China's transformation in its business and innovation environment has proved remarkable, offering great growth potential for multinational corporations in the country, said a Takeda Pharmaceutical Co Ltd top executive.

"China's healthcare reform and development over the past few years have been profound. The country now represents a significant growth driver for Takeda. It is becoming a more important part of our global business and strategy, not only in commercial but in clinical research and development," said Christophe Weber, president and CEO of Takeda, during the China Development Forum in Beijing.

The pharmaceutical company charted a plan in 2020 to put forward more than 15 innovative products by 2025, which will benefit more than 10 million patients in China. Currently, 10 new medicines have already been approved, making Takeda a leader among MNCs in terms of winning approvals in the country over the past three years. Among the 10 products, seven are included in the National Reimbursement Drug List.

Despite COVID impacts and industrial uncertainties, Takeda delivered robust results. The company said it has been elevating its strategy with a focus on China and is considering making the market its second-largest globally by 2030.

"We are now among the top 10 multinational biopharma companies in China. Our business has been growing in the past five years because we are committed to bringing our most innovative products into China and will continue to do that. I think it will position us very well in this country, which is investing in innovation and making sure that new products gain access to more patients," the CEO said.

"I'm very optimistic about Takeda's future overall and in China because the market will contribute more and more to our global business and growth in the years to come," he added.

Takeda is also investing based on market research to help further unleash the potential in the world's second-largest pharmaceutical market.

China has been stepping up efforts in pharmaceutical R&D. According to the National Medical Products Administration, in the past decade, innovative drugs approved in China took up 15 percent of the world's total. New drugs under development by Chinese enterprises accounted for 33 percent of the global total, ranking second in the world.

China has established funds to this end since 2008. Between 2008 and 2020, funds raised related to drug innovation exceeded 20 billion yuan ($2.9 billion). In 2015, the completion of the reform for the drug and medical device approval system attracted huge capital inflow into biopharmaceutical R&D. By 2022, funds raised by players in the sector surpassed 1.7 trillion yuan, among which 2021 alone took up over 300 billion yuan, the NMPA said.

"China's biopharmaceutical industry is on a track of high-quality development," said Bi Jingquan, executive vice-chairman of the China Center for International Economic Exchanges, and also former head of the NMPA.

To make China a better center for biopharmaceutical innovation, Bi said that the government should stabilize market expectations and enhance investor confidence. In addition, efforts should be made to improve the transparency of drug review and approval, as well as strengthen intellectual property rights protection.

Weber said healthcare systems must be more sustainable and resilient. He said: "Healthcare cost and investment will grow faster than the economy. To manage the transition, China has to focus on building a cost-effective healthcare system while ensuring adequate financing tools to secure the system's sustainability.

"Currently, the majority of healthcare systems are traditional fee-for-service models. It could be more efficient and cost-effective if the model can be shifted to outcome-based or value-based under which patients pay for healthcare outcomes."

Standard Chartered will focus on the further opening-up of China's financial sector while the country, which is at the heart of its operation, will steadily expand institutionalized opening-up with regard to rules, regulations, management and standards, said Bill Winters, group chief executive of Standard Chartered PLC.

"As China's opening-up becomes increasingly more important and prevalent, we think it's a critical area for us to continue focusing on and it has worked well, especially being in the stage of institutionalized opening-up," said Winters during his first visit to China since 2020 to attend the three-day China Development Forum, which wrapped up on Monday.

"Part of the reason that it's such a pleasure to be in Beijing is that our growth opportunities are very much aligned with China's strategic priorities," he said.

Standard Chartered has been an active participant in cross-border payments and investments, foreign exchange and risk management, the Belt & Road Initiative, and green and sustainable finance, which has been a key area of focus for the group, he said.

"For us, it has meant a substantial double-digit growth in China in each of the past three years despite the ups and downs of the global economy. We are investing very heavily to further promote our growth and China's institutionalized opening-up, and play our role as a connector between the different markets in which we operate," he said.

Last year, Standard Chartered announced it would invest $300 million in China-related business in the next three years.

"We've made very good progress so far. We received some new licenses, which will involve further investment," Winters said.

In January, Standard Chartered Bank (Hong Kong) Ltd obtained regulatory approval to set up a wholly foreign-owned securities company in Beijing, which will further enhance the group's position in China's onshore capital markets.

"We invested heavily in the infrastructure that will support China's institutionalized opening-up, including cross-border payments, currency risk management and domestic payments to support cross-border business. We also continued to invest in our wealth management products and services," Winters said.

In addition to a technology and operations center in Tianjin, the group set up another such center in Guangzhou, Guangdong province, with a target of hiring 1,000 people, to support its broader China business.

Currently, the country's further opening-up and the global expansion of Chinese companies are relying heavily on high-standard economic and trade agreements such as the Regional Comprehensive Economic Partnership agreement, said Jerry Zhang, executive vice-chairman and CEO of Standard Chartered China.

"Our business related to the ASEAN trade corridor grew by more than 60 percent in 2022. Customer activities in South Asia and the Middle East have remained strong. In recent years, we have been constantly seeing Chinese customers in these regions and have deployed many Chinese-speaking employees," Zhang said.

In addition, Standard Chartered is committed to making the internationalization of the renminbi a development strategy for the group, hoping to cooperate with its clients and China's central bank in their long-term strategic goals in this area.

Regarding the Belt and Road Initiative, Standard Chartered completed more than 130 projects in the countries and regions involved last year and 40 percent of the projects met the environmental, social and governance standards of the United Nations.

Standard Chartered is committed to incorporating more green development concepts into BRI-related projects in the future, Zhang said.

She applauded the great strides China has made in further opening up its financial sector in recent years.

