It's time to guard against excessive RMB exchange rate adjustments

With the final chapter of the US presidential election now written and President-elect Donald Trump's strong return to politics, market concerns are rising that the United States might again implement policies that could weaken the Chinese yuan, or the renminbi.

In early 2018, the Chinese renminbi's rebound was stopped by then US president Trump's initiatives to escalate US-China trade tensions. The Chinese currency briefly tested the 7 per dollar mark at the end of 2018 and mid-2019 and finally broke below that level in August 2019. This is what could be considered Trump 1.0's impact on the yuan.

During the 2024 election campaign, Trump threatened to impose high tariffs on goods directly or indirectly exported from China to the United States.

He highlighted plans to escalate trade frictions with China in major aspects — removing permanent normal trade relations with China, imposing tariffs that could possibly amount to 60 percent on all Chinese goods exported to the United States and gradually halting imports of essential goods from China.

Influence channels

These measures would influence the yuan exchange rate via China's balance of payments and supply-demand dynamics in the foreign exchange market.

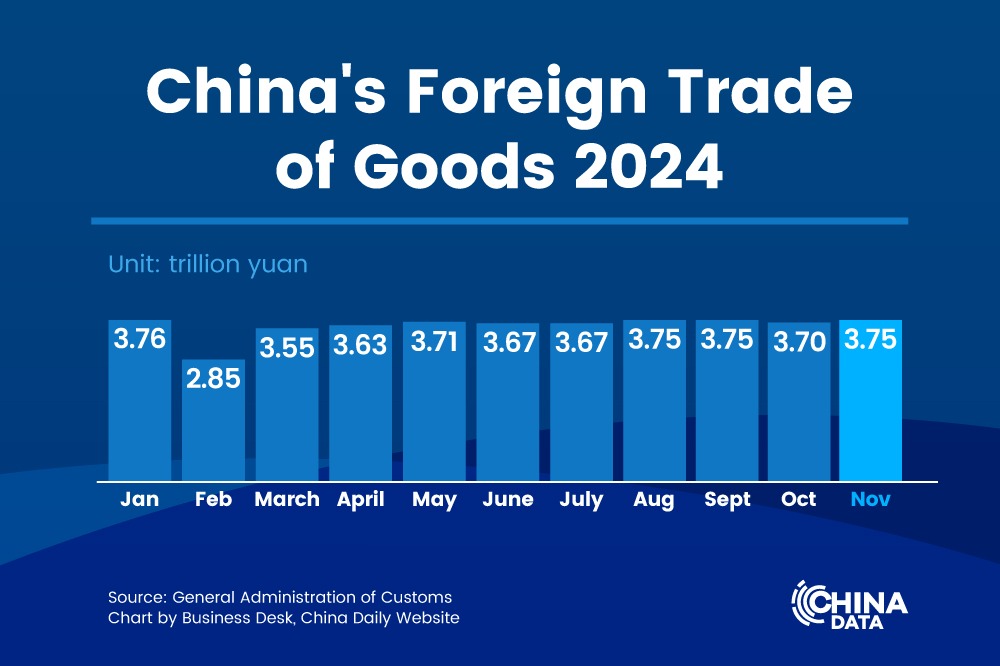

On the one hand, if the proposed tariffs are implemented and China cannot find large-scale alternative export markets in the short term, this could affect China's foreign trade and trade surplus.

On the other, if the United States imposes higher trade barriers on Chinese goods, foreign direct investment into China will likely decrease, and Chinese firms may increase overseas investments and factory construction, accelerating the relocation of Chinese industries abroad.

Trump's presidency may also impose indirect effects on the yuan exchange rate via two main channels. First, the financial and confidence channel. Based on the experience of Trump 1.0, heightened US-China trade tensions have generally been bearish for the yuan, while easing tensions have been favorable.

