More engagement aimed at boosting mutual trust best way to de-risk

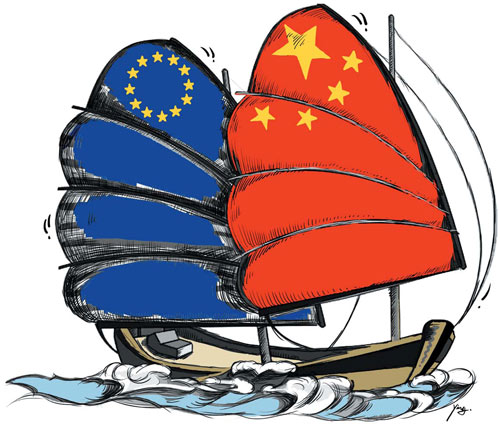

The term "de-risking" is not new to the business world. It means making investment portfolio less risky, or eliminating the risk of financial losses. The term, however, has gained a geopolitical meaning after European Commission President Ursula von der Leyen said in a speech on China on March 30 that "it is neither viable, nor in Europe's interest to decouple from China", adding that what the European Union seeks is "de-risking".

She listed a few areas of key technologies such as semiconductors and critical raw materials such as lithium used in electric car batteries in which the EU requires to "de-risk" from China.

To the surprise of many, the United States followed the EU's narrative this time, with National Security Advisor Jake Sullivan saying in late April that the US was not looking for decoupling, but "de-risking", from China, a statement that was repeated a few days later by the G7 leaders at their summit in Hiroshima, Japan.

The statement came after some US and EU officials, pundits and media had failed in their unrealistic strategy of "decoupling" from the Chinese economy over the past few years after having China's full participation in economic globalization a couple of decades ago.

Decoupling is mission impossible, given that the supply chains in East Asia and the rest of the world are intertwined and the fact that China is the largest trading partner of more than 120 economies, including the EU, and a major trading partner of the US.

De-risking, on the other hand, is understandable if it just means "don't put all you eggs in one basket". However, neither the EU nor the US has detailed the scope of "de-risking", though von der Leyen said that most EU-China trade is mutually beneficial and has no dependency issue.

Common sense tells us that if two trading partners enjoy strong mutual trust, de-risking is unnecessary. So the key is to strengthen mutual trust through more engagement and cooperation, instead of fearmongering and sowing discord that will only increase risks.

It is absurd to talk about "de-risking" just because China's political and value systems are different from those of the West. These differences have existed for decades. In fact, China had far more differences with the EU and the US 45 years ago than it has today. Yet that didn't prevent them from expanding their trade and investment relations by leaps and bounds, including in areas such as climate change, global governance and people-to-people exchanges.

World Trade Organization rules on non-discrimination and mechanisms such as the dispute settlement system ought to guide and govern global trade, rather than the faux ideological argument of "democracy versus autocracy".

The de-risking narrative is flawed, especially because it is the US that has been wielding its economic and financial power as a weapon including by imposing economic sanctions on dozens of countries and freezing the assets of nations, thereby posing a huge risk to many economies. That includes the EU. Didn't former US president Donald Trump declare German cars a national security threat? Or, doesn't the Inflation Reduction Act passed during the incumbent US administration disadvantage the EU's clean technology companies?

At the end of the EU-US Trade and Technology Council meeting in Sweden on Wednesday, US Secretary of State Antony Blinken reiterated that the US is not seeking confrontation, decoupling or Cold War with China, but "de-risking" from it.

However, the fact is, the US has been leading a reckless global campaign to curtail China's rise, including forcing Dutch and Japanese semiconductor equipment manufacturers to restrict their exports to China.

In the name of de-risking, some US and EU politicians are pursuing a strategy to exclude China from the global technology supply chains. This will only create more risks for the whole world and dampen the recovery of the global economy, which is yet to emerge from the shocks of the COVID-19 pandemic and the Russia-Ukraine conflict. Hence, the US-led West's de-risking strategy will also fail.

The author is chief of China Daily EU Bureau based in Brussels.