"In terms of market access, there are now few barriers left, although we are still striving for business licenses in some specific areas," Zhang said.

"I think it is worth anticipating changes based on the concept of differentiated regulations proposed by Chinese financial regulators. The balance sheets of foreign banks in China are relatively small and regulators hope that these banks can develop healthily and sustainably in the country. In this regard, it is probably necessary to have a bit of flexibility in certain aspects of regulation. This is something we are looking forward to," she said.

BEIJING -- Economic experts and business leaders showed optimism about China's economic growth outlook in 2023 at the just-concluded China Development Forum 2023, saying that China is a major driver of the global economy and a reliable supplier for industrial and supply chains.

In its government work report, China unveiled an around 5-percent expansion target for the Chinese economy this year. Kevin Kang, chief economist of KPMG China, said the goal is obviously higher than the estimated growth of most major economies.

China's consumption sector is expected to accelerate its recovery, and the country's technological innovation and green transformation are advancing investment in manufacturing, Kang said.

As the country picks up its recovery pace, and as overseas growth decelerates, the Chinese economy is expected to once again emerge as an important driver of global economic growth, he added.

Zhu Min, vice chairman of the China Center for International Economic Exchanges, believes the around 5-percent growth target is prudent and sustainable, against the backdrop of rising uncertainty in the global economy.

Zhu cited factors such as the stabilization of the property market, the consumption revival and robust investment into the high-tech manufacturing industry, which will all contribute to the goal.

Although many scholars, analysts and business leaders spoke of multiple challenges in the broader global environment, they also stated that China should have the confidence to cope with external challenges.

"China has already been deeply embedded in the international value chain and become a global manufacturing hub and a 'world factory,' as a result of over 40 years of reform and opening-up," said Yi Xiaozhun, former WTO deputy director-general.

Yi noted that multinationals cannot divorce from China, let alone abandon it and construct a new global value chain.

A set of data from US-China Business Council President Craig Allen attests to Yi's view. US exports to China reached a record high in 2022. A total of 77 percent of what American companies make in China is sold on China's domestic market, and only 7 percent is exported back to the United States.

Despite challenges, American and Chinese companies are extremely resilient, Allen said.

CDF 2023, which was held offline in Beijing for the first time since 2020, saw a number of political bigwigs and business magnates visiting China and sharing their expectations for opportunities rising from the country's development.

As one of the companies that voiced its commitment to grow together with China, Pfizer said it looks forward to its new strategic partnership with the Healthy China Research Center, a Chinese research advisory platform, to advance the goals of Healthy China 2030 and other opportunities, according to Albert Bourla, the company's chairman and chief executive officer.

Oil giant plans production expansion to fuel China's efforts toward carbon goals

Saudi Aramco will support China's domestic energy security by expanding its oil and gas production capacity while reducing its oil production carbon intensity to facilitate the country's green transition, said a top company official.

"Saudi Aramco aims to play a key role at the heart of China's long-term energy security and high-quality development," said Amin H.Nasser, president and CEO of the company, during the China Development Forum in Beijing.

The climate change mitigation goals cannot be achieved at the expense of energy security. Saudi Aramco will expand its oil production capacity to 13 million barrels per day by 2027 while increasing gas production by more than 50 percent by 2030 to fuel China's efforts to this end, Nasser said.

The CEO said the company — the world's largest oil exporter — is also working on green solutions, such as advanced carbon capture and storage and circular carbon economy technologies, as "China's venture capital space offers important investment opportunities to stimulate the technology development and innovation required".

Aramco said on Monday that its wholly-owned unit Aramco Overseas Co will acquire a 10 percent stake in Shenzhen-listed Rongsheng Petrochemical Co Ltd for 24.6 billion yuan, which is expected to expand its downstream presence in China.

Aramco will supply 480,000 b/d of Arabian crude to a Rongsheng subsidiary — Zhejiang Petroleum and Chemical Co Ltd — under a long-term sales agreement.

The company also said on Sunday that it will kick off construction this year of a major integrated refinery and petrochemical complex in Panjin, Liaoning province, which will receive 210,000 b/d of crude after completion from Aramco. The facility will be fully operational by 2026.

Aramco has a 30 percent stake in the complex through its joint venture Huajin Aramco Petrochemical Co with China North Industries Group Corp, or Norinco, which holds a majority share of 51 percent. Panjin Xincheng Industrial Group owns the remaining stake of 19 percent.

The project represents "a major milestone in our ongoing downstream expansion strategy in China and the wider region, which is an increasingly significant driver of global petrochemical demand", said Mohammed Yahya Al-Qahtani, Aramco executive vice-president of downstream.

Multinational corporations have been continuing to prioritize downstream assets in China, as demand in the country is expected to continue growing along with economic recovery, said Lin Boqiang, head of the China Institute for Studies in Energy Policy at Xiamen University.

Saudi Arabia is China's top crude supplier, while China is also central to Aramco's strategy to diversify into more specialized high-value chemical products and less carbon-intensive hydrocarbon usage at the same time, Lin said.

Market fluctuations will lead to more cooperation between countries rich in resources and big energy consumers, and are mutually beneficial in refining, as well as science and technology research and development, he added.

The company also signed a memorandum of cooperation with the Guangdong provincial government on Sunday to jointly explore investment opportunities in energy cooperation, research and innovation and industrial projects.

Saudi Aramco is willing to strengthen cooperation with Guangdong in petrochemicals, hydrogen energy and ammonia energy, to support Guangdong in developing more sustainable petrochemical industries, he said.

The CEO said: "We want to be an all-inclusive source of energy and chemicals for China's long-term energy security and China's high-quality development. That is why we are doubling down on China's energy supply, including new lower carbon products, chemicals and advanced materials, all supported by emissions reduction technologies."

