'Renewable' world in the making

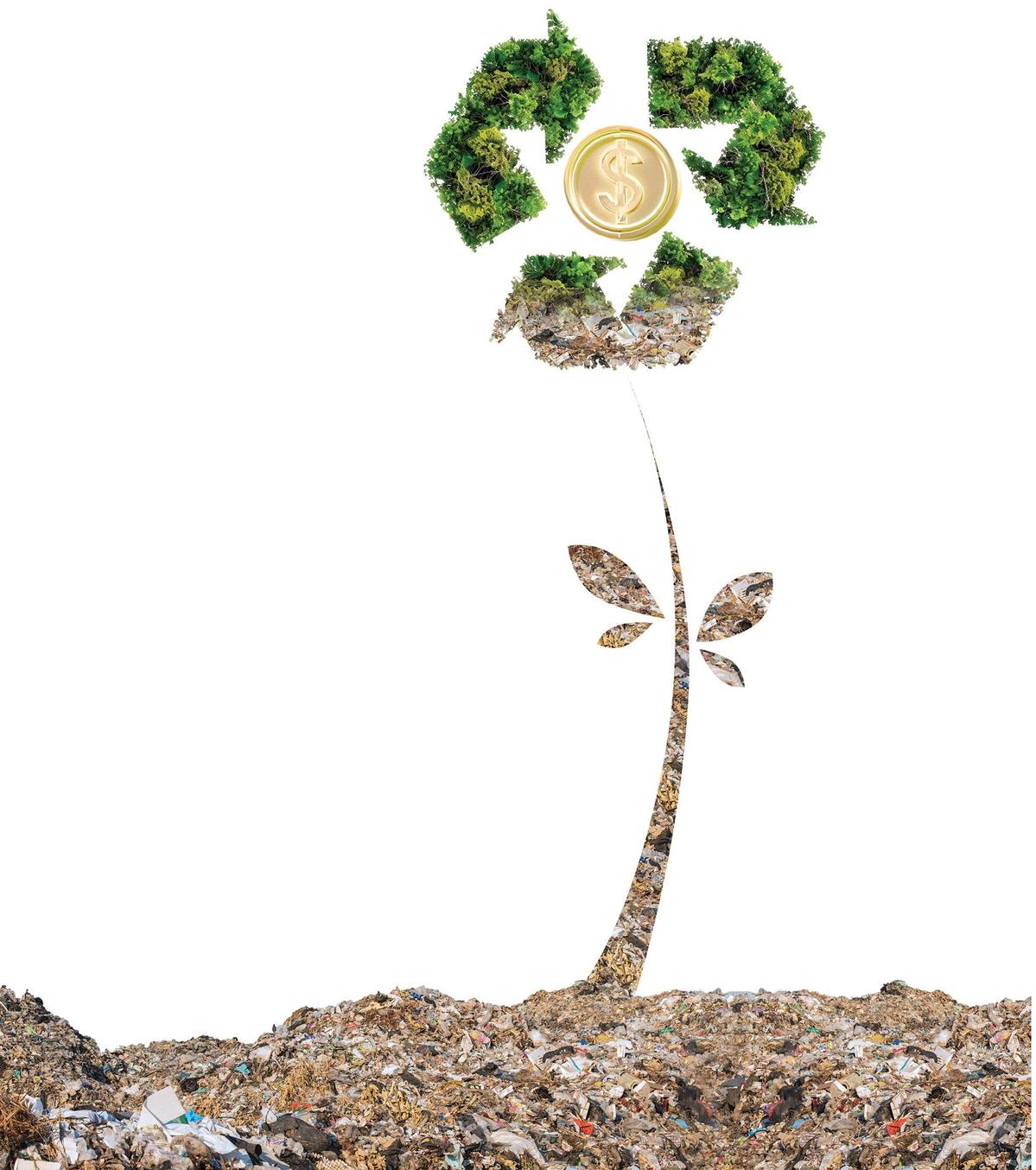

Hong Kong is doubling down on efforts to create a circular economy by mandating the use of specified waste disposal bags to cut down on the generation of garbage and promote a more eco-friendly environment. Li Xiaoyun reports from Hong Kong.

Hong Kong residents will soon be required by law to help the city achieve its sustainability goals, including protecting the environment and fostering a circular economy, by using designated garbage bags to dispose of trash.

But there has been an intense public debate on the effectiveness and feasibility of garbage fees in combating the city's mounting waste-management problem, the financial burden imposed on low-income families, as well as the potential ripple effect on the operational costs to businesses.

