Classic Keynes-Hayek economic debate worth revisiting

The relationship between government and the market has long been a source of debate in economic theory. The divergent views of economists Friedrich Hayek and John Maynard Keynes have shaped much of this discourse.

Hayek firmly opposed government intervention in the market. He believed that even in times of economic crisis, if the government artificially creates demand, it will inevitably lead to the misallocation of resources, potentially sowing the seeds for new turmoil and crises.

Keynes believed that policymakers cannot afford to simply wait for the market to naturally converge toward equilibrium. By the time that hypothetical long-term recovery occurs, the immediate hardships faced by individuals and the broader economy would have already taken a devastating toll.

At the core of this debate lies their contrasting views on the market's ability to self-correct. Both Hayek and Keynes acknowledged the fundamental role of the market and agreed that it should not be replaced by government control. However, their assessments of the market's efficiency and occasional need for intervention diverged significantly.

The key to striking the right balance lies in carefully assessing the state of the market itself. If the market is functioning well, there may not be a need for government involvement. However, if the market itself is plagued by significant problems, then the government must intervene.

The collapse of Silicon Valley Bank in March 2023 has served as a sobering reminder of the critical role that governments must play in addressing market instabilities.

As fallout from the bank's failure led to a significant contraction in commercial bank lending and turmoil in the financial markets, the US Federal Reserve responded swiftly by significantly expanding its asset holdings — a move that was widely praised as a wise and necessary intervention.

This episode has reinforced the growing consensus among experts that when problems arise in the market, government intervention is essential to stabilize the situation and help the market weather the crisis.

However, in China, the approach to market rescue efforts has often been complicated by concerns over moral hazard. The dilemma of whether to prioritize addressing moral risks before providing market support has frequently hampered the government's ability to act decisively in times of crisis.

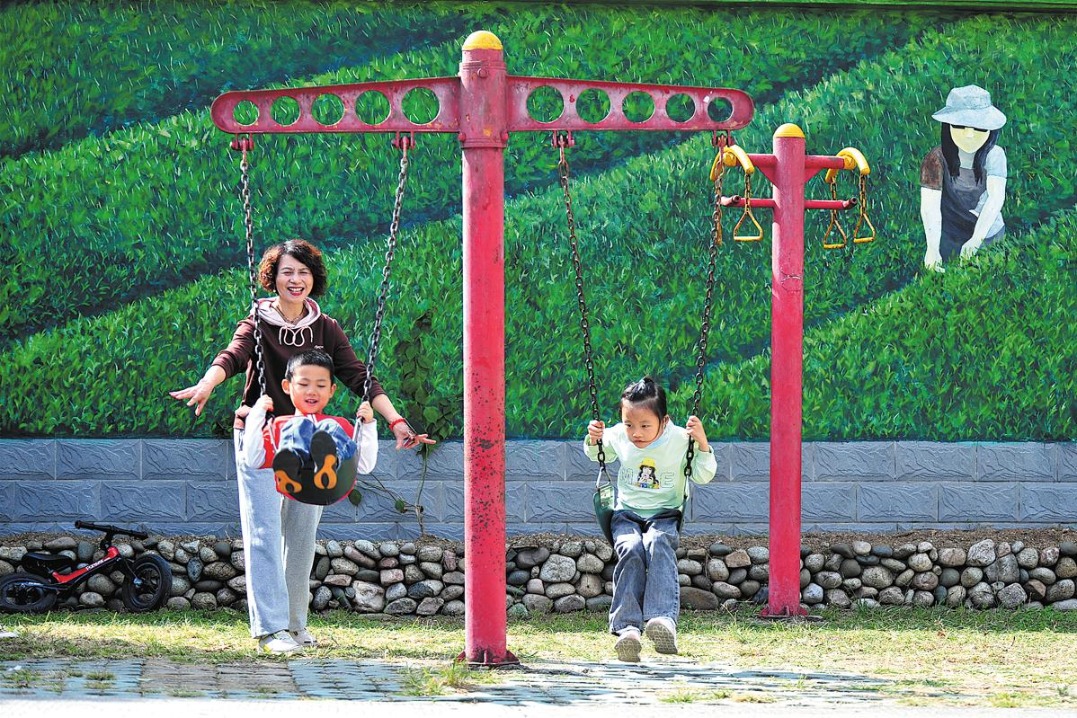

It's a matter of timing. Let's say if a child has already fallen into the water, it would be absurd to stand by and watch, simply to teach them a lesson. The priority should be to save the child first, and then consider how to prevent such incidents in the future.