Looking forward to the Chinese market, Nasser said he sees a major win-win opportunity to build a world-leading, integrated downstream sector in China, with special emphasis on the high conversion of liquids directly into chemicals as part of the company's broader liquid-to-chemicals business expansion plans.

As a global tech company and one of the top three auto parts suppliers in the world, ZF is committed to the Chinese market with continued investment. It aims to be at the forefront of cutting-edge technologies in the world's largest and most dynamic vehicle market, top executives said at the China Development Forum held in Beijing from Mar 25 to 27.

Amid various challenges faced by the automotive industry in recent years such as COVID-19, chip shortages and rising energy and raw material prices, ZF Group remains committed to investing in China and strengthening its efforts to develop the local supply chain, said Holger Klein, chairman and CEO of ZF Group.

Klein, who has lived in Shanghai for the past three years along with ZF's Asia-Pacific team, said that the main reason behind the latest investment is that ZF has found Chinese vehicle manufacturers have higher requirements for technology and the iteration speed of products.

"It requires ZF Group to get closer to Chinese customers and assist them in dealing with the increasingly fierce market competition," he said.

He added that China has now become a global innovation hub for ZF and an important market to launch the company's latest products.

The 800V high-voltage electric drive system used in the Eletre SUV made by Lotus, a sports car marque owned by China's Geely, and the intelligent 4D radar used in the R brand of SAIC are the world's first mass-produced projects developed by ZF, manifesting the Chinese market's thirst for technology and speed.

Stephan von Schuckmann, member of the board of management of ZF Group, said that the electric drive market in China has the fiercest competition worldwide.

"Once launched in China, the products will be brought to other markets, underlining the importance of the Chinese market to us," said Schuckmann, who also in charge of ZF's electrified powertrain technology division and group-wide materials management.

In 2022, ZF opened a new electric drive factory in Shenyang in Northeast China's Liaoning province to complement European luxury auto brands and established another factory in Hangzhou, Zhejiang province, for Lotus and other Chinese carmakers, according to Schuckmann.

ZF also launched new production and development projects in Jinan and Rizhao in Shandong province; Guangzhou in Guangdong province; Anting in Shanghai and Zhangjiagang in Jiangsu province in 2022 to strengthen localization.

Since entering the Chinese market in 1981, ZF has gone through the stages of "Sold in China", "Made in China" and "Developed in China", and is on its way to "Led by China", said the company.

Over the past decade, ZF's employees in China have grown from less than 6,000 to more than 20,000. The group has nearly 50 production locations, four R&D centers and 240 after-sales service outlets across more than 20 cities in China.

Renee Wang, executive vice-president of ZF Group, president of ZF China and Operation Asia-Pacific, said: "ZF will seize opportunities during the transformation of China's automotive industry, continue to enhance its core technology and the competitive advantage of its local independent R&D through extensive collaboration with original equipment manufacturer customers and technology partners.

"We are playing an increasingly active role in an open ecosystem," she said.

According to Wang, ZF China achieved sales of 7.7 billion euros ($8.3 billion) in 2022, an increase of 10 percent year-on-year. Sales in the Asia-Pacific region, with the majority coming from China, accounted for around 25 percent of the group's global sales in 2022.The figure is expected to increase to 30 percent by 2030.

