Listing reform promotes higher quality growth: China Daily editorial

The ChiNext Index, which tracks China's Nasdaq-style board of growth enterprises, gained nearly 2 percent on Monday, reflecting investors' confidence in the country's shift to the registration-based initial public offering system.

The first batch of 18 companies debuted on Monday in Shenzhen under the new registration system, which allows the market to decide which companies should be listed. Previously, it was determined by an approval committee formed by the regulatory body.

Starting from Monday, companies listed on the ChiNext board will also have a 20-percent limit for gains or losses, which is seen as the boldest move to liberalize stock trading after Shanghai's smaller STAR Market piloted the reform last year. When its stock market debuted in the early 1990s, China adopted a series of arrangements, such as the 10-percent daily fluctuation limit, which still applies to the main board, to protect individual investors and prevent drastic market fluctuations.

But as the market has matured, China has introduced market-oriented reforms so the stock market can support the country's pursuit of high-quality development.

For a long time, Chinese enterprises have mainly acquired capital through indirect financing channels, such as bank loans. Direct financing such as through bond issuance and stock listings accounts for less than 40 percent of total corporate financing.

Traditional enterprises, especially big and State-owned ones, such as real estate companies, are the favorite clients of banks, because they have good assets to serve as collateral for loans. But it is hard for some fast-developing innovative enterprises to secure loans as they do not possess any assets that they can offer as a guarantee. For companies such as emerging high-tech companies therefore financing through the capital market is a more realistic option.

Actually, the fast expansion of high-tech companies in the developed economies since the 1980s is attributable to the high ratio of direct financing in those countries.

China has become the second-largest economy in the world in terms of overall GDP scale. But it needs to further liberalize its capital market to provide reliable financing sources for its high-tech and innovative growth enterprises.

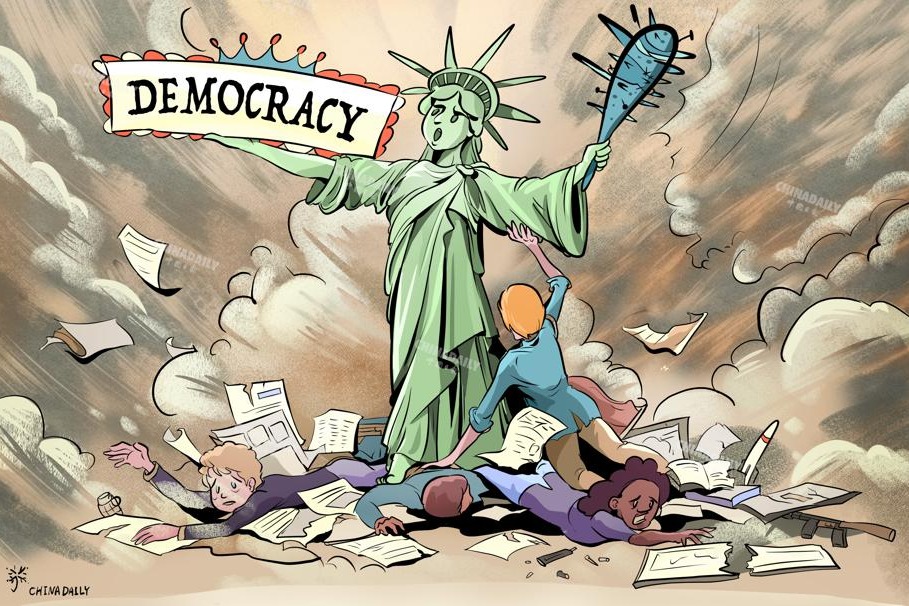

In the short term, as protectionist sentiment has been on the rise in some developed countries against Chinese enterprises that have listed overseas, the accelerated systemic reform in the domestic stock market can provide a viable alternative for affected Chinese companies.

In the longer term, the stock market reforms will help China transition more smoothly from its past development mode driven by investment and exports to higher quality development propelled by technology and innovation.