Businesspeople in central and western parts more optimistic

For Xu Deming, who runs a furniture business in Shunde, Guangdong province, the last two years were like a nightmare.

"The last two years were the most difficult for us, as our exports dropped 50 percent, while all costs, including labor and rental, have increased," said Xu, who has run the business for the past decade, adding that he has applied for a bank loan to upgrade his company's technology.

Xu expressed hope that better times were around the corner for his firm, noting that his loan application was likely to be approved soon "due to new preferential policies on small and medium-sized enterprise financing".

He is not the only entrepreneur in China who has caught a chill from the cooling economic climate, but also he is not alone in expressing optimism that the situation will warm next year.

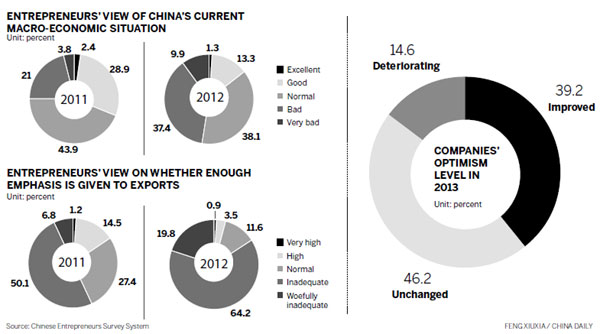

According to a survey conducted by the Chinese Entrepreneur Survey System, Chinese business people's top concerns are a lack of overseas demand, excess capacity, and financing difficulties faced by small and medium-sized enterprises.

However, they remain cautiously optimistic about next year, expecting a rebound in new orders, reduced costs, improved earnings, a moderate rise in exports, and increased employment and investment.

The system is an organization supported by research institutes under government departments, including the State Council, the National Bureau of Statistics and the National Development and Reform Commission.

According to Lu Zhongyuan, deputy director of the Development Research Center of the State Council, business people's expectations are closely related to central government policies and international economic climate.

"They should make more effort to conquer external challenges, and the government should improve its services to help enterprises increase their competence in the market," he said.

The survey, now in its 20th year, was held from Aug 10 to Oct 15 and involved 4,015 business people engaged in the manufacturing, retail, construction, real estate, agriculture, logistics, energy, mining and service sectors.

Most of the survey's respondents - 70 percent - were from the manufacturing sector, with 66 percent of those surveyed based in eastern China.

Due to the global economic downturn, especially in Europe and the United States, China's export volume increased by just 7.8 percent in the first 10 months of this year, compared with double-digit growth last year.

The Ministry of Commerce forecast that China's full-year export growth for 2012 would be around 6 percent, lower than the nation's GDP growth, which would be a very rare occurrence.

Nearly 20 percent of the business people surveyed said overseas demand dropped seriously, with 44 percent of the total engaged in the export business, with this accounting for an average of 41 percent of their business.

The most affected sectors were textiles, apparel and medicine. The decline in exports was accompanied by a decline in the price of exported goods, which was cited by 43 percent of those surveyed, who pointed to price declines in the textile, iron and steel, non-ferrous metal and metal products industries.

Due to a slowdown in export growth, overcapacity became a problem in many export-related sectors, such as textiles, apparel, papermaking and machinery. More than 67 percent of those surveyed said excess production capacity was a great challenge.

Seventy-two percent of those surveyed thought corporate property prices are too high. More than half of those surveyed said financing difficulties remained very serious, with 43 percent saying that this was the biggest problem.

Despite the challenges, the majority of business people in China thought that the economic situation will improve in 2013, with 39 percent saying their business performance is likely to turn around next year, and just 15 percent expecting it to deteriorate.

Business people in western and central regions are more optimistic about the outlook for next year, with the proportion expecting the situation to turn around next year a full 30 percentage points higher than their counterparts in eastern China.

Optimism was higher in medium-sized enterprises and privately owned companies, with the agriculture, mining, IT, water, heating and electricity industries being the sources of the greatest optimism.

A manager of a State-owned mining company in Zhengzhou, Henan province, said business has been flat since early 2009

"But I think it will be better next year, because a series of new infrastructure projects have been planned by the central government," said the manager, who wished to remain anonymous.

With fixed-assets of tens of millions of yuan, his company has set its sights on sales growth next year exceeding the growth rate of the nation's GDP.

"Continuing very high growth as we have experienced during the past few years is not practical, and business operators had better take a long-term view and keep growth stable and healthy," said Lu from the Development Research Center of the State Council.

The nation has set a target to double its 2010 GDP and per capita income by 2020. "It is very ambitious, but we can calculate that if the annual growth is around 7 percent, the goal can be achieved," he said.

The urgent tasks for China's industry are structural optimization and increased innovation, said Lu, adding that, for China's business people, the most urgent tasks are restructuring their enterprises, and upgrading management to reduce costs and increase efficiency.