Chinese firms urged to adopt broader perspective for better use of resources

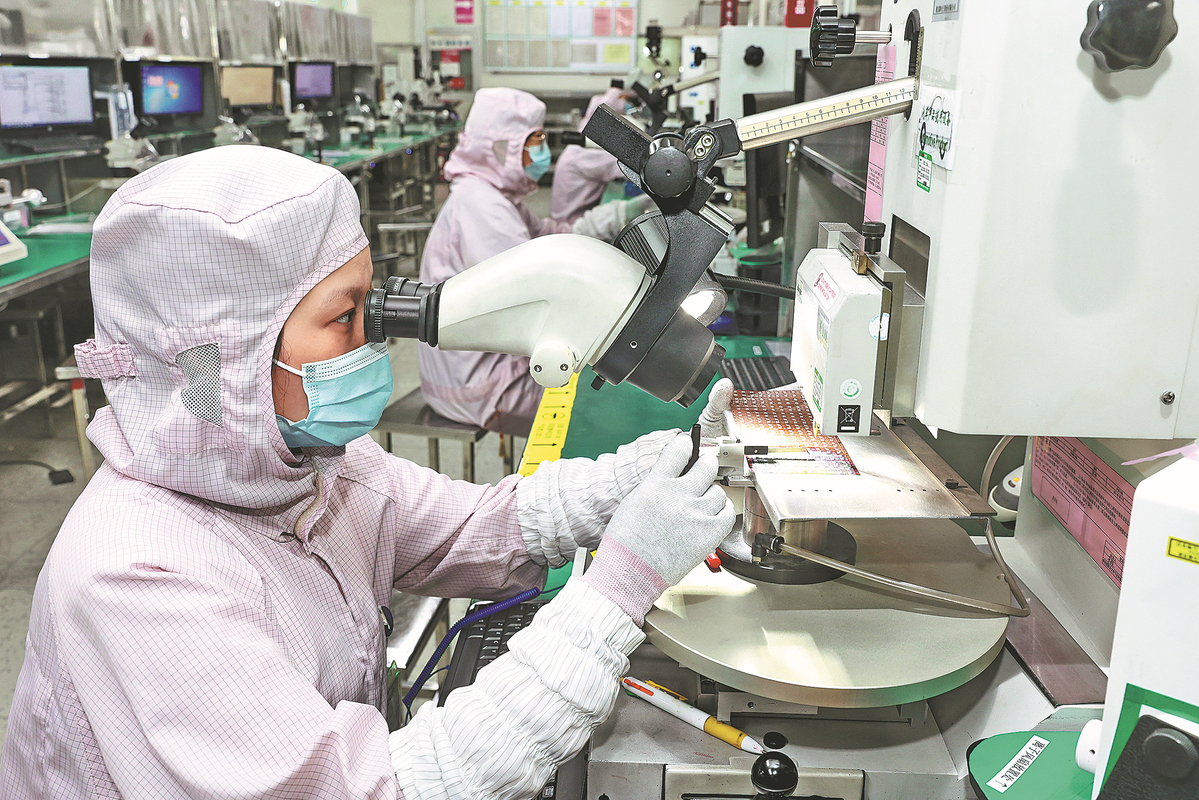

China will encourage domestic enterprises to integrate more deeply into global industrial and supply chains, and strengthen the coordination and allocation of resources in key industries such as semiconductors, the country's top industry regulator said on Monday.

Minister of Industry and Information Technology Jin Zhuanglong said optimizing and stabilizing the industrial chain and supply chain cannot be separated from the smooth and efficient circulation of industrial resources around the world.

China will optimize the layout of the domestic industrial chain and focus on key areas, promote the convergence of high-quality element resources, such as technology, finance and talent, to cultivate a number of advanced manufacturing clusters, Jin said.

According to him, more efforts will be made to strengthen resource coordination and allocation of key industries like integrated circuits, new energy, biomedicine and medical equipment worldwide, so as to jointly create a collaborative and efficient industrial ecosystem.

Jin made the remarks at the China Development Forum that ended on Monday.

The moves reflect China's efforts to ensure industrial and supply chains function as public goods and deepen international cooperation in this area.

Denis Depoux, global managing director of consultancy Roland Berger, told China Daily on the sidelines of the CDF, "China remains a significant market for most foreign companies, and has gradually become an important source of innovation to strengthen the global competency of some foreign companies."

With the optimized COVID-19 containment measures, the winter of 2022-23 has, to a certain extent, seen "a replay of the 2021 situation when China's supply chain supported economic recovery in Europe and in the US because of its flexibility and availability", Depoux said.

China's industrial and supply chains, he said, have improved significantly, as domestic and foreign companies invested heavily in modernizing their local production systems.

"China has demonstrated its innovation capability and is leapfrogging in several fields, gaining leadership globally in areas like the electric vehicle chain, from batteries to charging infrastructure, photovoltaic panels, wind turbines, nuclear and telecommunications equipment."

China's industrial modernization, big consumption potential and growing innovation prowess are three strong fundamentals that create a new China story for the world, he said.

Li Dongsheng, founder and chairman of TCL, a Chinese manufacturing and tech company, who attended the CDF, said that in recent years, the Chinese economy has shown great resilience and vitality in the face of challenges from the COVID-19 pandemic. As China's industrial and supply chain adjust to the new environment, its economy and market demand can be strong and sustainable.

"TCL looks forward to having more cooperation with foreign enterprises in technology and trade, so as to jointly contribute to the high-quality development of China's economy and promote the expansion of domestic demand in the Chinese market."

As the United Nations forecast that India is projected to surpass China as the most populous country this year, some experts worry China's advantages in manufacturing and its position in the global supply chains may diminish.

But Jeffrey Sachs, a renowned economist and director of the Center for Sustainable Development at Columbia University, told China Daily: "China's strength right now is that it is on the cutting edge of many of the most important technology innovations for the future, including low-carbon energy solutions, electric vehicles, batteries, supply chains, artificial intelligence, high-speed trains and many other sectors. All of this will be very good for China's growth in the future."

BEIJING - Economic experts and business leaders showed optimism about China's economic growth outlook in 2023 at the just-concluded China Development Forum (CDF) 2023, saying that China is a major driver of the global economy and a reliable supplier for industrial and supply chains.

In its government work report, China unveiled an around 5-percent expansion target for the Chinese economy this year. Kevin Kang, chief economist of KPMG China, said the goal is obviously higher than the estimated growth of most major economies.

China's consumption sector is expected to accelerate its recovery, and the country's technological innovation and green transformation are advancing investment in manufacturing, Kang said.

As the country picks up its recovery pace, and as overseas growth decelerates, the Chinese economy is expected to once again emerge as an important driver of global economic growth, he added.

Zhu Min, vice chairman of the China Center for International Economic Exchanges, believes the around 5-percent growth target is prudent and sustainable, against the backdrop of rising uncertainty in the global economy.

Zhu cited factors such as the stabilization of the property market, the consumption revival and robust investment into the high-tech manufacturing industry, which will all contribute to the goal.

Although many scholars, analysts and business leaders spoke of multiple challenges in the broader global environment, they also stated that China should have the confidence to cope with external challenges.

"China has already been deeply embedded in the international value chain and become a global manufacturing hub and a 'world factory,' as a result of over 40 years of reform and opening-up," said Yi Xiaozhun, former WTO deputy director-general.

Yi noted that multinationals cannot divorce from China, let alone abandon it and construct a new global value chain.

A set of data from US-China Business Council President Craig Allen attests to Yi's view. US exports to China reached a record high in 2022. A total of 77 percent of what American companies make in China is sold on China's domestic market, and only 7 percent is exported back to the United States.

Despite challenges, American and Chinese companies are extremely resilient, Allen said.

CDF 2023, which was held offline in Beijing for the first time since 2020, saw a number of political bigwigs and business magnates visiting China and sharing their expectations for opportunities rising from the country's development.

As one of the companies that voiced its commitment to grow together with China, Pfizer said it looks forward to its new strategic partnership with the Healthy China Research Center, a Chinese research advisory platform, to advance the goals of Healthy China 2030 and other opportunities, according to Albert Bourla, the company's chairman and chief executive officer.

