Government investment funds new drivers of innovation

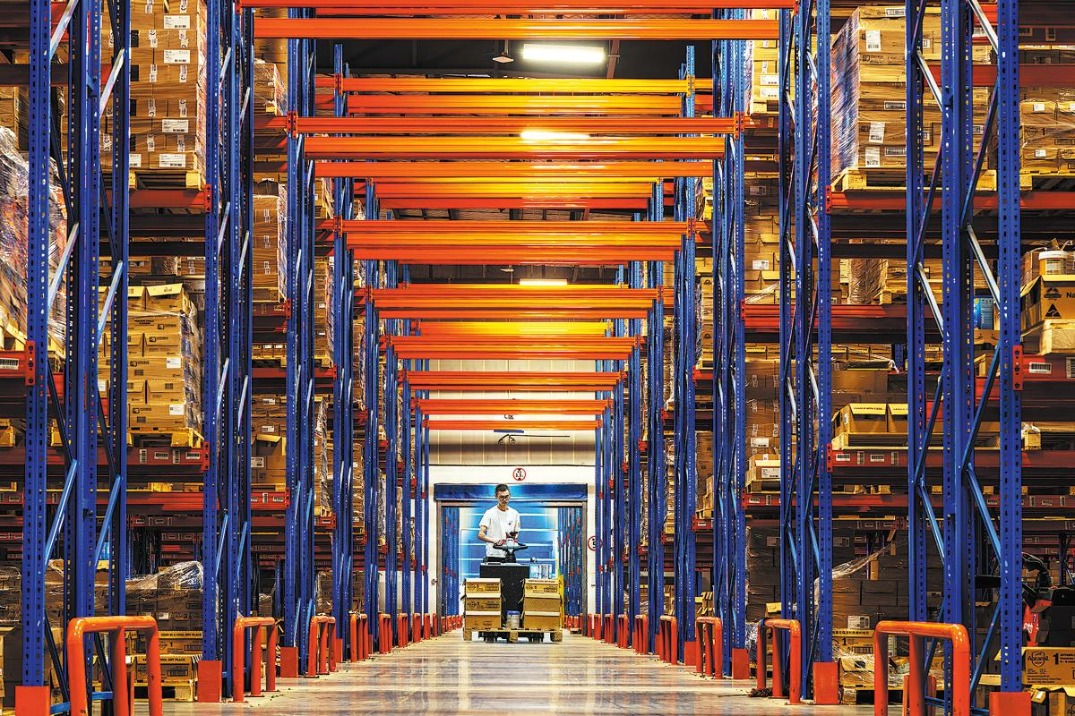

The central authorities have recently stressed effective supervision on government investment funds in accordance with market-oriented, law-based and professional principles. By establishing government investment funds and adopting market-oriented methods such as equity investments, the government guides social capital toward key areas and weak links, such as emerging industries, infrastructure and small and medium-sized enterprises.

In recent years, local governments have launched a large number of funds of considerable size. However, some government investment funds have faced issues such as overlapping policy objectives, idle and fragmented funds, and noncompliant investments. It is therefore necessary to ensure that the establishment and operation of government funds are legal and compliant. At the same time, improving the internal governance structure of funds, respecting market laws and enhancing the operational efficiency of funds are crucial.

Government investment funds should become responsible long-term and patient capital providing long-term and stable financial support for investment projects and the capital market. Meanwhile, reforming its assessment and error tolerance mechanisms and creating a good environment that encourages innovation and tolerates failure are essential. The layout of funds should be moderately concentrated, focusing on critical and innovative industry sectors that require government regulation.

By promoting the high-quality development of government investment funds, better leveraging fiscal funds and actively guiding social capital investment, the government can effectively support the growth of new industries, models, and drivers of growth, and make the government investment funds new drivers of technological innovation and industrial upgrading.

ECONOMIC DAILY