Sanctions won't crush China's hi-tech rise: China Daily editorial

To further strangle China's technology sector, the United States is reportedly considering banning all sales to Chinese telecommunications equipment giant Huawei by US suppliers, including Intel and Qualcomm.

Such a move would tighten the restrictions already imposed by Washington on sales to Huawei in 2019 on the unwarranted grounds of national security concerns. US suppliers have since then had to ask for government approval to sell their products to China's first major global brand, greatly limiting the company's access to processor chips and other technologies. Yet under the new policy that Washington is set to roll out, all license requests to supply Huawei would be denied.

Such a practice, which runs counter to the principles of a market economy and tramples on the basic rules that govern international trade, reflects how desperate Washington has become as it goes to great lengths to try to suppress China's technological progress. Last week, the Joe Biden administration also reportedly persuaded the Netherlands and Japan to join the US in restricting exports of semiconductor technology to China.

Yet the stepped-up crackdown also in a way attests to the futility of Washington's strategy to keep Chinese technological companies at bay. Take Huawei for instance. Despite being squeezed by US sanctions globally over the past several years, the company has largely pulled itself "out of crisis mode" by launching new business lines serving factories, self-driving cars and other industrial customers that are less vulnerable to US pressure. Its revenue last year was forecast to be little-changed from 2021 at 636.9 billion yuan ($91.6 billion), according to Eric Xu, one of its executives, in a December letter to employees. "US restrictions are now our new normal, and we're back to business as usual."

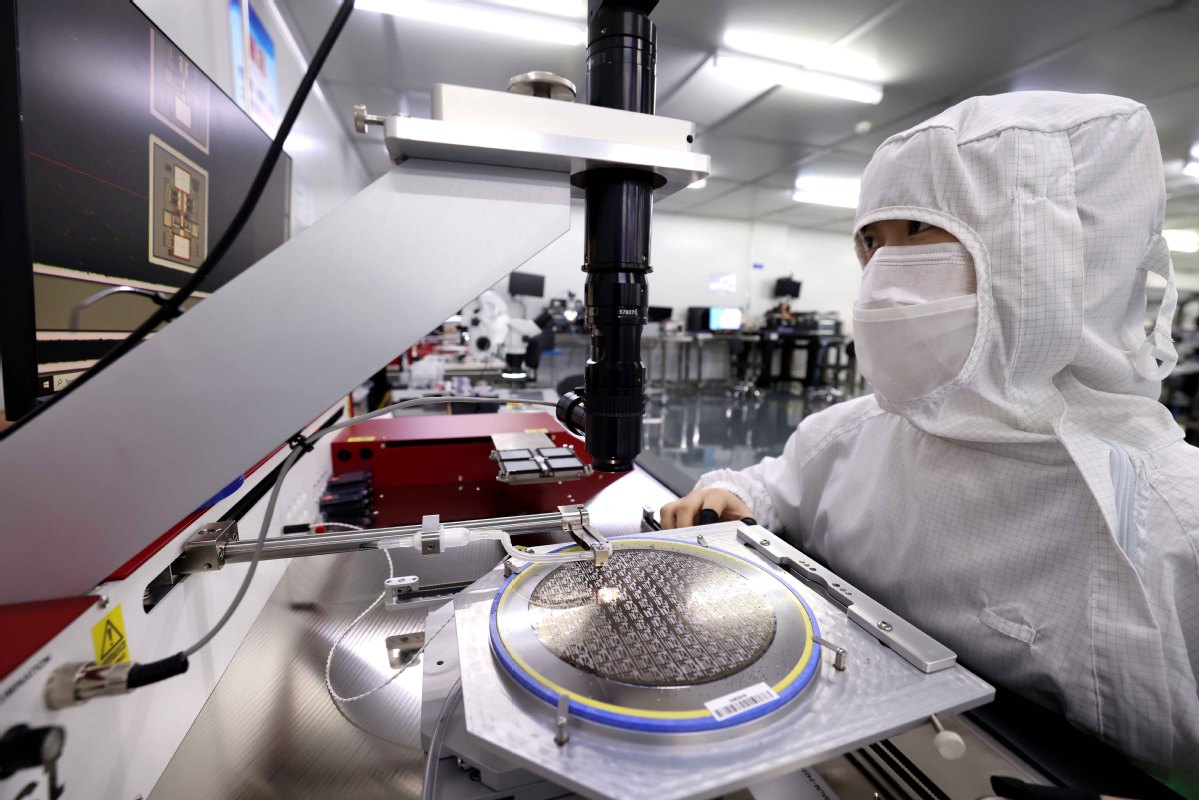

Meanwhile, the US high-tech sanctions are also hurting US suppliers as well given that China is the world's largest consumer of semiconductors, and the lion's share of revenue from purchasing these chips go to foreign companies. For example, China consumed $143.4 billion worth of semiconductor wafers in 2020, and less than 6 percent of them were produced by companies headquartered in China.

Rather than crushing China's high-tech advancement, the increasing US pressure on Chinese technological companies will only propel them to strive for self-reliance through indigenous innovation. The country was already on track to produce around 5 percent of the world's memory chips by the end of 2020, and is now widely believed to be on the brink of a breakthrough in its efforts to become self-sufficient in semiconductors.

"What doesn't kill you, makes you stronger". That saying is apt for China's nascent yet unstoppable high-tech rise.