Cooperation, instead of decoupling, creates prosperity, said Oliver Zipse, chairman of the board of management of BMW AG, on Sunday at the China Development Forum.

"Just as BMW's investment creates jobs in China, (Chinese battery maker) CATL's investment brings prosperity to Europe," he said.

Zipse said the German premium carmaker has invested over 83 billion yuan since 2010 in its production base in Shenyang, capital of Northeast China's Liaoning province, where its joint venture BMW Brilliance is based.

"China is the BMW Group's largest single market and one of its most strategic. Our largest R&D operations outside of Germany are in China," he said.

Besides BMW Brilliance, the German carmaker also has a joint venture with China's largest SUV maker Great Wall Motors.

The joint venture, called Spotlight, will produce electric models from the Chinese marque and BMW's Mini brand, and they will be sold in China and overseas markets.

Zipse said he is very optimistic about the future of Spotlight, calling it "a perfect example" of how Sino-German partnerships can be symbiotic and generate win-win-results.

"Chinese modernization is a global opportunity," he said, adding that the tremendous undertaking creates global-scale innovation and sustainable technology but also builds bridges and sends a strong signal of multilateral cooperation.

Zipse's trip to attend the China Development Forum has been his second one to the country within six months.

The German executive was a member of German Chancellor Olaf Scholz's delegation to the world's No 2 economy in November 2022.

Saudi Aramco has confirmed its investment in a major petrochemical project in Liaoning province, as announced by Amin Nasser, the President and CEO of the company.

During the China Development Forum on March 26, Nasser stated, "Today we are signing definitive agreements with North Huajin Chemical and Panjin Xincheng to begin construction on a state-of-the-art integrated refinery and petrochemical complex in Liaoning province."

The project, valued at over 83.7 billion yuan, will be a joint effort between Huajin Chemical Industries, Saudi Aramco, and Panjin Xincheng, and is located in the Liaobin Coastal Economic and Technological Development Zone in Panjin city, Liaoning province.

"In particular, we see a major win-win opportunity to build a world-leading, integrated downstream sector in China, with a special emphasis on the high conversion of liquids directly into chemicals as part of our broader liquid-to-chemicals business expansion plans," said Nasser.

The project was launched in March 2011 and was designated a key project for the revitalization of Northeast China in 2014 by the State Council.

Li Lecheng, the governor of Liaoning province, described the project as a major and strategic move for mutual benefit and win-win for both countries.

The Panjin municipal government has formed a dedicated project team to provide comprehensive support in planning, resource allocation, public utilities, supporting facilities, and office locations.

Liu Shiquan, Chairman of China North Industries Group Corporation, hopes to build the project into a landmark project of the Belt and Road Initiative construction and a model project of comprehensive strategic cooperation between China and Saudi Arabia.

According to the Liaoning Provincial Department of Commerce, Liaoning province has attracted over 16,000 foreign-invested enterprises, including BMW and Michelin, ranking eighth in the country. As part of its efforts to further strengthen its opening-up, Liaoning province has been fully leveraging its advantages in location and geopolitics, deeply integrating into the construction of the Belt and Road Initiative, and striving to create a new frontier for opening up to the outside world.

Li Mofei contributed to the story.

Video by Liu Yuan, Zheng Xin, Zhang Dong, Wang Xiang, Wang Yinhao, Li Yixin and Wu Yong.

China has not changed its position on developing a sound, stable and constructive relationship with the United States, but the current ties are still chilly, State Councilor and Foreign Minister Qin Gang said.

He made the remark in Beijing when meeting on Saturday with a visiting US delegation representing friendly organizations and the US business community.

Extending warm greetings to the delegation, Qin said that US enterprises are welcome to expand their investment in China, and China will continue to provide a better business environment for companies from the US and other countries.

Qin, who is former ambassador to Washington, told the guests that with Xi Jinping's unanimous election as Chinese president at the first session of the 14th National People's Congress earlier this month, China will maintain the stability and consistency of its major policies and guidelines.

The country will be more open to the world as it continues to advance its high-level opening-up, and the Chinese economy and society are expecting a strong recovery, he said. Although all of these are boons for the US business community, it is regrettable that Sino-US relations are still chilly this spring, he added.

Qin said the two countries should respect each other, coexist peacefully and cooperate for win-win results, noting that sound bilateral relations require efforts from both sides.

The foreign minister urged the US to discard its zero-sum mentality, stop containing and suppressing China through unfair means, work with China to overcome current difficulties and bring bilateral ties back to the track of healthy and steady development.

Sino-US relations remain tense as Washington keeps using competition as a pretext to smear China and restrain its right to development.

On Thursday, the US added 14 Chinese companies to its red flag list, requiring US exporters to conduct greater due diligence before shipping goods to them, Reuters reported.

According to a statement on the Foreign Ministry's website, members of the visiting US delegation said that they are deeply aware of the vigor and vitality of China's socioeconomic development, as well as the Chinese people's expectations for developing bilateral ties.

The US business community supports the sound development of the Sino-US relationship and maintaining the stability of bilateral relations, they said, vowing to prevent the two countries from falling into a vicious circle of isolation or conflicts.

They also said they welcome more face-to-face engagements between the US and China, and look forward to further increasing flights between the two countries, in order to promote bilateral exchanges among various sectors and deepen cooperation on economy, trade and investment.

Cooperation between China and the US has brought enormous benefits to both peoples ever since the establishment of diplomatic relations. Newly released US official data shows that trade in goods between the two countries hit a record $690.6 billion in 2022.

