Economy rebounding after drop

China's economy experienced a deep contraction in the first quarter due to disruptions caused by the novel coronavirus outbreak, but major economic indicators improved substantially in March, indicating the country's recovery has gained a firmer footing, officials and economists said on Friday.

Supportive government policies are expected to intensify in the coming quarters to expand domestic demand by stimulating investment and consumption as the global spread of the virus may bring more headwinds to the world's second-largest economy.

China's GDP in the first quarter contracted by 6.8 percent from a year earlier, according to the National Bureau of Statistics.

While it remains unclear whether the government will still set a GDP growth target for the year, economists said China's policy priority for the next step needs to focus on stimulating demand and stabilizing employment to facilitate a sustainable economic recovery.

More proactive fiscal policies and more accommodative monetary policies are needed to prevent the economy from experiencing a second wave of disruptions caused by the global economic downturn amid the COVID-19 outbreak, they added.

The country's industrial production shrank by 8.4 percent year-on-year in the first quarter, but the decline narrowed from a 13.5 percent drop in the first two months, according to the NBS.

Fixed-asset investment, which includes infrastructure and real estate investment, declined by 16.1 percent year-on-year during the first quarter, compared with a 24.5 percent plunge in the first two months.

The outbreak created a severe blow to the country's economy in the first quarter, but major economic indicators rebounded in March and the country's economic performance will improve further in the second quarter, NBS spokesman Mao Shengyong said at a news conference in Beijing on Friday.

The government will step up policy support to expand domestic demand by increasing effective investment and releasing consumption potential. More tax relief and financial aid will be offered to businesses to help them resume production and make it through the difficult times, Mao said.

The Chinese stock market rose on Friday with the benchmark Shanghai Composite Index up by 0.66 percent to close at 2,838.49 points as the first-quarter economic contraction was broadly in line with investors' expectations.

Lian Ping, chief economist at Zhixin Investment, said the government needs to intensify policy support to prevent the economy from suffering a second wave of blows from the global economic downturn and possible collapse of external demand.

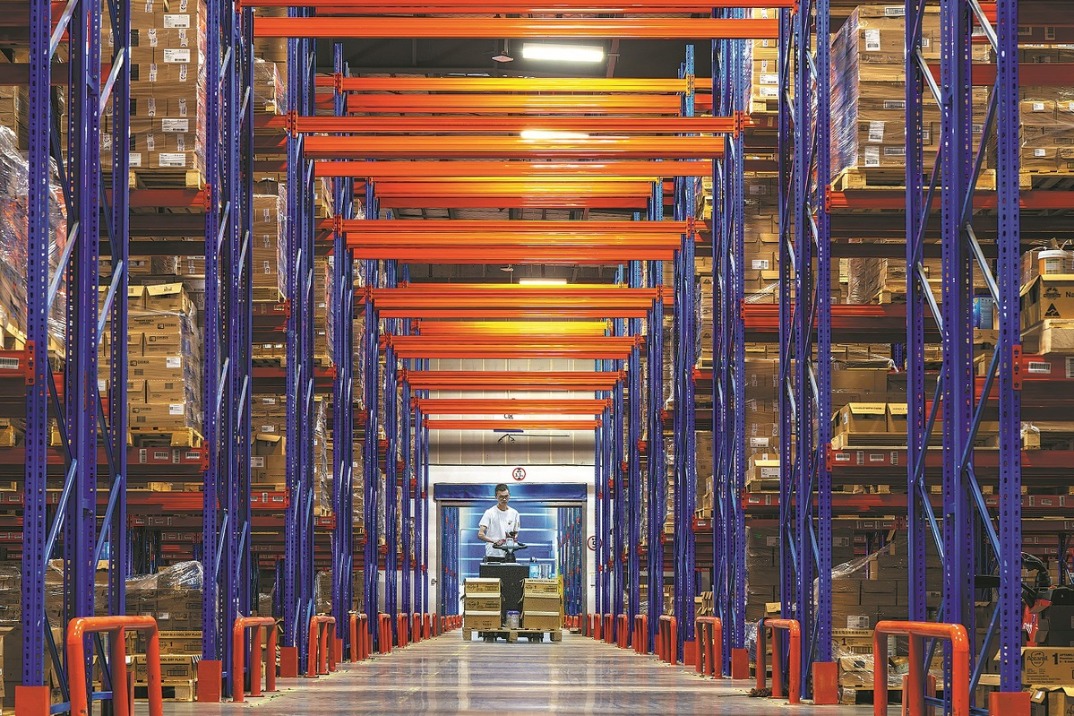

Chinese companies, including exporters, have seen an increase in cancellations of orders. While most large enterprises have resumed production, according to NBS calculations, many smaller companies are still struggling to resume work under rising financial difficulties and labor shortages.

"As overseas demand is shrinking dramatically, China's policy focus in the future should be on expanding domestic demand, and consumption is the most important area. More favorable policies are needed to stimulate consumption in durable goods including houses and automobiles," Lian said.

Retail sales dropped by 19 percent year-on-year in the first quarter, which indicated that domestic demand remains relatively weak and there is still room for policies to effectively boost households' consumption, economists said.

Urban household income declined by 3.9 percent year-on-year in the first quarter. The urban unemployment rate was 5.9 percent in March, down by 0.3 percentage point from February, according to the NBS.

"More support needs to be given to households as the decline of residents' income and risks associated with unemployment could affect households' long-term consumption," said Wu Chaoming, chief economist at Chasing Securities.

Steven Zhang, chief economist at Morgan Stanley Huaxin Securities, said the government will continue to increase fiscal spending by issuing special treasury bonds and raising the budget deficit ratio to provide more financing for major investment projects.

Meanwhile, the People's Bank of China, the central bank, will coordinate with the proactive fiscal policy to continue injecting more liquidity in the financial market and cutting interest rates to lower business financing cost, Zhang said.

The country's total financing reached a record level of 5.2 trillion yuan ($735 billion) in March, increasing 11.5 percent year-on-year, which was the fastest single-month growth in history. Credit growth is a positive sign that the Chinese economy is recovering as more companies are borrowing to facilitate their production resumption, economists said.