The law was to have been enforced on April 1, but has been put off for four months, until Aug 1, to allow for deeper discussions in the community and among enterprises. The garbage bags will be of various sizes — from 3 to 100 liters in holding capacity — and cost between HK$0.3 (4 US cents) and HK$11 each. For oversized waste that cannot fit in the bags, users will have to attach a specific label to each garbage item before disposal, each priced at HK$11.

According to the city's Environmental Protection Department (EPD), households with three or four people could expect to spend HK$30 to HK$50 monthly on garbage disposal.

The Legislative Council passed the Waste Disposal (Charging for Municipal Solid Waste) (Amendment) Ordinance 2021 on Aug 26, 2021, but it has drawn a strong response from residents on the heels of the special administrative region trying to get itself back on track with an economy battered by more than three years of COVID-19.

Industry experts believe the new regulation is not aimed at penalizing offenders, but is intended to serve as a financial incentive to induce consumers to embrace a more eco-friendly way of life. It will also change consumer behavior and encourage producers to switch their operational strategies to greener practices.

Necessity for circular economy

Charging for waste marks Hong Kong's first step toward reducing solid waste and moving toward a circular economy — defined as a way to cut down on waste and encourage sustainable use of natural resources. "The Sustainable Development Goals Report 2022" by the United Nations Statistics Division shows that global domestic material consumption rose by more than 65 percent in the past two decades, amounting to 95.1 billion metric tons in 2019. It warns that material extraction and consumption worldwide will need to be cut by one-third to return to safe consumption limits.

Despite the SAR government's bid to reduce waste through various campaigns and recycling facilities, the city's waste generation problem has remained a pressing concern. According to the EPD, each Hong Kong resident disposed of an average of 1.51 kilograms of municipal solid waste daily in 2022, higher than the level of 1.45 kilograms recorded in 2017. This places Hong Kong well above other developed Asian cities in terms of waste generation. "Tokyo, for example, averages 0.77 kilograms per capita, while the average in Seoul, South Korea, stands at 0.95 kilograms," says Lawrence Iu, executive director of the Hong Kong-based think tank, Civic Exchange.

Hong Kong's environment authorities have warned that the three landfills in the New Territories will be saturated in a few years if the current pace of waste disposal is not halted.

In view of the situation, the government's move to charge the public for waste disposal is a necessary and positive step in dealing with the challenges of waste management, says Lin Yatang, assistant professor of the Department of Economics at the Hong Kong University of Science and Technology.

Iu says charging for waste will create demand for the recycling industry, while at the same time incentivizing consumers to opt for products with light packaging and longer lifespans, thereby spurring changes in the upstream supply chain.

Some enterprises have been actively exploring alternative packaging materials, developing new business models, and prioritizing product innovations that emphasize durability, recyclability and reusability, says Cindy Ngan, a climate and sustainability partner at PwC Hong Kong.

Iu says he believes that one of the driving factors behind Ikea — a multinational company founded in Sweden that has gradually adopted more-sustainable packaging — is to meet the market demand generated by the stringent environmental policies of the Nordic region.

The home-goods retailer is not alone in embracing the global trend toward a greener future. As of the end of 2021, SF Express — a Shenzhen-based courier company — has deployed more than 720,000 circular packaging boxes made from easily recyclable materials, creating 2.8 million reuse cycles.

To combat plastic waste, Foodpanda — one of Hong Kong's leading food delivery platforms — has teamed up with the World Wide Fund for Nature Hong Kong to introduce a reusable packaging pilot program, allowing Foodpanda customers to order food from select restaurants that offer reusable containers. After having their meal, customers can return the containers to designated recycling machines and get a HK$15 electronic voucher for each container returned. The initiative can be seen as a valuable exploration by the food-and-delivery industry to reduce solid waste disposal.

But while large corporations may have the resources to navigate waste charges easily, Ngan says that the costs of waste disposal could be a financial and operational burden for small and medium-sized enterprises. She suggests that the government consider providing longer transition periods to implement any new requirements and financial incentives for these businesses.

Nevertheless, she emphasizes that adopting environmentally friendly and sustainable business models is the prevailing trend in the world. Companies that fail to proactively address these problems will encounter increasing obstacles in the future.

Hong Kong businesses do have great potential to contribute to solid waste reduction, but the lack of financial incentives in the past has dampened their motivation, Iu says.

Ngan says that although current waste-reduction measures may raise companies' operational costs in the short run, some may see opportunities for them to transform.