Message to development forum says nation to create opportunities for world

China will steadily expand institutional opening-up with regard to rules, regulations, management and standards, and will work with all countries and parties to share opportunities arising from it, President Xi Jinping said on Sunday.

In a congratulatory letter sent to the China Development Forum 2023, Xi said China will remain committed to its fundamental national policy of opening up to the outside world, pursue a mutually beneficial strategy, and continue to create opportunities for the world with new advances in China's development.

Xi said that at present, momentous changes of a like not seen in a century are accelerating across the world, regional conflicts and disturbances are frequent, and the global economic recovery is sluggish. He added that the facilitation of global economic recovery requires consensus and cooperation. The Global Development Initiative proposed by China has received wide support and an active response from the international community, said Xi.

Vice-Premier Ding Xuexiang, also a member of the Standing Committee of the Political Bureau of the Communist Party of China Central Committee, attended the opening ceremony of the forum and read out the congratulatory letter. In a keynote speech, he emphasized the importance of establishing a new development pattern. He said China aims to foster more open "dual circulation" development involving both domestic and foreign markets rather than a closed domestic loop.

Zheng Shanjie, head of the National Development and Reform Commission, said China welcomes foreign companies to invest and do business in the country and share its development opportunities. China will comprehensively deepen reforms and opening-up, promote the building of a high-standard market system and foster a world-class business environment, Zheng said.

The country will also make appropriate reductions to the negative list for foreign investment, ensure national treatment for all foreign-invested enterprises, enhance the stability, scale and structure of foreign trade and promote the high-quality development of the Belt and Road Initiative, he said.

Citing China's economic performance in the first two months of 2023, Zheng said the Chinese economy is stabilizing and picking up, with a notable improvement in both supply and demand. The country has the confidence and capabilities to foster high-quality development.

China will strengthen coordination between fiscal and monetary policies as well as policies relating to employment, industry, investment, consumption, prices, environmental protection and regional development, which will support the country's high-quality development, he added.

Finance Minister Liu Kun said that China's fiscal policy will make strengthening support for market entities a priority to solidify the internal driving force for high-quality development, ensuring equal treatment for all market players, including private businesses and foreign enterprises.

Fiscal support will be delivered to medium-sized, small and micro enterprises, self-employed individuals and industries under stress to reduce their burden, Liu said.

The Ministry of Finance will increase macroeconomic adjustments, including boosting infrastructure investment in the areas of transportation, energy, hydraulics, agriculture and information. Consumption demand will be expanded by beefing up transfer payments and improving tax and fee benefits, he added.

Boosting technological innovation will remain a policy priority, Liu said. Efforts will be made to increase relevant expenditure, give better play to the key role of enterprises in innovation and improve fiscal and tax policies to promote industrial upgrades and boost emerging industries.

Jeffrey Sachs, a renowned economist and director of the Center for Sustainable Development at Columbia University, told China Daily that "China's strength right now is that it is on the cutting edge of many of the most important technology innovations for the future. … This will be very good for China's growth in the future."

Sachs said China's constructive role in the world economy is further deepening. China is already the leading trade partner with most of the world. And the country is now at the cutting edge of innovation and key technologies for sustainable development. Meanwhile, the world's second-largest economy is playing a larger role in the global finance system, he added.

"President Xi Jinping's congratulatory letter at the opening ceremony of CDF … sends a very positive message to the world that China absolutely will continue to engage in a win-win manner with the world economy. I believe this is an accurate, correct and very important message," Sachs said.

Kristalina Georgieva, managing director of the International Monetary Fund, said China's economy is experiencing a strong rebound that will deliver a welcome lift to the world economy, contributing about one-third of global growth in 2023.

Xinhua contributed to this story.

Contact the writers at [email protected]

BEIJING -- The huge potential and sound development of the Chinese economy will provide broad cooperation space and development opportunities for domestic and foreign investors, a senior Chinese official said Sunday.

"Investing in China is investing in the future," Zheng Shanjie, head of the National Development and Reform Commission, said during the ongoing China Development Forum 2023.

During the past decade, China's economic aggregate has reached a new level and its economic structure has been optimized, Zheng said, highlighting that since the beginning of this year, the Chinese economy has continued to rebound with stronger growth drivers.

Looking ahead, the Chinese economy has strong resilience, great potential and vitality, and the sound economic fundamentals for long-term growth remain unchanged, he said.

Efforts will be made to expand domestic demand, pursue innovation-driven development, comprehensively deepen reform and opening-up, coordinate urban-rural development, and ensure both development and security, Zheng added.

The country will make greater efforts to build a high-standard market system, appropriately shorten the negative list for foreign investment, grant foreign-funded enterprises national treatment, and promote high-quality Belt and Road cooperation, Zheng said.

Senior executives from tech giants in the United States spoke highly of the Chinese market and supply chain after their long-delayed return to the China Development Forum this weekend, a sign that industry experts believe reflects their recognition of one of their biggest markets worldwide.

Tim Cook, CEO of US tech giant Apple Inc, started his speech to the forum on Saturday by saying that "it was so wonderful to be back". It was his first trip to China since the COVID-19 pandemic.

He spoke of the way Apple's relationship with China has changed from focusing on supply to "more and more interactions with Chinese customers" later.

"Apple and China grew together, a symbiotic kind of relationship both enjoyed," he said.

Amid market rumors that some US tech firms are exploring the possibility of moving production and assembly away from China, Cook didn't directly mention the issue but spoke highly of the company's "very large supply chain", millions of developers and thriving App Store.

The US tech giant assembles most of its components in China and has 5 million registered Chinese mobile app developers in its iPhone ecosystem.

Cook was among a group of delegates from leading multinationals attending the forum. Others include Ray Dalio, founder of Bridgewater Associates and Albert Bourla, CEO of Pfizer.

