Are EU-made EVs the solution?

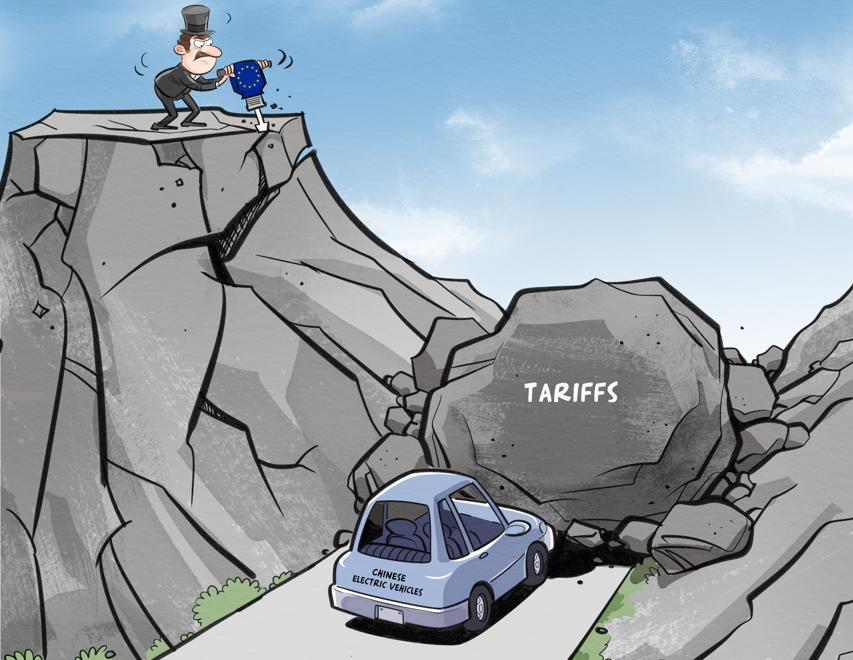

On Wednesday, the EU announced additional duties of up to 38.1 percent on imported Chinese electric vehicles (EVs) from next month. Such a decision on Chinese-made EVs including those manufactured by BYD, Geely and SAIC is about competitiveness, not government subsidies, period. It is about politics, as opposed to economics.

The EU has alleged that the possible government assistance to Chinese automobile makers and exporters, according to the World Trade Organization countervailing treaty, would unfairly afford Chinese automakers and exporters an advantage, causing severe harm to the EU's auto industry.

But the paradox is that the bulk of EU auto manufacturers supposed to be harmed by Chinese EV exports is opposed to European Commission President Ursula von der Leyen's political pet project against China. In fact, the entire German auto industry is against it, which is understandable given that Volkswagen and BMW are the workhorses that import EVs from China. The dirty secret about this issue that Von der Leyen doesn't want to talk about is that more than 50 percent of the EVs China exports to the EU are actually produced by Western auto giants such as Tesla, BMW, Volkswagen and Renault.

For example, despite France demanding that extra tariffs be imposed on EVs imported from China, one of the best-selling, and probably most affordable, EVs in the European market is actually made by France-based Renault's joint venture company in China and sold in Europe under its marque Dacia. Renault, for the record, opposed the EU investigation into Chinese-made EVs.

According to the WTO's anti-dumping and countervailing rules, subsidies that constitute an apparent WTO violation should contain two elements: one, subsidies should directly pertain to exports; and two, they should be received directly during the production stage, that is, the manufacturing stage. But neither element is apparent in this case.

First, there is no specific evidence of the Chinese government giving exports-specific subsidies to Chinese EV makers. Logically speaking, one would expect Chinese-made EVs sold in the EU to be less expensive than the ones sold at home if such exports-specific subsidies were indeed given to the EV makers. In reality, however, the exact opposite is true.

Second, the so-called government subsidies to EV makers that Western leaders and media are talking about are mostly incentives provided by local governments to consumers — something that the EU also does — R&D institutions specializing in basic research, product development firms and manufacturing plants. Such subsidies fall in the gray area under the WTO's countervailing rules, and are usually litigated through the WTO's dispute settlement mechanism. For example, key EU countries are notorious for pumping at least 18 billion euros ($19.24 billion), in various forms of government aid, into Airbus.

And even if such types of government aid were given to Chinese EV makers, the value apportioned to each EV exported to Europe would be so small that a comparable tariff would not be more than a few euros per EV, exposing the farce being played out by the EU.

But why play out this farce? Because more than 9 million renewable energy cars were sold in China in 2023, with about 6 million of them being EVs. On the other hand, China exported only 455,000 EVs to Europe, but about half of those were made by Western automakers operating in China, such as Tesla, Renault, BMW and Volkswagen.

EU governments, especially the Emmanuel Macron government in France, want to impose extra tariffs on Chinese-made EVs not because Chinese EV makers get government subsidies, but because EU leaders fear that Chinese EVs would outcompete their EU counterparts. Spain, for example, is also affected, to some extent, because it is home to some auto factories.

The auto industry is not just an economic matter. It is a political matter, too, because of its deep value chain that involves an extensive manufacturing base with hundreds of ancillary companies and hundreds of thousands of workers.

But the EU's attempt to ease out Chinese EV companies from the domestic market is not a viable strategy. The right strategy would be to embrace and compete against them, as Volkswagen, BMW and Renault have done. The entire European auto industry needs a complete transformation to be able to catch up with China's EV industry. Another good strategy would be to forge partnerships with Chinese companies, the same way that the latter did with EU companies starting in the late 1980s.

The Chinese side is open to the idea of moving some of its manufacturing bases to Europe in cooperation with its traditional EU partners. The Chinese battery-manufacturing companies will follow suit. This joint-venture model is in the best interest of both sides, because it would prevent the loss of jobs and create new commercial opportunities in Europe. The proven recipe of success in China can be used to benefit Europe, too.

The author is a professor at the University of International Business and Economics. The views don't necessarily reflect those of China Daily.

If you have a specific expertise, or would like to share your thought about our stories, then send us your writings at [email protected], and [email protected].