China firms support UK fight against pandemic

Chinese companies played a key role in addressing the COVID-19 crisis in the United Kingdom last year, a new report shows, with businesses delivering vital services and products as the pandemic rocked local communities and economies.

Chinese healthcare companies operating in the UK saw revenues rise by 40 percent and their workforces grow by 14 percent last year, according to the Tou Ying Tracker, an annual analysis of China-UK enterprises produced by accountancy company Grant Thornton UK in collaboration with China Daily UK and the China Chamber of Commerce in the UK, or CCCUK.

"This result reflects the impact Chinese medical technology has had on helping the UK manage the clinical effects of the COVID-19 pandemic," the report said.

Among Chinese companies delivering support last year were Mindray, which supplies medical devices including ultrasound imaging, patient monitoring, defibrillation, and anesthesia products, and Breas Medical, which makes hospital and homecare ventilation products.

The report also singled out Bio Products Laboratory Holdings, which collects and purchases plasma-derived products, and Pharmaron UK, which delivers drug research and development services, as key players.

Separate analysis reveals the crucial role China-based companies played in bolstering COVID-19 surveillance in the UK.

Between September 2020 and June 2021, more than three-quarters of UK government contracts for rapid antigen tests involved Chinese suppliers or manufacturers, according to trade data seen by UK non-profit The Citizens.

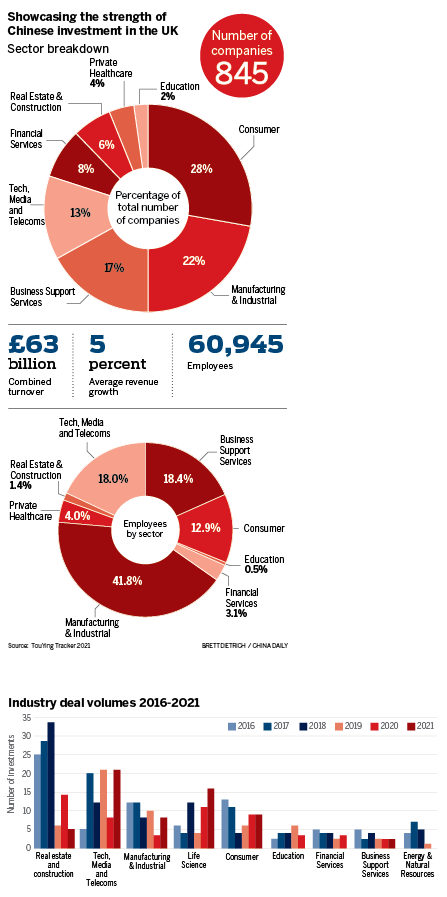

The number of Chinese businesses in the UK with annual revenue of at least 5 million pounds ($6.8 million) rose to 845 in 2021, up from 838 the year before, the Tou Ying Tracker found. These companies only represent a fraction of those doing business in the UK, and the report identified around 30,000 companies that are part of a China-owned corporate group or are majority held by a Chinese national.

"This is the fourth consecutive year that the number of businesses included in the Tou Ying Tracker has grown, despite economic headwinds including the COVID-19 pandemic and Brexit, showing that the UK continues to be an attractive place to invest and work," said Simon Bevan, head of the China Britain Business Group at Grant Thornton.

Despite the growth in the healthcare sector, 2021 was a challenging year for enterprise in the UK, and Chinese businesses did not come away unscathed.

Combined annual revenue for companies in the report was 63 billion pounds ($84.1 billion), down from 92 billion pounds the year before, with average annual revenue growth of 5 percent, which was down from 12 percent.

The combined number of employees at the companies fell, from 75,000 in 2020 to 60,945 last year.

The COVID-19 pandemic had a dramatic effect on jobs, the report said, and particularly those in the travel and hospitality sector, where the size of the workforce shrank by 12 percent.

And the novel coronavirus was not the only impediment to business growth last year.

"Surging energy prices, snarled-up supply chains … inflation and increasing nervousness about the national security implications of foreign direct investment all contributed to a lack of confidence about global economic conditions," the report said. "Add in incomplete Brexit negotiations, where the UK and EU still have not agreed final financial services or customs rules, and a murky picture presents itself for any international investor."

Bevan said that, due to Brexit, the "style of Chinese investment into the UK may change", as companies make sure they retain a foothold in the EU, but he said the UK "will still likely form an important part of their European strategy".

In the face of these pressures, Chinese import activity and investment into the UK displayed resilience. China replaced Germany as the UK's biggest import market in the first quarter of last year, according to UK government trade data, and China was still in top position when the latest monthly data was released in December.

The number of Chinese investments in the UK during the first half of 2021 reached pre-COVID-19 levels, Grant Thornton said in a separate study, showing a "healthy rebound in deal activity", with a 44 percent increase year-on-year.

Bao Ling, minister of China's embassy in the UK, said China and the UK reached an "important consensus" on expanding cooperation in healthcare, green growth, the digital economy, financial services, and innovation during high-level talks in October. "China and the UK have complimentary advantages, and our business communities have a strong desire for closer partnership," Bao said.

Deal value in the first half of 2021 fell by 68 percent, but this was mainly due to one exceptionally high-value deal in the first half of 2020, when China Resources Group acquired UK recycling business Viridor for 4.2 billion pounds, the biggest deal of the year.

Two major deals last year included Chinese technology giant Tencent buying UK video games company Sumo for 919 million pounds and investing 35 million pounds into Bristol-based Ultraleap, which develops hand-tracking technology.

While pandemic-related disruption rumbles on, Chinese businesses in the UK remain optimistic about the future, said Fang Wenjian, general manager of Bank of China's London branch and chairman of the CCCUK.

"Chinese companies still see the UK as a key element of their global presence and a market with great potential," said Fang. "Gradually, as the UK recovers from the pandemic and the China-UK relationship strengthens, we can clearly foresee that the scale of investments made by Chinese enterprises in the UK will increase."

More than 80 percent of Chinese companies in the UK expect their revenue and profitability to improve during the next two years, a CCCUK survey found.

Top 30 fastest-growing Chinese enterprises in the UK identified by the 2021 Tou Ying Tracker:

- Alipay (UK) Limited

- Anker Technology (UK) Ltd

- Billions Europe Ltd

- Bio Products Laboratory Holdings Limited

- BOCI Global Commodities (UK) Limited

- Breas Medical Limited

- Brunel Healthcare Manufacturing Limited

- BYD (U.K.) Co., Ltd

- CGN Global Uranium Limited

- Chaucer Syndicates Limited

- Far East Facade (UK) Limited

- Farsound Aviation Limited

- Filippo Berio UK Limited

- Fine Organics Limited

- Haier Appliances UK Co., Ltd

- Haitong International (UK) Limited

- Henry Bath & Son Limited

- Hisense UK Limited

- Huawei Technologies Research & Development (UK) Limited

- Imagination Technologies Limited

- Meridian Steel Limited

- MH Star UK Ltd

- Mindray (UK) Limited

- Nutriad Ltd

- Outfit7 Investments Limited

- Pharmaron UK Limited

- Saxo Capital Markets UK Ltd

- Solax Power UK Limited

- Splash Damage Limited

- Trip Air Ticketing (UK) Limited