Noting at a subforum that the digital economy is quickly transforming the world, Cristiano Amon, president and CEO of Qualcomm Inc, emphasized that "no single company can do it alone".

"Qualcomm has a long history in China that spans nearly three decades. We are proud of the deep relationships we have built over the past 30 years… and the new partnerships we are building today," he said.

Bourla said that by supplying technology and semiconductors to wireless communications, advanced and power-efficient computing, and cutting-edge artificial intelligence, Qualcomm has worked closely with companies across industries and around the world — including in China — to innovate and advance social development and drive economic growth.

He said that one of the most significant trends is digital transformation, which has quickly become a strategic imperative for sustainable growth and innovation, even in the current macroeconomic climate.

Bourla said that China's recent plan for its overall digital development, which is designed to accelerate the creation of a "digital China", is a vivid example.

Despite rising calls from US officials to decouple from China, Huang Qifan, former mayor of Chongqing, emphasized that such an undertaking could never succeed.

"China has a uniquely massive single market, unified in terms of law, tax, business rules and other factors key to economic development," Huang said.

India, for instance, which is a potentially larger market than China, is fragmented and its market is governed by different state-level laws and business rules, he said.

"Thus, China's single market advantage greatly lowers costs related to manufacturing, research and development, fixed asset investment, logistics, market development and even raw material procurement. This scale advantage can reduce manufacturing costs by 30 to 40 percent," he added.

Instead of worrying about economic and geopolitical uncertainties, Huang said that China should develop future industries, like automated new energy vehicles and humanoid robots for housekeeping services, and turn them into world-class and durable products, to be globally competitive.

BEIJING -- Chinese Vice-Premier Ding Xuexiang has stressed further advancing opening-up and sharing market opportunities with the world.

Ding, also a member of the Standing Committee of the Political Bureau of the Communist Party of China Central Committee, made the remarks on Sunday at the opening ceremony of the China Development Forum 2023.

He read out a congratulatory letter sent by Chinese President Xi Jinping to the forum.

Emphasizing the importance of establishing a new development pattern, the vice premier said China aims to foster more open "dual circulation" involving both domestic and foreign markets rather than a closed domestic loop.

The country will continue to widen market access, improve the business environment, fully implement the national treatment of foreign-funded firms, and make greater efforts to attract and utilize foreign investment, Ding said.

Efforts will be made to promote coordinated development among different regions, encourage localities to exploit their comparative advantages in advancing opening-up, and promote high-quality Belt and Road cooperation, he added.

Ding also called for international cooperation to build an open world economy and share opportunities through opening-up, urging global efforts to strengthen international macro-economic policy coordination, safeguard multilateralism, deepen technological cooperation, pursue green growth impetus, and actively advance the Global Development Initiative.

The China Development Forum 2023, themed "Economic Recovery: Opportunities and Cooperation," opened in Beijing on Sunday. It is hosted by the Development Research Center of the State Council.

Experts, entrepreneurs, government officials and representatives of international organizations from all around the world attended the opening ceremony.

With China firmly committed to opening-up and continuing to expand market access while improving the business climate and services for foreign investors, more and more foreign firms will feel that investing in China is investing in the future, according to government officials and business executives.

Commerce Minister Wang Wentao on Sunday reiterated that China is devoted to building a market-oriented, law-based and internationalized business environment, and will keep expanding market access for foreign investors while promoting institutional opening-up.

"As China's door opens wider and its business climate and services for foreign investors continue to improve, more and more foreign-funded enterprises will come to China and take root," Wang said at a subforum of the China Development Forum 2023, which kicked off on Saturday and ends Monday.

"Many foreign companies have told us that China is a must-go market, and we also told them that they are not outsiders, but part of the 'family'," Wang added.

According to Craig Allen, president of the United States-China Business Council, cooperation between US companies and their Chinese counterparts is extremely resilient despite challenges.

US exports to China reached record highs in 2022, and China remains a crucial destination for US agriculture, food, chemical exporters and other commodities, he said, adding that USCBC data suggest that about one million people in the US are employed as a result of exports to China.

Apart from trade, US investment in China is also very important, and 77 percent of what US companies make in China is sold in China for the local market and only 7 percent is re-exported, Allen said.

The minister said that China will properly downsize the negative lists for foreign investors to further cancel or relax restrictions on market access. It will align with high-standard international economic and trade rules to expand opening-up with regard to rules, regulations, standards and management, and implement the upgrading of pilot free trade zones while advancing the construction of the Hainan Free Trade Port.

He also said that areas of interest to many foreign investors, such as government procurement, bidding, standards formulation and intellectual property rights protection, will be key focuses for improvement.

The country will reinforce support for innovation and encourage foreign companies to engage in new development tracks to gain greater impetus for growth. Relevant measures include encouraging foreign investors to set up research and development centers in China, and cultivate emerging sectors like digital trade and the green economy.

Allen said that he expects further liberalization be considered in areas like cloud computing, internet services, legal services and entertainment.

"More competitive environments, fairer markets in China will lead to jobs, efficiencies, innovation and growth," he said.

In light of the commitment to opening-up, many top multinational companies have reaffirmed their long-term confidence in China.

Oliver Zipse, chairman of BMW AG, said that he believes cooperation is the foundation for economic progress and that the modernization of China will unleash demand for innovative goods and services. He added that the growth and success of BMW in China has created prosperity in both China and Germany.

Foreign direct investment in China and Europe links the economies and is a significant counter to decoupling, he added.

Albert Bourla, chairman and chief executive officer of US pharmaceutical company Pfizer, said that it will continue to work with key stakeholders in China to drive progress and promote innovations that will improve patients' lives. In 2022, 11 new Pfizer drugs and indications were approved in China, and the company expects to submit up to 12 new drug applications in the country by 2025.

