serve the world through the Belt and Road Initiative-with the soft power of brands.

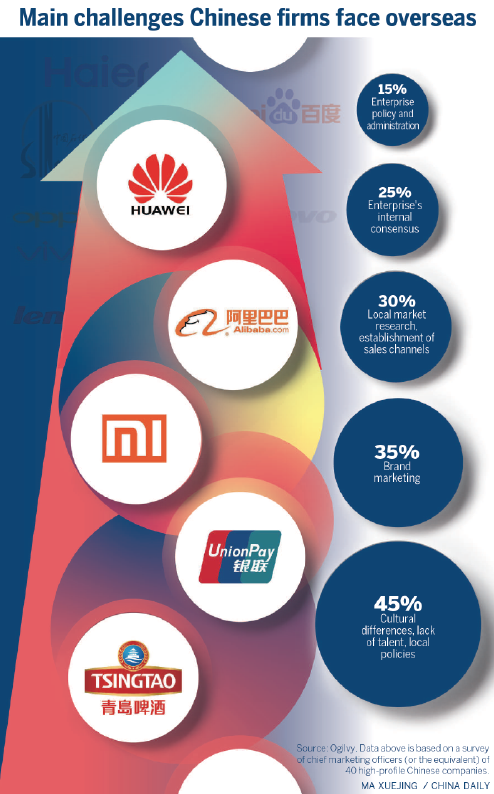

A recent Ogilvy report based on the survey of chief marketing officers (or the equivalent) of 40 high-profile Chinese companies revealed as much.

"We believe Chinese brands have tremendous growth potential globally," said Chris Reitermann, Asia and China CEO of global marketing agency Ogilvy. "An early commitment and focus on a brand strategy that guides all overseas efforts will enable Chinese brands to develop a more sustainable business abroad."

The Ogilvy report identified the key drivers for Chinese enterprises' outbound expansion. They are seeking new markets for growth, to survive in spite of stiff domestic competition and to acquire advanced technologies.

Yet, except for the already famous Chinese brands such as Huawei, Haier and Xiaomi, newcomers from China on the global stage initially tended to rely not on branding but on distribution, manufacturing, even mergers and acquisitions.

But now, branding is increasingly becoming a game-changer in shaping consumer perceptions, especially as a growing protectionist sentiment looms over the global economy, making any outbound decisions more prudent, said Reitermann.

"I do think a lot of companies have underestimated the value of a clearly defined brand in getting people to understand who this company is, what this company does, and what its values are," he said.

The transformed macroeconomic environment is pushing companies to shift from the traditional M&A route to growth to more organic, green-field investment, and that makes a "clearly-defined brand" a necessity, he said.

Agreed Deng Delong, global president of consultancy Trout & Partners, which specializes in brand positioning. He believed the global distribution of assets will be conducive to world economy at large, and also accords with Chinese companies' goals of seeking new growth opportunities.

But instead of expanding recklessly overseas, brands should first identify local needs, position themselves accordingly and prove their relevance, he said.

"Especially amid economic uncertainties, a strong and unique brand proposition will entitle companies unparalleled pricing power. This would put them in an advantageous position even amid trade disputes," Deng said.

Realizing that branding calls for deep pockets, many Chinese companies are taking a gradual approach by working with overseas partners first to make an impact.

For instance, K Boxing, a Shanghai-based manufacturer of menswear, hosted three major garment shows overseas. It is looking to tap into local industry players abroad, supply chain partners, and get the attention of international media, said the company's CEO Hong Boming.

"We don't want to just 'rush' into the global scene before we are fully prepared, especially on the branding front," said Hong. "Branding isn't simply about helping sell products to a global audience. It's about conveying the brand DNA, concepts and our unique characteristics."

Other endeavors include teaming up with world-renowned design teams from Italy and the United Kingdom, and rolling out limited-editions, co-branded products, in conjunction with Marvel, the global comics and movie brand, he said.

"To influence is to engage… And it's not a one-off campaign but something ingrained in our business strategy."

That's a lesson young Chinese brands are learning from the more experienced ones.

Prophet, a global branding and marketing consultancy, recently compiled its latest Brand Relevance Index, which stated that phone and telecom equipment maker Huawei, drone king DJI and tech giant Xiaomi are among the strongest-performing Chinese brands on the global stage.

"Huawei has made some smart moves with sponsorships (Leica), marketing (leveraging global celebrities in advertising), and products (focusing on camera leadership)," said Jay Milliken, senior partner and Asia regional lead at Prophet.

"We've seen strong performance of Huawei outside China this year, with the branding achieving No 37 in Germany."

According to Milliken, ideally a brand should focus on being relevant to its core consumer target. The biggest challenge for Chinese companies going global in the future is going to be more about "Brand China" than the individual company's brand.

Meanwhile, given the current trade frictions between China and the United States, Chinese brands will need to take a thoughtful approach to global expansion-that is, they should choose countries or regions where consumer perception of Chinese brands is higher and where geopolitical tensions are lower.

"Xiaomi is a good example of this strategy. It has made a concerted effort to grow its mobile phone business in India and now enjoys the largest share of that market," said Milliken.

All in all, Chinese businesses have made great attempts to build brands globally, which is reflected in their adjusted setup of marketing functions, and the increasing sophistication of business leaders in their understanding of branding. Nevertheless, they still have a long way to go before they could even think of outshining their global competitors.

Respondents in the Ogilvy survey identified local policy, cultural differences and lack of talent as the top three challenges facing their overseas operations. While different in nature, these challenges all stem from one overarching cause: lack of brand-building investment.

Reitermann underscored the value of building a consistent brand platform to secure license to operate, establish trust with local stakeholders and foster a corporate culture that attracts top local talent.

"The gap still lies in the discrepancy between the grand vision held by senior executives and various entities within the organization handling day-to-day businesses, he said.

Experts also pointed out that Chinese brands should consider the amount of localization they need to undertake to be successful outside of their home market.

"Western brands that have entered China have learned that they need to tailor their business and brand strategy to the China market and the same will hold true for Chinese brands that want to go global," said Milliken.

He referred to possible paths to success. One is the so-called dual-brand strategy, meaning that companies operate under different names in domestic and overseas markets.

A case in point is technology media firm Bytedance, which runs short video app dubbed Douyin in China but TikTok outside of China. This leaves much autonomy for the overseas team to carry out locally relevant operations.

Another approach is to forge partnership with trusted overseas partners, which is best reflected in Huawei's tie-up with Leica and DJI's collaboration with Microsoft.

But brand-building is bound to be a long-term cause, said Reitermann. "It will probably take Chinese companies another 10 years to get there."