|

BIZCHINA> Photos

|

|

Think tank wants RMB devaluation

By Wang Xu (China Daily)

Updated: 2008-12-03 08:03

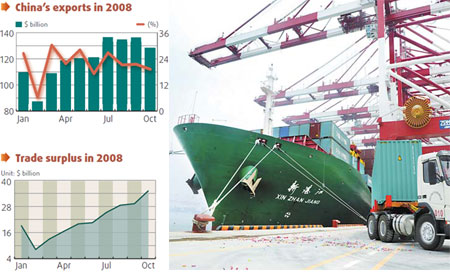

China needs to depreciate the renminbi against the US dollar to cushion the greenback's sharp appreciation versus other major currencies over the past months, a researcher from a top government think tank said on Tuesday. "As part of the macro-control measures, adjustment of the renminbi's exchange rate is reasonable and necessary," Pei Changhong, director of the Institute of Finance and Trade Economics under the Chinese Academy of Social Sciences, said at a press conference held in Beijing. "If the dollar continues to rise against the euro, we will have to further adjust the renminbi," said Pei, adding a proper exchange rate level should support the nation's export sector. Pei's comments came on the heels of the renminbi's largest one-day fall against the dollar on Monday. Some analysts say the fall is a sign that the government may have decided to use depreciation to bolster the struggling export sector and alleviate unemployment. The nation's economy has been losing steam in the year as the worsening world financial situation is poised to drag most of the major developed economies into recession. The export sector is most severely impacted, largely due to the appreciation of the Chinese currency and shrinking overseas demand. The renminbi has gained about 7 percent against the US dollar in the first half, amounting to about 20 percent rise of the yuan since China decided to scrap its peg to the greenback in 2005. Over the past two months, the dollar has gained more than 20 percent against the euro, leading to a de facto appreciation of the yuan, which remained largely stable against the dollar. "An adjustment (of the yuan) could help balance its exchange rate with the euro," said Pei. The European Union is now China's largest export destination, a market local exporters would be eager to defend given that US consumers have already started to cut spending. Exporters hard hit Official statistics show the nation's total export growth has declined to 19.2 percent in October from a year earlier. However, analysts say the real slowdown could be more severe, as the renminbi's appreciation tends to exaggerate the export figures, which are based on dollar value. "The real export growth is only about 8 percent to 9 percent," said Pei. Over the past months, the government has introduced a host of measures including raising the rebate of export taxes as well as scrapping the export restrictions on some products. The nation will further encourage the development of its export sector and strive for a stable export growth, Xie Xuren, the finance minister, wrote in an article published in Qiushi, a Chinese magazine. The export-oriented manufacturing sector, despite being criticized by some as low value-added, is important for the nation to provide jobs for its massive pool of migrant workers. Over the past months, there are increasing reports about factory closures in the coastal regions, which have forced the migrant workers to head home to the countryside for a living, if possible. Although the benefits of a depreciation of the renminbi appear to be obvious, some also cautioned about its risk. "The cost of the move can outweigh its benefit," said Guo Tianyong, an economist with the Central University of Finance Economics. "It's doubtful whether a small depreciation could attract more orders. Meanwhile, a sustained depreciation could trigger an outflow of capital, which also harms the nation's aim to increase investment." Moreover, some also think such a move could trigger a political backlash from the nation's trade partners. US officials are likely to urge China to continue to allow the renminbi to rise in value against the dollar over the weekend, when the US Secretary of the Treasury Henry Paulson will meet with top Chinese officials during the two-day US and China Strategic Economic Dialogue, according to the Associated Press.

(For more biz stories, please visit Industries)

|