Stefan Hartung, board chairman of Robert Bosch GmbH, said the German industrial and technology group will strengthen the layout and development of new energy vehicle-related products in China.

"Electrified powertrain solutions will drive major growth in business over the course of the decade," he said, adding that Bosch will accelerate the development of fuel cell, hydrogen and electric-mobility technologies in China.

The Gerlingen-headquartered group's innovative electric-drive systems for commercial vehicles will be localized in China in 2023. It launched the first production line for high-volume membrane electrodes in Wuxi, Jiangsu province earlier this year, and plans to produce bipolar plates in the country by 2025.

Yann Bozec, president of US luxury fashion company Tapestry's Asia Pacific branch, said that the company will continue to expand investment in China.

"For Tapestry, China is not only a crucial market, but also a source of inspiration in seeking breakthroughs and innovation," he said.

Tapestry plans to open 30 new stores in China in 2023 and 100 by 2025.

China's economy is experiencing a strong rebound that will deliver a welcome lift to the world economy, contributing about one-third of global growth in 2023, said Kristalina Georgieva, managing director of the International Monetary Fund.

It is advisable for China to make more policy efforts to raise productivity and rebalance the economy away from investment and toward consumption-driven growth, which will be more durable and helpful to climate goals, Georgieva said at the China Development Forum 2023 in Beijing on Sunday.

China's economic rebound comes at a time when the global economic prospects remain challenging, according to Georgieva.

"For the world economy, however, spring is yet to come," she said, as uncertainties are exceptionally high due to the risks of geoeconomic fragmentation and rising financial instability at the time of higher debt levels.

The rapid transition from a prolonged period of low interest rates to much higher rates — which are necessary moves to fight inflation — inevitably generates stresses and vulnerabilities, as seen in recent developments in the banking sector of some advanced economies, Georgieva said.

Response actions taken by policymakers in advanced economies have eased market stress to some extent, but uncertainty remains high and underscores the need for vigilance, she said, adding that the IMF is assessing potential implications for the global economic outlook and financial stability, with a focus on low-income countries with a high level of debt.

China's economy is stabilizing and gaining momentum amid a steady recovery this year, and the country has the confidence and capabilities to foster high-quality development, according to the country's top economic regulator.

Zheng Shanjie, head of the National Development and Reform Commission, said the country will strengthen the coordination between fiscal and monetary policies as well as policies in terms of employment, industry, investment, consumption, prices, environmental protection and regional development, which will support the country's high-quality development.

He said the country will also make a big push to boost the spending power, actively expand effective investment, promote the construction of 102 major projects mapped out by the 14th Five-Year Plan (2021-25) as well as other projects key to economic and social development and support the healthy development of the private investment.

More efforts will also be made to boost innovation-driven development, accelerate the push for modernizing the industrial system, develop emerging industries and the digital economy and promote the upgrading of the traditional industries, Zheng made the remarks during the ongoing China Development Forum in Beijing on Sunday.

When it comes to the drivers of the Chinese economy, he said China's economic development is supported by quite a number of favorable conditions, including a well-functioning industrial system,an ultra-large domestic market,the world's biggest middle-income groups and a strong development foundation.

Citing China's economic performance in the first two months of 2023, Zheng said the economy is stabilizing and picking up with a notable improvement in both supply and demand.

Meanwhile, Zheng warned of difficulties and challenges ahead, saying the country is taking solid steps to deal with the headwinds.

Looking into the future, he said China welcomes foreign companies to invest and do business in China and share in China's development opportunities.

Zheng said the country will comprehensively deepen reforms and opening-up, promote the building of a high-standard market system and foster a world-class business environment that is market-oriented, law-based and internationalized.

The country will also make appropriate reductions to the negative list for foreign investment, ensure national treatment for all foreign-invested enterprises, promote the stability, scale and structure of foreign trade and advance high-quality Belt and Road Initiative, he said.

Being afraid of China's rise is a mistake in the United States, and the best way to overcome it would be a much more intensified dialogue between the two countries, said Jeffrey Sachs, a renowned economist and professor at Columbia University.

"There's a lot of tension between the US and China. I believe a lot of that tension arises from the US side," Sachs said in an exclusive interview with China Daily on the sidelines of the ongoing China Development Forum in Beijing on Sunday.

According to him, Washington's fear of China is misplaced and should be reduced.

"Economics is not a zero-sum game. This is the American mistake, because some Americans think that if China is rising, the US must be losing, but this is false. Economics is a win-win cooperative game," Sachs added.

According to him, China's constructive role in the world economy is absolutely deepening. China is already the leading trade partner with most of the world. And the country is now at the cutting edge of innovation and key technologies for sustainable development. Meanwhile, the world's second-largest economy is playing a larger role in the international payments and finance system.

"President Xi Jinping's congratulatory letter at the opening ceremony of CDF this morning sends a very positive message to the world that China absolutely will continue to engage in a win-win manner with the whole world economy. I believe this is an accurate, correct, and very important message," Sachs said.

As the United Nations forecast that India is projected to surpass China as the most populous country in 2023, some experts worry that the change could reduce China's advantages in manufacturing and its appeal to foreign companies.

But Sachs said "China's strength right now is that it is on the cutting edge of many of the most important technology innovations for the future, including low-carbon energy solutions, electric vehicles, batteries, supply chains, artificial intelligence, high-speed trains and many other sectors. All of this will be very good for China's growth in the future."

Sachs said he is a strong supporter of the BRICS, whose members include Brazil, Russia, India, China and South Africa.

"Now, some new countries want to join the BRICS framework, which will provide a greater part of dynamism for the world economy,” he added.