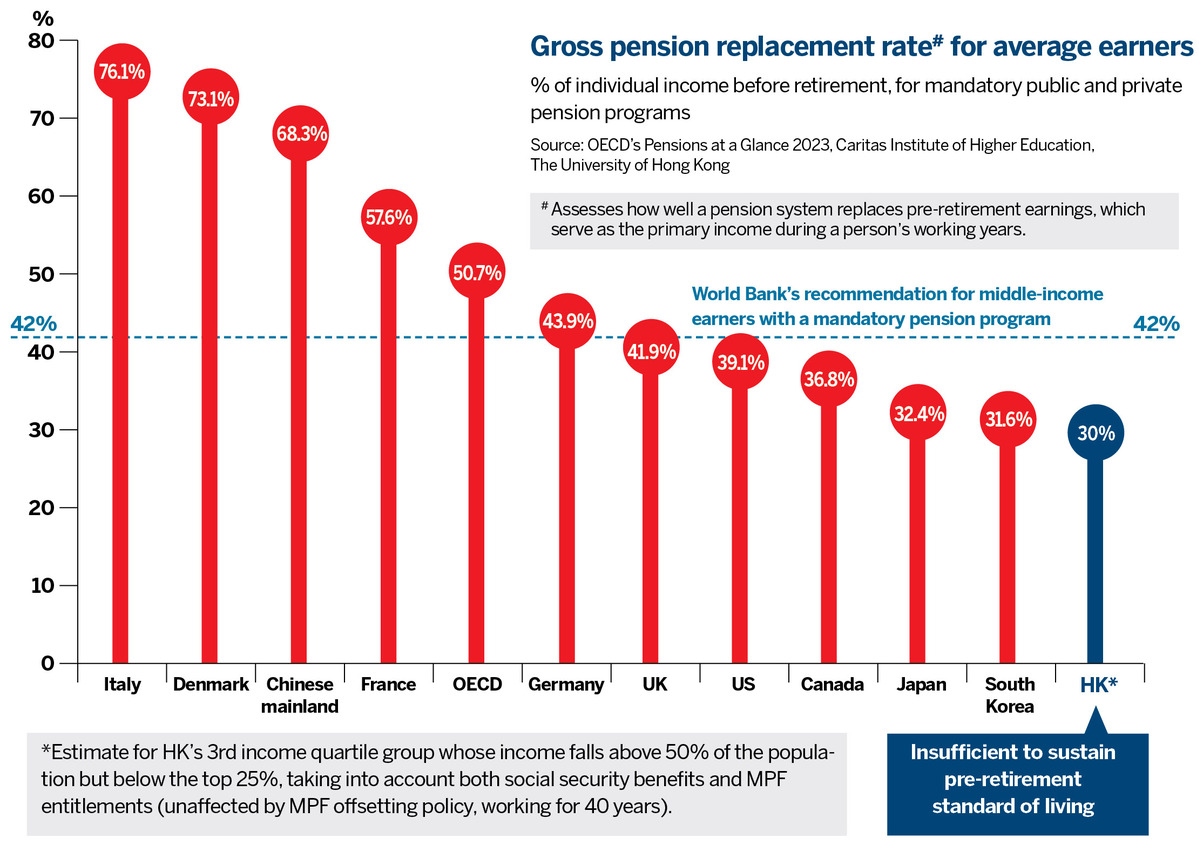

Can the over 65s survive on MPF savings?

Holistic policies

Wong Kwok, a lawmaker representing the city's largest labor union, the Hong Kong Federation of Trade Unions (HKFTU), says that the lack of proactive policies aimed at encouraging the elderly to work beyond the age of 65, and the shortfall in MPF retirement packages, discourage elderly participation in the workforce. He compares this with the bundle of policies adopted by Singapore and Japan, which include tax incentives, cash allowances and other stimulus measures to encourage the elderly to remain active within the job market.

Wong urges the government to take a proactive approach with the elderly, rather than relying on the market economy to determine the outcomes of MPF gains (or losses) and elderly employment programs. An HKFTU survey found that MPF savings are only sufficient to cover one-third of the financial needs of a retiree. The remaining costs of living have to be found elsewhere. The returns from the MPF are unsatisfactory, and the government should not shirk its responsibility for dealing with this, says Wong.

Can the MPF guarantee a return of 1 percent above inflation? Wong believes the administration would be able to achieve this, if it offers a 5 percent guaranteed return on silver bonds for those aged 60-plus. As an example, he refers to the Hong Kong Monetary Authority's Exchange Fund of over HK$4 trillion, which achieved a compounded 4.5 percent annual investment return between 1994 and 2023.

Wong says that, as MPF contributions after 65 years old are not mandatory, the government should cover them, or compensate employers who do, and contribute to the higher medical insurance costs for the elderly to enable them to remain in the workforce. Establishing a matching fund could also be considered, Wong adds, to evolve a holistic bundle of policies.

Contact the writer at [email protected]