Foreign banks more bullish on Chinese mkt

Analysts believe recent policies will have profound and far-reaching implications for nation's economy

The effect of policy measures is clear in China — with improvement achieved in consumption, production and home sales, as well as acceleration in export growth and elevated stock trading.

The purchasing managers' index, which measures sentiment in the manufacturing sector, showed expansion in November, rising to 50.3 from a reading of 50.1 in October, and has bounced back to expansionary territory for two consecutive months, said the National Bureau of Statistics.

According to Desmond Kuang, chief investment officer for China at HSBC Global Private Banking and Wealth, the incremental policies since late September have improved the production willingness of manufacturers and bolstered confidence — as both supply and demand in the manufacturing sector saw recovery.

In October 2024, retail sales of consumer goods expanded 4.8 percent year-on-year, quickening from an increase of 3.2 percent a month earlier. Specifically, household appliances posted a surge of 39.2 percent, driven by the national trade-in program.

"We expect the trade-in program to continue playing a crucial role in boosting consumption," said Lu Ting, chief China economist at Nomura.

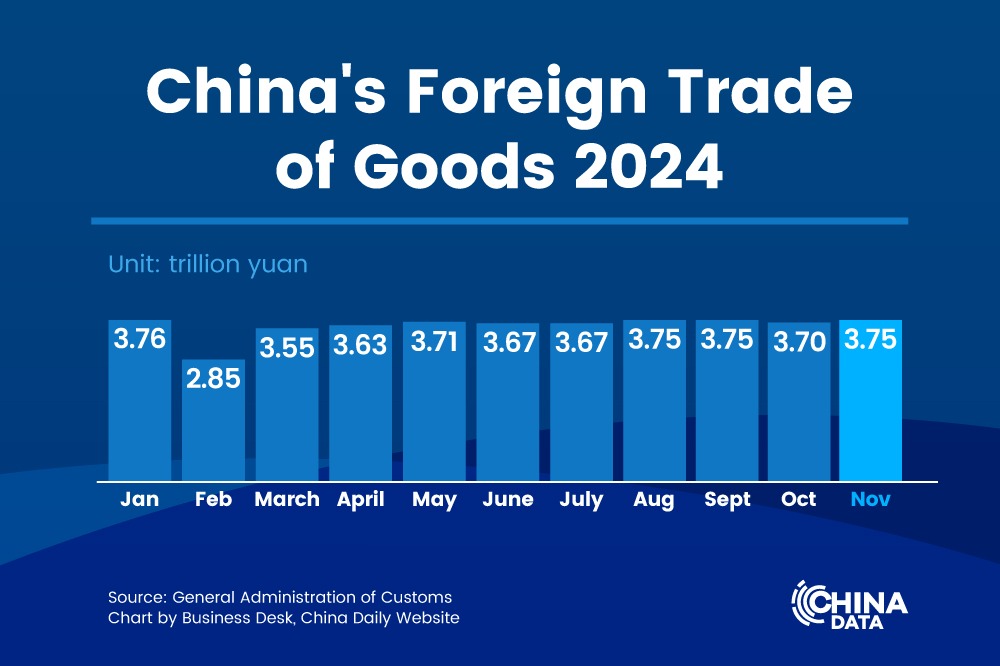

Resilient external trade also remained a bright spot. Export growth increased from 2.4 percent year-on-year in September to 12.7 percent in October, with Chinese exports to ASEAN, Latin America and Africa showing an increased rate of expansion.

"China is better positioned to withstand a protectionist climate when compared to the past," said Ji, adding that burgeoning demand from emerging markets may help cushion external shocks.

Regarding the property market, which saw both new and secondhand home sales register growth in October after eight months of declines, Wang Yi, head of the China real estate team at Goldman Sachs Research, said the Chinese government has made reversing the property market downturn and stabilizing the sector a major policy focus. "A series of forceful measures are helping realize the goal," Wang added.

Looking ahead, Xiong Yi, chief China economist at Deutsche Bank, believes domestic demand will continue to be a major driving force of the Chinese economy in 2025. With both incremental and existing policies taking hold, China's economy is expected to continue to gain momentum.

Several high-profile business executives from foreign financial institutions, including John Waldron, president and chief operating officer of Goldman Sachs Group, BlackRock CEO Larry Fink, and Citigroup CEO Jane Fraser, recently made visits to China. They voiced optimism about the prospects of the development of China's economy, and expressed their willingness to continue to deepen engagement with the Chinese market.

Xinhua