BRI cements all-around regional collaboration

Land-Sea Trade Corridor helps enhance international connectivity

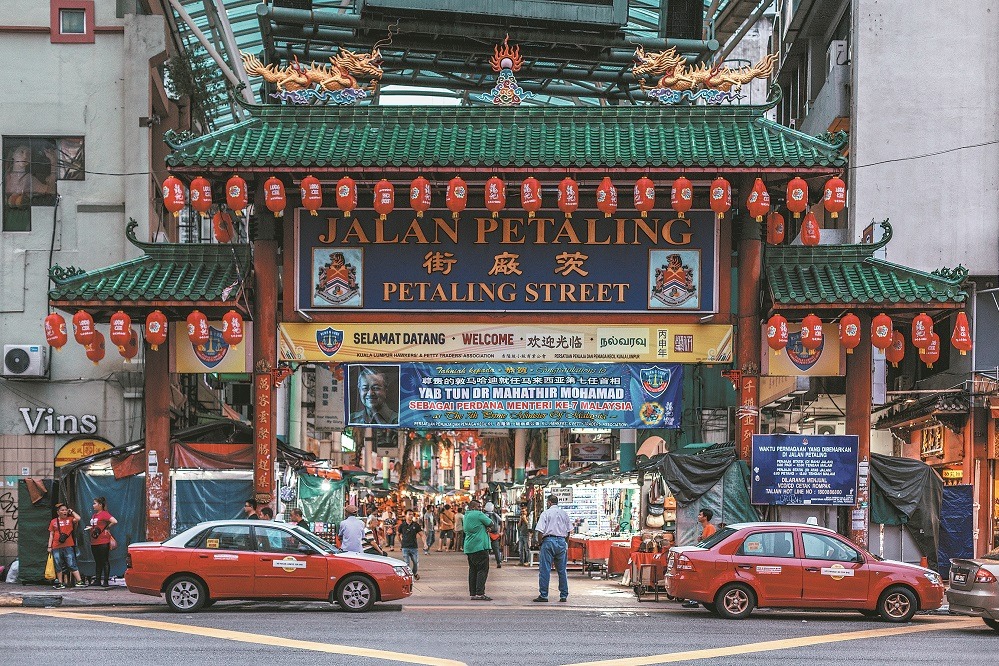

Market watchers and business leaders said substantial development of the Belt and Road Initiative and the New International Land-Sea Trade Corridor will anchor a solid foundation for mutually beneficial collaboration between China and Singapore for the years to come.

They predicted the evolving partnership will strengthen bilateral ties, while Singapore, having built itself into a major financial, commercial, logistics and shipping center in Asia, will continue to serve as a bridgehead for cooperation between China and its fellow members of the Association of Southeast Asian Nations.

Teo Siong Seng, former chairman of Singapore Business Federation, believes China and Singapore will reap the advantages of synergies resulting from enhancement of economic, trade, and investment relations throughout the Asia-Pacific region, generating multiplier effects.

By becoming the first signatory country to ratify the Regional Comprehensive Economic Partnership pact, Singapore acknowledged trade as a crucial component of its economy, and the pact will serve as an important mechanism to boost trade with other RCEP members, said Liang Ming, director of the Institute of International Trade under the Chinese Academy of International Trade and Economic Cooperation.

Propelled by the fast growth of the New International Land-Sea Trade Corridor, the two countries are also likely to scale up business activities in such fields as the digital economy, finance, new infrastructure, clean energy, high-end technology and shipping, Liang said.

Launched in 2017, the New International Land-Sea Trade Corridor is a trade and logistics passage jointly built by provincial-level regions in western China and ASEAN members. Building upon regular freight train services, China supports the operation of specialized train services for automobile transportation, refrigerated goods and certain types of cargo along the route, said Wu Haiping, director-general of the department of general operation at China's General Administration of Customs.

A total of 4,510 land-sea services were operated along the New International Land-Sea Trade Corridor in the first half of 2023, up 9 percent year-on-year, data from the GAC showed. During this period, the trade corridor facilitated provinces, autonomous regions and municipalities along its route to partake in foreign trade amounting to 350 billion yuan ($47.91 billion), highlighting year-on-year growth of 40 percent.

In another move to create conditions that will enhance their business ties, China and Singapore agreed in August to accelerate full resumption of direct flights between the two countries and promote closer trade cooperation, people-to-people exchanges and tourism, according to information released by China's Ministry of Foreign Affairs. The two governments also pledged to continue to advance high-quality BRI cooperation to achieve new outcomes of connectivity and mutually beneficial cooperation, and the Chinese government has resumed the 15-day visa-free policy for Singaporean citizens.

In 2017, China and Singapore signed a memorandum of understanding on jointly promoting construction of the BRI. Since 2013, China has been Singapore's largest trading partner for 10 consecutive years, while total trade value between the two countries has soared 22.8 percent on a yearly basis to $115.13 billion in 2022.

In May, the Shanghai Stock Exchange and Singapore Exchange, or SGX, signed a memorandum of understanding to launch an SSE-SGX exchange-traded fund — more commonly known as ETF in the industry, further reinforcing connectivity between the two countries. SGX Group said this latest collaboration with SSE bridges two rapidly growing ETF markets in Asia and extends the range of ETFs available for listing feeder funds between China and Singapore.

The move also facilitates greater collaboration opportunities between issuers in both markets, thereby enhancing investment options for investors. In addition, it builds upon the listing of three ETFs in 2022 under the link established between SGX and China's Shenzhen Stock Exchange.

SSE president Cai Jianchun said the signing of the MOU demonstrates SSE and SGX will continue to promote cross-border cooperation between China and Singapore and develop more connectivity products investing in selected ETFs to meet growing demand for cross-border opportunities between both markets.