The real estate market in China has faced a similar conundrum, where the discussions around moral hazard have often taken precedence over the immediate and pressing need to stabilize the sector. There is no doubt the market should be rescued first, allowing it to survive before delving into the complexities of moral risk management.

As income inequality continues to rise around the world, governments should play a more active role in promoting common prosperity and ensuring social harmony and stability.

While a market economy is capable of achieving Pareto optimality — a concept related to efficiency — experts caution that this does not necessarily translate to an equitable distribution of income. A state of extreme income inequality can also be Pareto optimal. This means that the market, on its own, lacks the ability to rectify the problem of unequal income distribution.

The global trend of rising income inequality has been particularly evident in the US.Since the onset of globalization in the 1990s, the share of national income going to wages and salaries has diverged from the share going to corporate profits. While worker wages have declined, corporate profits have seen a significant rise.

The US has been a major beneficiary of globalization. This is because the country has been able to create value at no cost, in exchange for products and services from other countries. However, the US has failed to distribute the gains of globalization fairly within its own borders.

As a result, the wealthy in the US have captured the majority of the benefits from globalization, while ordinary workers have suffered the consequences, leading to a widening of the income gap and exacerbating social tensions.

The problem in the US is primarily an internal one. As a capitalist country, the US lacks the ability to effectively transfer resources between different socioeconomic classes. These are the consequences of relying solely on the market.

In the future, as artificial intelligence-driven production becomes more prevalent, the government's role in regulating income distribution will become even more crucial. The market alone cannot be trusted to ensure that the fruits of technological progress are shared fairly.

From this perspective, nations can actively promote the formation of scale advantages in their domestic industries, which then drives a significant amount of intra-industry trade among developed countries.

China's success in the new energy vehicle industry serves as a prime example. Over the past three years, the country's NEV market share has skyrocketed from less than 5 percent to 45 percent of the global segment, accompanied by a surge in Chinese auto exports.

This remarkable transformation is closely linked to China's sustained policy support for the NEV sector, covering production, consumption and infrastructure development.

However, this success has been perceived as a "threat" by some other countries, leading the European Union to recently issue a 700-page report highlighting China's supportive policies, which the EU views as "market distortions".

The Chinese government's substantial asset holdings present an opportunity to actively distribute income and boost domestic demand.

Data from 2018 show that State-owned enterprises accounted for 52 percent of assets in the corporate sector, with an even higher proportion in the financial sector. This means that the returns generated by these government-held assets ultimately accrue to the government itself.

As China navigates the complex relationship between the market and the government, a one-size-fits-all approach based on Western economic dogma is not the solution. Instead, a nuanced, case-by-case analysis that considers China's specific economic structure and income distribution is more appropriate.

The appropriate relationship between the market and the government should be evaluated based on three key criteria — whether it promotes the development of productive forces, enhances comprehensive national strength, and improves the living standards of the people.

The relationship between the market and the government must align with China's current ownership structure and income distribution system.

The influence of market players is based on the premise of income, and the more income they have, the greater their market influence. If market players are unable to convert their income into effective demand, it will lead to a shortage of effective demand and other economic problems.

In this context, the government's approach to fiscal spending should differ from that of private entities. Rather than focusing primarily on microeconomic rates of return, the government's expenditures should prioritize social benefits.

The government's fiscal policy should be aimed at doing what the private sector is unwilling or unable to do, such as investing in infrastructure projects. At the current state of affairs, the authorities should play a more active role in these areas to provide solid support for China's sustainable economic development, rather than completely withdrawing from the market.

The writer is the chief economist at BOC International.

The views do not necessarily reflect those of China Daily.