China should seize opportunities to make full use of homegrown tech

More importance should be attached to industries that feature higher investment and lower returns in order to stimulate economic growth in China, especially as COVID-19 abates in most parts of the country.

"National economy" level industries can be divided into four categories. The first features high input and output, the second high input and low output, the third boasts low input and output and the fourth has low input and high output. Proportion of different categories varies in accordance with the economic structure in different countries.

In most industries, other than a few exceptions including high-speed railways and 5G, China still occupies a limited market share compared with developed countries, especially on a per capita basis. Therefore, growth of the Chinese economy is driven by the overall potential of industries in all categories.

It means the driving force for the Chinese economy not only exists in the trendy "new infrastructure" sector, but also "traditional infrastructure", which also includes equipment renovation, agricultural production improvement and real estate.

However, for a long time, inflated expectations have been placed on category IV industries by following the practice of some developed countries. At the same time, the potential of other categories has been neglected.

The National Bureau of Statistics said the year-on-year growth of fixed asset investment has been decreasing over the past five years. It was 9.8 percent in 2015, 7.9 percent in 2016, 5.7 percent in 2017, 0.7 percent in 2018, and slumped by 13 percent last year.

These figures represent the challenges China is facing in modern times.

In fact, the scale of category I, II and III industries in China is much larger than that of category IV industries, while the category II sector includes many industries in their incubation periods. Their overall potential is often not sufficiently explored, and this slows overall economic growth.

The preference for industries with low input and high output has led to the sluggish economic growth in developed countries, too. In the United States, for example, there is great influence from the stock market, but this has led to the loss of much of its manufacturing base to overseas competitors. To make things worse, consequences of such preference and neglect are hard to notice when all parties are overly concerned with share prices. As time passes, people will get used to low economic growth and take the model of "low growth and high share prices" as the correct "high-quality development mode".

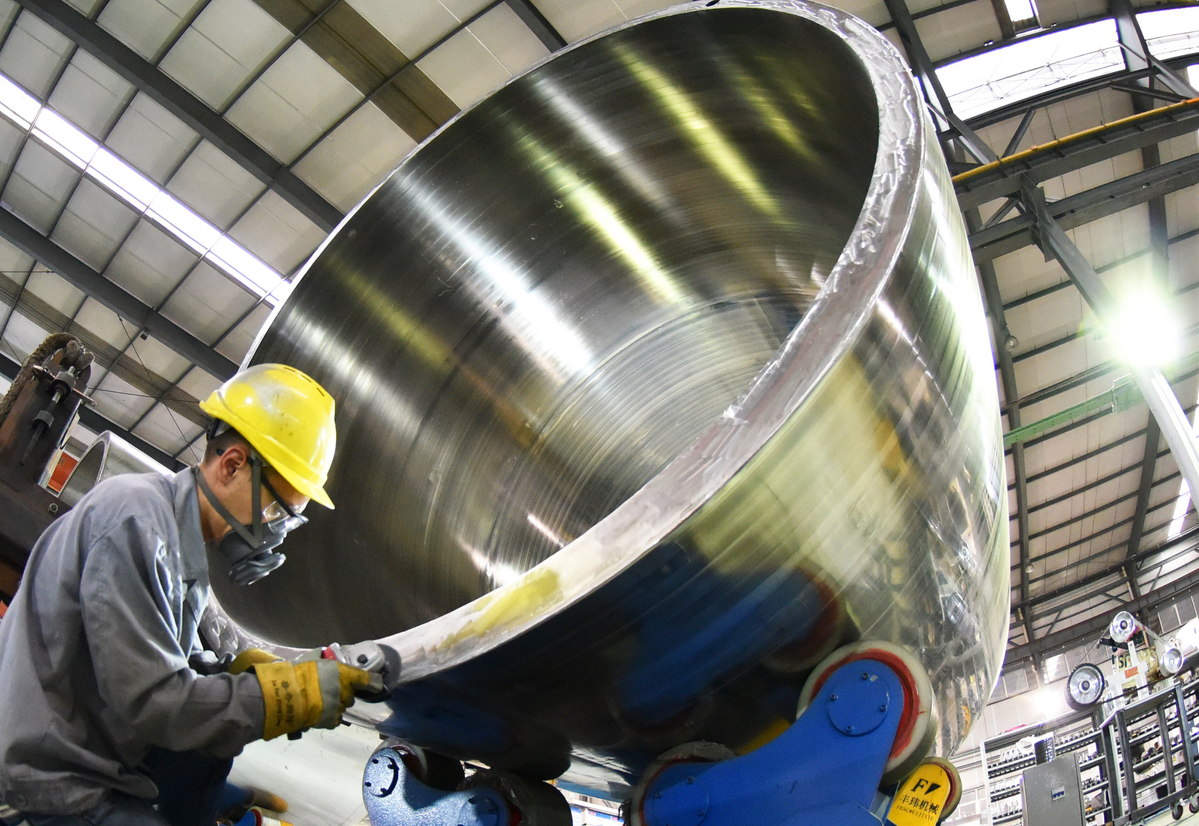

While category I and II industries still have great growth potential in China, they also require much investment. But they avoid placing high hopes on category IV industries or blindly cutting overcapacity. Industrial upgrading is not simply shutting down companies, but also providing them with technological upgrades. This in turn requires much input.

To further explore the growth potential of the Chinese economy, the key is to boost companies' technological innovation capabilities.

There is a misunderstanding that Chinese technologies cannot support rapid economic development amid intense competition from abroad. For one thing, China has the most complete and largest industrial system in the world and has made considerable progress in technological innovation. Achievements include high-speed railways, extra-high voltage, new energy (wind, solar, etc), nuclear power and high-performance computers. Therefore, barriers placed on China's technological progress from abroad will only have minimal to no substantial impact.

Additionally, China can also take countermeasures to mitigate the impact of foreign pressure. For example, considering the huge trade surplus China enjoys with the US, the latter can only affect China in terms of a few products like high-end chips. However, the US relies heavily on Chinese products for daily life. China's role is therefore difficult to replace in the short term. In other words, the one who loses more will not necessarily be China. The nature of the industrial chain is division of labor and cooperation. Even the most advanced sections cannot abandon coordination and support from other sections.

Of course, the most fundamental thing is to improve the technical competence of Chinese companies themselves. The relation between promoting independent technological innovation and introducing outside technological resources should be balanced. Relying on others' technologies alone will create inevitable limitations.

Boosting independent technological innovation can be led by the country's policies, companies, colleges and scientific institutes. Chinese companies should take determined efforts to boost these factors.

Since the reform and opening-up, most domestic companies have tended to follow the path of companies in developed countries-especially the industrial and innovation systems dominated by US enterprises-without sufficient emphasis placed on self-owned innovation. This can be seen by the fact that some Chinese companies are reluctant to use domestic technologies or parts. It's understandable when foreign technologies and parts are available in cases where local ones are not, or are comparatively substandard. But the situation has changed. The good news is that more Chinese companies, including Huawei, are actively seeking cooperation with domestic partners and building their own industrial and innovation systems.

The Chinese economy has huge development potential. We should take the right measures, seize opportunities in all industries and invest more to make full use of homegrown technologies.

The writer is a professor at the School of Economics and Management of Tsinghua University.