|

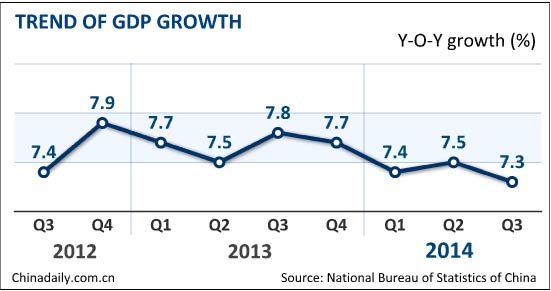

China's GDP in the third quarter grew 7.3 percent over a year earlier, according to National Bureau of Statistics data released on Tuesday, hitting the slowest level in the past five and a half year.

The expansion rate is the slowest since the first quarter of 2009, when the global financial crisis roiled China. China in the first half of this year grew 7.4 percent over a year ago.

Fixed-asset investment, a key driver of economic growth, grew 16.1 percent in the first nine months, while retail sales grew 12 percent in the same period, the NBS said.

Industrial output in September grew 8 percent, up from 6.9 percent increase in August, a six-year low, the NBS said.

|

The third-quarter figure beat expectations by many economists of about 7.2 percent, or lower. Associated Press |

|

Chinese leaders are trying to steer the country toward growth based on domestic consumption instead of over-reliance on trade and investment. Associated Press |

|

Economists are divided on whether or not authorities would step in with major stimulus measures such as interest rate cuts. Reuters |

|

Fourth quarter growth will need to do a lot better to meet Beijing's 2014 growth target of 7.5 percent. CNBC |

There are some upsides of the statistics, including the rapid growth of some new businesses and emerging industries, which underscored the changing makeover of China's economy, Sheng noted.

Wen Bugao, deputy director of policy research department under the National Development and Reform Commission, China's top economic planner, said it is "over-simplistic" to say that China's economy is facing great downward pressure.

"The sheer size of the economy has developed into an extent that it is difficult to maintain a fast expansion rate. At the same time, the traditional drivers of the economy, such as export and investment, are loosing steam. What's more, the economy is ‘energyand raw materials. All these factors contributed to the moderated growth," he said.

He said only innovation, either in technological or institutional sense, can help to lift the competitiveness of the economy.

Market also expects that as the top leadership emphasize the "new norm" of the economy, there will be greater tolerance of the slowdown and fewer possibility that strong stimulus policy will be used.

Zhu Haibin, chief China economist atJPMorgan Chase& Co, said:"We expect policy rates will stay unchanged and credit growth will remain stable in the coming months. The central bank is reluctant to implement traditional monetary easing, because it is concerned about distortions in the monetary policy transmission mechanism. Instead, a new operational framework may focus on lowering market interest rates; targeted quantitative measures and a shift in credit components to improve direct support from credit to the real sector."

|

|

|

| Weak inflation makes more room for policy change | China's September PPI down 1.8% |