EU considers gas supply alternatives

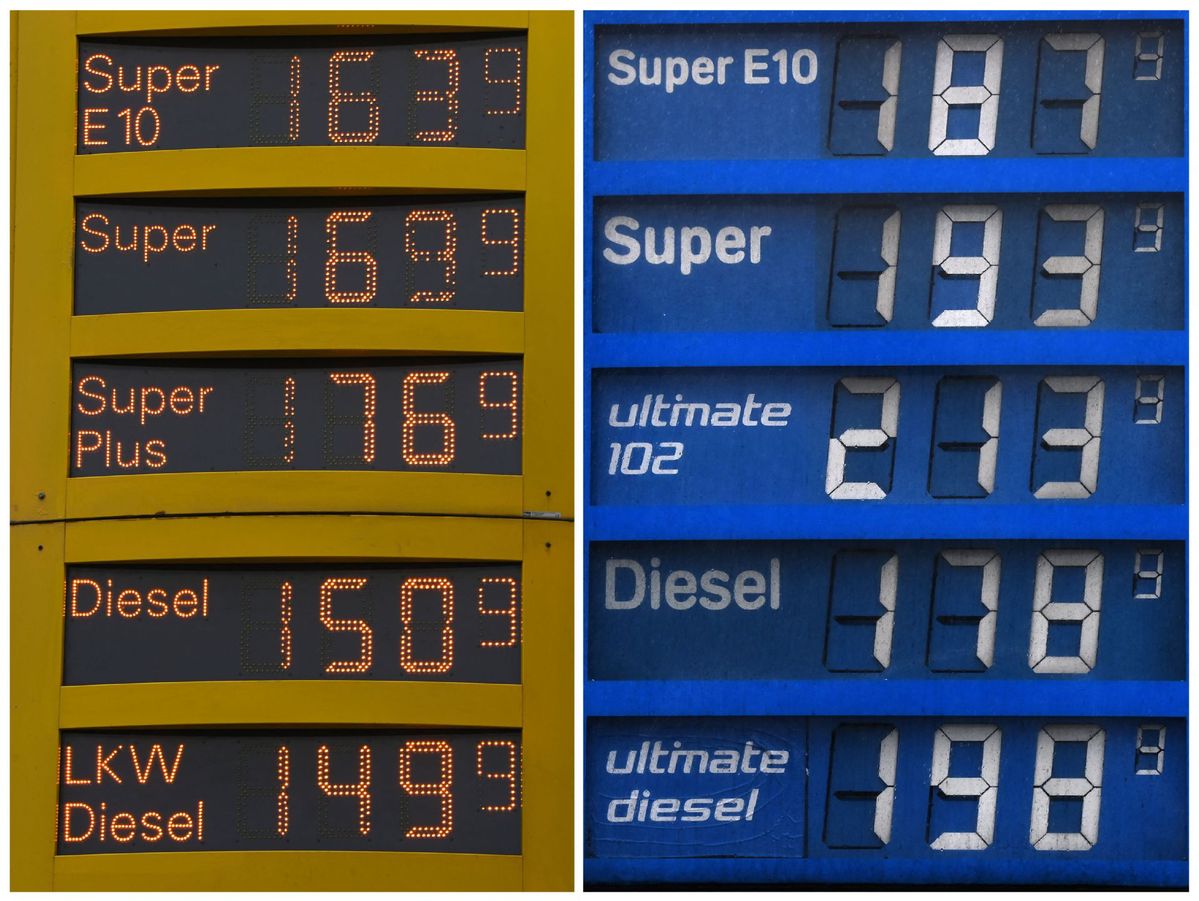

Amid the escalating crisis between Russia and Ukraine, European Union leaders are trying to reduce their energy dependence on Russia, but experts believe the gaps won't be filled easily or quickly.

The EU's natural gas prices surged almost 50 percent on Thursday afternoon to above 138 euros ($154) per megawatt-hour, according to Trading Economics, a platform for economic and financial data.

Experts were worried that the harsher sanctions on Russia by the EU membership and other Western nations could force Russian energy exports such as oil and natural gas out of the global markets.

German Chancellor Olaf Scholz announced on Feb 22 the suspension of approval of the Nord Stream 2 gas pipeline, worth about $11 billion.

Such moves have triggered concerns about the EU's vulnerability to a sharp supply disruption.

European Commission President Ursula von der Leyen expressed confidence over the weekend that "even in case of full disruption of gas supply from Russia, we are on the safe side for this winter" and that Europe "would be able to replace the Russia gas with LNG (liquefied natural gas) deliveries that we get from our friends all over the world."

"Because this crisis shows that Europe is still too dependent on Russian gas. We have to diversify our suppliers and massively invest in renewables. This is a strategic investment in our energy independence," von der Leyen said on Wednesday.

European Commissioner for Energy Kadri Simson said in Madrid last week that the EU is considering different scenarios for natural gas supply if Russia partially or totally restricts its exports to Europe.

The Estonian politician conceded that there might be a problem with gas supplies amid the Ukraine situation. Estonia gets almost all of its natural gas from Russia.

Besides a possible restriction on gas deliveries by Russian gas company Gazprom, the gas stocks are at historical low levels and gas storage is only at 30 percent in Europe, news outlet Euractiv quoted Simson as saying.

Europe has become the top destination for US LNG shipments, with half of the LNG shipped in February going to Europe, according to market data provider Refinitiv. But there are concerns that the EU's LNG terminals have limited available capacity to absorb extra supply and that there is not enough LNG to replace Russian gas.

Simone Tagliapietra, a senior fellow at Bruegel, a Brussels-based economic think tank, said that the EU would likely be able to survive a disruption of all Russian gas flows until spring. "However, the picture becomes more complicated for next winter. And in any case, the economic implications would be massive," he said on social media on Thursday.

Tagliapietra said that since the Western sanctions are designed to allow energy payments to continue, there are no reasons for Russia to cut supplies unless it launches a deliberate counter sanction.

A paper published last month by a group of Bruegel researchers concluded that if Russian gas stops flowing, measures to replace supply won't be enough.

"The European Union will need to curb demand, implying difficult and costly decisions," the paper said.

Europe now relies on Russia for about 40 percent of its natural gas. Germany gets 55 percent of its natural gas imports from Russia. Germany depends highly on natural gas in its energy mix after it phased out nuclear power. It is exiting coal-generated power under a plan to shift totally to renewable sources by 2045.

Agencies contributed to this story.