For instance, in 2018, Trump announced tariffs on Chinese goods, which ended the yuan's rally and prompted China to implement measures to stabilize the exchange rate. In 2019, when US-China trade negotiations stalled, the yuan fell below 7 against the dollar, but the subsequent first-phase trade deal led to a recovery in the yuan's exchange rate.

The other indirect channel is the impact of the Trump administration's tariffs on US inflation, which in turn influences the US Federal Reserve's interest rate policy and the US dollar index.

If Trump 2.0's fiscal, trade and immigration policies lead to persistent high inflation in the United States or even a second wave of rising inflation, the Fed may suspend rate cuts or even re-initiate rate hikes.

If so, the Fed policy would be less accommodative than expected, potentially strengthening the US dollar, let alone any disruptions in investor sentiment and exchange rates caused by Trump's potential comments on US interest rates and exchange rates. This has been one of the key elements of the recent "Trump trade" in the market.

Nation's response

Compared to the US-Japan trade relationship, there is still room for adjustments in US-China trade dynamics. If the Trump administration's tariff measures cause a significant short-term drop in China's exports and trade surplus with the US, the potential negative impact on China's economy should not be underestimated.

This reflects the increasingly complex and challenging external environment facing China's economy, with growing uncertainties and instabilities.

To address this, the priority is to engage with various stakeholders in the United States, guiding trade policies in a more cooperative direction. Over recent years, China's significance in the US trade imbalance has diminished, while the United States still faces relatively high inflationary pressures. As a result, the incoming Trump administration may not be strongly motivated to immediately or fully implement the tariff threats.

Second, China must take advantage of the opportunity window that has emerged since late September, marked by a shift in the macroeconomic policy stance and marginal improvements in economic performance.

China should continue to deepen reform and opening-up, ensuring that the economy returns to a reasonable operating range, reversing investor expectations and boosting market confidence.

In October 2020, US Federal Reserve Chairman Jerome Powell stated that the US economic recovery had not yet been completed and that the risk of insufficient policy intervention outweighed the risk of excessive intervention. Even if it turned out that policy actions went beyond what was necessary, they would not be in vain — economic recovery would be stronger and faster.

This philosophy offers a valuable reference for China's macroeconomic policies. By increasing countercyclical adjustments and staying ahead of the market curve, China can position itself more advantageously in future trade negotiations.

Furthermore, China must closely monitor the development of Trump 2.0's trade policies toward China, conduct scenario analysis and stress tests, and take proactive measures to prepare for potential risks, all while looking for opportunities in challenging circumstances. By preparing for the worst while striving for the best outcomes, China can better navigate these turbulent times.

It is worth mentioning that the impact of tariff threats on the yuan exchange rate cannot simply be modeled on the experience of Trump 1.0.

During Trump 1.0, the US administration initiated the decoupling between the United States and China with technological competition, shocking the market and leading to the renminbi exchange rate overshooting. By the later stages of Trump 1.0, the market grew fatigued with his extreme pressures on China, and market reactions became increasingly muted.

Trump 2.0's renewed high-profile efforts to pressure China's economy may once again draw market attention, but this is likely to be event-driven. If efforts from relevant stakeholders can help reduce the intensity of Trump 2.0's tariff policies, it would mitigate the related shocks.

Recently, multiple international investment banks predicted that the renminbi exchange rate could weaken to 7.5-7.6 by the end of 2025, implying only limited adjustment from the current level.

Meanwhile, maintaining the renminbi exchange rate's flexibility to fluctuate within a reasonable range can help absorb external shocks and prevent excessive market pressure from building up.

Policymakers should also develop response plans based on scenario analysis and stress testing, ensuring the timely use of the "micro-regulation plus macro-prudential" policy toolbox when necessary.

By taking a comprehensive approach, strengthening expectation management and preventing one-sided market forecasts from materializing, China can guard against the risk of excessive exchange rate adjustments.

The writer is global chief economist at BOCI China.

The article is translated from a piece published on China Business News.

The views do not necessarily reflect those of China Daily.