"By embracing sustainable practices and aligning themselves with evolving consumer values, retailers can not only mitigate short-term costs, but also unlock long-term benefits, including improved operational efficiency, reduced environmental impact, and enhanced brand reputation," she says.

Apart from producers and retailers, the recycling industry is likely to be a potential beneficiary in Hong Kong's sustainability campaign. "Hong Kong's recycling sector has been lagging behind, with limited infrastructure and efficiency," Lin says. With about 2,000 private recyclers acting mainly as middlemen, the industry lacks the scale and profitability needed to force meaningful change, she adds.

But Lin says the waste charging policy may help revolutionize the city's recycling landscape, as it's expected to encourage households to participate in waste classification, sorting, and recycling at the source, ensuring a steady input into the recycling processes. Moreover, the funds generated can be strategically reinvested to bolster Hong Kong's waste management infrastructure, she says.

While the waste disposal measure will be a boon for the long-term development of the industry and market players, it is essential to consider the economic impact on the general public. Lin says she believes that to ensure that the waste disposal fees will not impose disproportionate burdens on low-income households, careful assessment of its impact on different socioeconomic groups is necessary.

"It's worth considering implementing a fixed rebate for households through alternative means, such as income tax returns", so that families that help to reduce waste, reuse and recycle them need not shoulder excessive costs, Lin says.

With Hong Kong trying to realize its vision of "Waste Reduction, Resources Circulation, Zero Landfill", set out in the "Waste Blueprint for Hong Kong 2035", introducing the waste disposal charge is expected to lay the groundwork for the city to achieve a circular economy despite its nascent stage of development.

Lin says a circular economy in Hong Kong's context is aimed at minimizing waste and maximizing resource efficiency by promoting practices like sharing, leasing, reusing, repairing and refurbishing goods.

Collaboration for a common goal

Given Hong Kong's strengths and limitations, Iu emphasizes the significance of collaborating with other cities in the Guangdong-Hong Kong-Macao Greater Bay Area to foster the growth of a circular economy in the SAR.

Citing Ulsan in South Korea, where a recycling cluster incorporates both factories and plastic recycling facilities, Iu says the incineration of nonrecyclable waste in the industrial park generates heat and high-temperature steam, which are harnessed as energy sources for the factories' operations.

Drawing inspiration from this model, Iu suggests that Hong Kong can establish a recycling cluster in collaboration with other cities in the GBA.

Hong Kong's limited space, high land costs, and expensive labor could hinder the construction of large-scale industrial facilities in the city. But the complementary strengths among mainland cities in the GBA provide an opportunity to adopt this model, Iu says.

Hong Kong, renowned for its strong capabilities in innovation and technology, can further offer research and development support for the creation of a recycling cluster. Mainland cities in the region, such as Dongguan and Huizhou, with their robust manufacturing networks, can effectively utilize the energy generated from waste recycling, including hot water and steam, for the operation of factories, Iu says.

Lin and Iu share a common perspective, with Lin proposing starting a joint program among the 11 cities in the GBA to set up a regional recycling and resource management network, which would facilitate the efficient flow of materials and foster the development of a circular supply chain within the region.

Lin cites Shenzhen's noteworthy waste recycling approach. In 2021, the southern mainland city achieved a waste recycling rate of 41 percent, placing it among the top cities in the waste classification assessment conducted by the Ministry of Housing and Urban-Rural Development.

"Shenzhen has adopted a strategy that embodies waste reduction through sorting and collection, streamlined collection, transportation, and utilization, as well as comprehensive waste incineration," Lin says.

Hong Kong has to send more than 60 percent of its waste to landfills, while Shenzhen has a large proportion of its nonrecyclable waste incinerated. Although incineration does generate emissions, it is worth noting the significant advancements that have been made in recent decades in global standards of incineration technology. Through precise temperature control tailored to different types of waste, emissions are reduced with greater efficiency, says Lin.

"Collaboration between Hong Kong and other cities in the Greater Bay Area could involve knowledge sharing and technology transfer, where Hong Kong can learn from Shenzhen's experience in implementing waste incineration strategies, adopting advanced processing technologies, and improving clean incineration techniques."

- Survivor of Japan's 'comfort women' system dies

- 19 foreigners among China's first officially certified hotpot chefs

- China approves new lunar sample research applications from institutions

- Fishing, Hunting festival opens at Chagan Lake in Jilin

- A glimpse of Xi's global insights through maxims quoted in 2024

- China's 'Ice City' cracks down on ticket scalping in winter tourism