Economic rebound stronger than expected in Q2

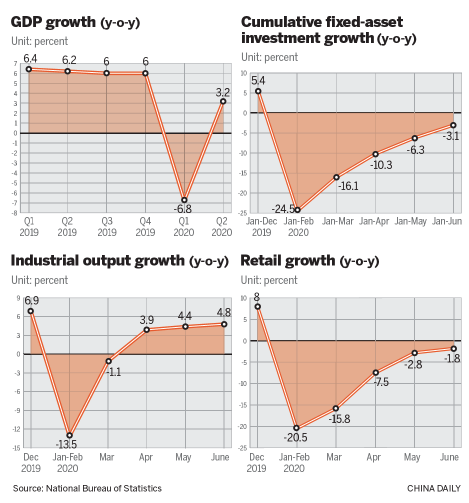

China's economy rebounded substantially in the second quarter with stronger-than-expected GDP growth of 3.2 percent from a year earlier, and economists said that such recovery momentum is likely to be sustained in the coming quarters as policies are expected to remain supportive and flexible.

The country has become the world's first major economy that has shown robust recovery from the damage caused by the COVID-19 pandemic as the economy returned to growth from a sharp contraction of 6.8 percent in the first quarter.

Key economic indicators have shown continuous improvement. The country's industrial production is recovering quickly and grew by 4.4 percent year-on-year in the second quarter, contrasting with an 8.4 percent decline in the first quarter, according to data released by the National Bureau of Statistics on Thursday.

The service sector expanded by 1.9 percent in the second quarter, reversing the decline of 5.2 percent in the first three months. Both investment and consumption are rebounding as the decline in fixed-asset investment narrowed to 3.1 percent in the first half of the year while the contraction of retail sales narrowed to 3.9 percent in the second quarter from the steep decline of 19 percent in the previous quarter, according to the NBS.

"Generally speaking, the economy overcame the adverse impact of the COVID-19 pandemic gradually in the first half of the year and demonstrated a momentum of restorative growth with greater resilience and vitality," Liu Aihua, an NBS spokeswoman, said at a news conference in Beijing.

Economists said that China's strong economic rebound was helped by factors including the country's effective measures to bring the pandemic under control, strong policy support for business resumption and investment, and better-than-expected export recovery as a result of the country's fast production resumption.

"While the global pandemic situation continues to deteriorate, China's economy has managed to recover quickly with GDP growth rebounding to above 2 percent, which is a remarkable achievement," said Lu Ting, chief China economist at Nomura Securities.

Lu said that China's fast production resumption has helped the country's export recovery and stabilized employment. In addition, timely and effective policies to spur infrastructure investment have also helped to drive up domestic demand.

Economists at US bank Goldman Sachs said in a research note that China's economic performance in the second quarter was well above market expectations thanks to much less drag on the economy from the virus and the government's strong and supportive policy stance.

More policies to boost consumption and domestic demand are expected as the country's recovery has shown some uneven signs with supply recovering faster than demand while investment appears to be rebounding more strongly than consumption, economists said.

Despite the recent steady recovery, the country's retail sales growth remains in negative territory, declining 1.8 percent year-on-year in June as the COVID-19 pandemic continues to restrain consumer spending in catering and other sectors that require physical contact.

Cheng Shi, chief economist of ICBC International, said that the focus of China's economic recovery will likely shift from investment to consumption and the marginal improvement in consumption will likely accelerate in the second half of the year. He forecast that China's retail sales growth is likely to turn positive in the third quarter.

A recent survey by the People's Bank of China, the central bank, showed that the proportion of residents who plan to increase their spending on housing, tourism and expensive goods in the next three months is rising, pointing to the improving spending appetite of domestic consumers.

Economists expect the monetary policy to gradually return to normal in the second half of the year while the overall policy stance will remain supportive and flexible as the country continues to face uncertainties from overseas markets and policymakers are still gauging the impact of the floods in the southern parts of the country on the economic recovery.

Nonetheless, Cheng said that the Chinese economy has shown strong resilience, which will likely make yuan-denominated assets a scarce resource in the global market and may push asset prices higher and attract more international capital into the Chinese market.