Dawn of supercharging puts China's NEVs in fast lane

Southern tech mecca of Shenzhen leads way in such key infrastructure

SHENZHEN — As you plug your electric vehicle into a supercharger stall in Guangdong province's Shenzhen — a major national tech hub — you find yourself marveling at the rapid charging progress bar on the car's dashboard.

At the brand new Lianhuashan supercharging station in Shenzhen, a driver of a new energy vehicle surnamed Sun unplugs the charging cable, saying, "I've got nearly 500 kilometers of range in roughly 20 minutes.

"And the range is enough for my daily commute and weekend outings for two weeks," Sun added.

"Recharge over a cup of coffee before hitting the road" is the slogan seen at many NEV supercharging stations that have recently sprung up in the city in South China. In June 2023, Shenzhen debuted its first fully liquid-cooled supercharging demonstration station and unveiled an initiative that seeks to establish Shenzhen as the "City of Supercharging" by 2030.

By the end of April, the city — home to approximately 18 million permanent residents as well as prominent NEV producer BYD — had installed 362 supercharging facilities, surpassing the number of gasoline stations. The latest available statistics put the number of supercharging stations in the city at 670 and Shenzhen plans to expand the number to 1,000 by the end of this year.

As the tech hub leads the push for ultrafast charging of NEVs, another tipping point was reached in the automotive sector, highlighting the growing dominance of NEVs over traditional gasoline-powered vehicles across the country.

Retail sales of NEVs nationwide reached 878,000 units in July, accounting for 51.1 percent of the total market for all auto sales during the period, according to data released by the China Automobile Dealers Association.

Behind this milestone, the country's ongoing efforts to enhance the charging infrastructure have played a crucial role in easing drivers' "range anxiety", which in turn has significantly boosted NEV adoption.

The availability of supercharging makes NEVs a more appealing choice as it significantly shortens charging times. While it usually takes seven to eight hours to charge a vehicle using a slow charging pile, and one to two hours using a fast charging pile, a supercharger is capable of charging an electric vehicle to 80 percent or above within 10 minutes — adding up to one km of range per second.

"For me, the biggest concern in driving an electric car was the slower charging speed compared to gas refueling. However, this concern has been dispelled by the option of supercharging," said Sun.

Shenzhen is home to more than 1 million NEVs, which accounts for a quarter of its entire vehicle fleet. In the first half, the penetration rate of NEVs in Shenzhen reached some 72 out of every 100 newly registered vehicles in the city being NEVs — well above the national level.

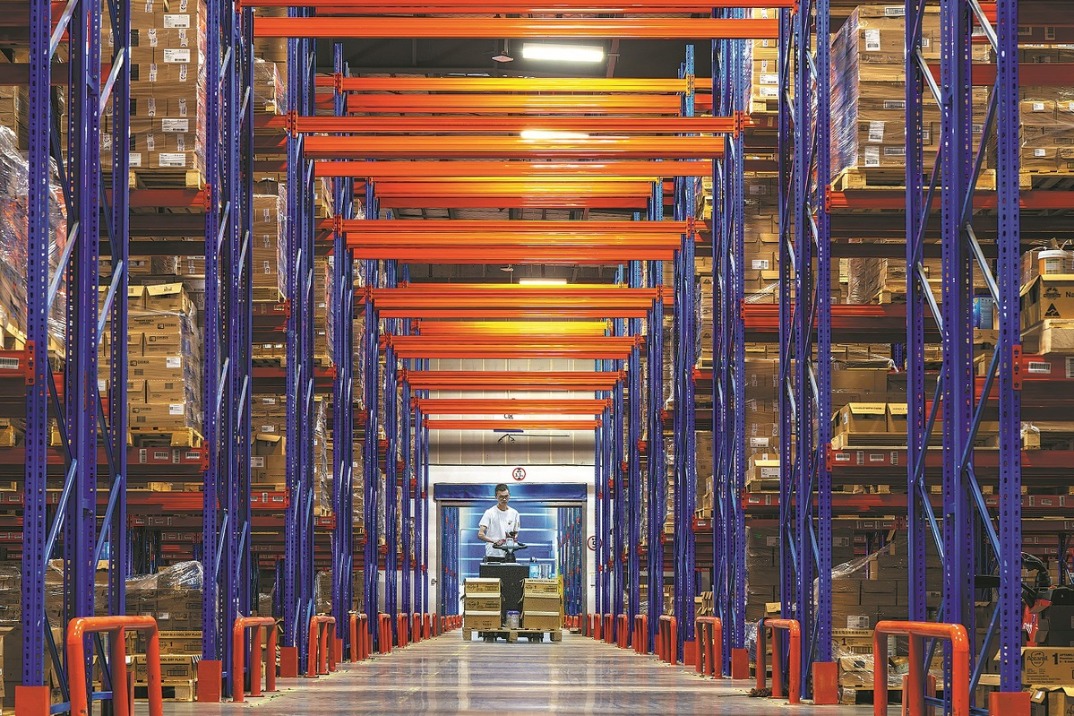

The city boasts over 360,000 public charging piles, an equivalent of roughly 180 piles per square kilometer. Most of the new superchargers are built upon existing public charging facilities and are distributed in large business complexes, bus stations and industrial parks across the city.

Across the country, other megacities are also installing supercharging facilities and developing roadmaps for building supercharging networks. Southwest China's Chongqing plans to build more than 2,000 supercharging stations for NEVs by 2025. Beijing plans to install 1,000 supercharging stations by the end of 2025.

In a policy interpretation issued in August, the Beijing Municipal Commission of Development and Reform said that Chinese consumers are increasingly expecting "on-the-go" charging experiences similar to gas refueling. The efficiency of charging services, in particular, affects consumer's decision-making when it comes to vehicle purchases.

Supercharging technology and a related service network are crucial to the appeal of NEVs, according to authorities.

Chinese industry research institute Forward published an analysis report saying that as of mid-June, the number of supercharging stations in China had exceeded 7,700, citing data retrieved from Chinese mobile mapping service Gaode Map.

Guangdong province topped the table in terms of the number of such facilities.

The year 2024 is the inaugural year for the implementation of supercharging-related standards, said Li Yangxing, vice-president of R&D at Sunwoda EVB Co Ltd, a new energy technology company, adding high-power charging stations will dominate the future landscape of public charging infrastructure.

"We found during our investigation that consumers are willing to pay more to upgrade to superfast charging. If their vehicles can achieve a 200-km range in just five minutes of charging, consumers are willing to pay up to 6,500 yuan ($897) to adapt their vehicles to the charging facilities," Li said.

Forward expects production at scale and the extensive construction of supercharging stations is likely to further drive down unit costs, which will contribute to the extensive adoption of supercharging.

As the government continues to intensify its support for the new energy sector, the construction and operation of supercharging stations can be guaranteed, according to the institute.

Xinhua

- Fortive increasing investment, localization efforts

- State Grid Fuyang Power Supply: Conducting pre-holiday inspections of charging stations to facilitate sustainable travel

- Charging infrastructure of rural areas boosted by State Grid's efforts

- Oil giants diversify revenue sources

- Charging rollout lags US EV sales