Shoppers more willing to spend as inflation concerns ease, survey finds

Chinese consumers' confidence stabilized in the third quarter, due to lower inflation across all categories and double-digit disposable income growth in both urban and rural regions, research from Nielsen showed on Tuesday.

The quarterly consumer confidence index rose by 1 percentage point to 106 in the third quarter - 14 points ahead of the global average, according to Nielsen's survey. The index dropped to 105 in the second quarter, from 110 in the first quarter.

Less concern over inflation in the last quarter drove up confidence among consumers in first-tier cities, which posted a 10-point gain in willingness to spend in 2013.

CPI rose 1.9 percent year-on-year in September, easing from 2 percent in August, according to the National Bureau of Statistics. And quite a number of economists have estimated that it is likely to remain below 3 percent by the year's end.

"Consumer confidence is stable and their willingness to spend is increasing as consumers start to feel more positive about the future," said Yan Xuan, Nielsen's president in China.

Such a result, Yan said, was an encouraging indication of economic rebound next year.

With the purchasing managers' index climbing further in October, many economists believe that China's economy may have bottomed out in the third quarter.

The PMI hit 50.2 in October, up from 49.8 in September, according to the bureau.

"The economy's growth has been steady, reflecting a slow but continuous rise in demand and more accommodative fiscal and monetary conditions," said Chang Jian, an economist with Barclays Capital.

Rick Kash, vice-chairman of Nielsen Group, said the economy had bounced back in the third quarter.

He cited the fast growth of furniture sales as an indication. According to the bureau, total retail sales in China increased 14.2 percent in the first seven months of the year, but furniture sales increased by 31.2 percent during the same period.

"The much faster growth in the furniture sector pointed to a recovery in the housing market which will help boost the Chinese economy next year," said Kash.

Meanwhile, domestic consumption played an increasingly important role in fueling GDP growth.

"With the fast growth of China's middle class and the urbanization process, people will be more willing to spend and that will help the economy achieve a soft landing," Kash added.

Rural Chinese consumers remained the most confident segment of the population in the last quarter at 113 points, the same level as the previous quarter and a 3-point year-on-year increase.

Confidence in third-tier cities, however, dropped 1 percentage point to 98, followed by second-tier cities, mainly provincial capitals, at 96 points, according to the survey.

"Those cities have been the most affected by the export slowdown since the start of this year," said Yan.

"First-tier cities on the other hand are making progress toward a more service-based economy and thus seemed better at insulating workers from some of the manufacturing doldrums that China experienced earlier in the year."

Nielsen's survey also shows that consumers from middle-income families in first-tier cities with an average monthly income of 7,000 yuan ($1,110) to 9,999 yuan benefited the most from lower CPI and consumer stimulus measures, showing a 10-point jump in their willingness to spend in 2013.

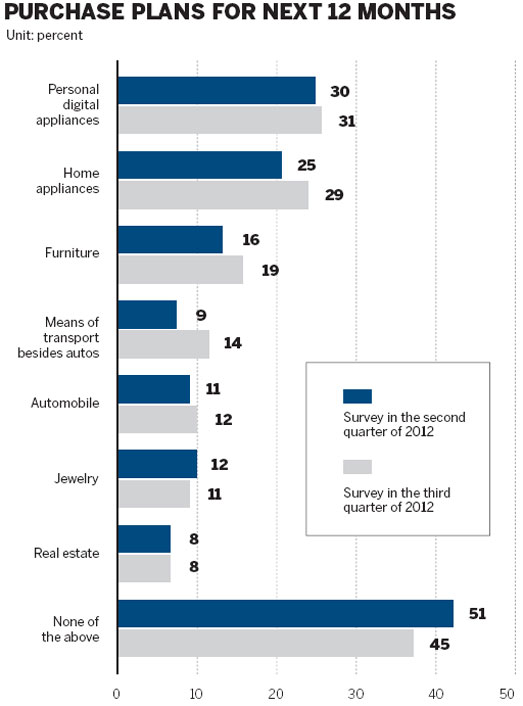

Personal digital appliances such as tablets and digital cameras ranked high on shopping lists for the next 12 months, as 31 percent of consumers said they were planning to purchase these items. That sentiment was strongest among consumers in first-tier cities, 66 percent of whom said they were planning to buy these items.

The demand for home appliances such as televisions and washing machines is also on the rise, with 29 percent of consumers indicating they are planning to purchase these items in the next 12 months, led by 60 percent of consumers in first-tier cities.

"Active promotional activities in the third quarter boosted consumers' willingness to spend," said Yan.