Reforms pay off for A-share firms as profits surge

|

|

An investor checks stock information on his mobile phone in front of an electronic board showing stock information at a brokerage house in Beijing, February 16, 2016.[Photo/Agencies] |

The total revenue and net profit of listed A-share companies in 2016 registered double-digit year-on-year growth as supply-side structural reform deepened and many upstream companies reduced overcapacity.

All 3,204 companies listed on the Shanghai and Shenzhen bourses completed releasing their annual reports by April 30.

The revenue of the listed companies totaled 32.5 trillion yuan ($4.7 trillion) last year, increasing 10.2 percent year-on-year; their net profit totaled 2.8 trillion yuan, increasing 11.2 percent year-on-year, according to Choice, an information service provider owned by Eastmoney.com.

A total of 2,195 A-share companies in 2016 achieved positive net profit growth year-on-year, and 620 saw their net profit double.

"The good result was achieved because of China's supply-side structural reform and improvements in the global economy," said Li Shuguang, a law professor at China University of Political Science and Law, who is specialized in the stock market.

Li said China pushed forward with reduction of overcapacity, destocking and deleveraging, which was good for listed companies, especially upstream companies in the coal and steel industries.

Companies in upstream and midstream industries such as coal, steel, chemical, construction and building materials, made the largest improvement in business performance. For example, A-share listed steel companies made a loss in the first quarter of last year and became profitable in the following three quarters.

Dong Dengxin, a finance professor at Wuhan University of Science and Technology, said upstream companies such as in the coal and steel industries effectively reduced overcapacity with policy encouragement in the second half of 2016.

"But they will again face the challenge of overcapacity this year," said Dong.

The net profit growth of companies in industries, such as mechanical equipment, public utilities and finance declined in 2016.

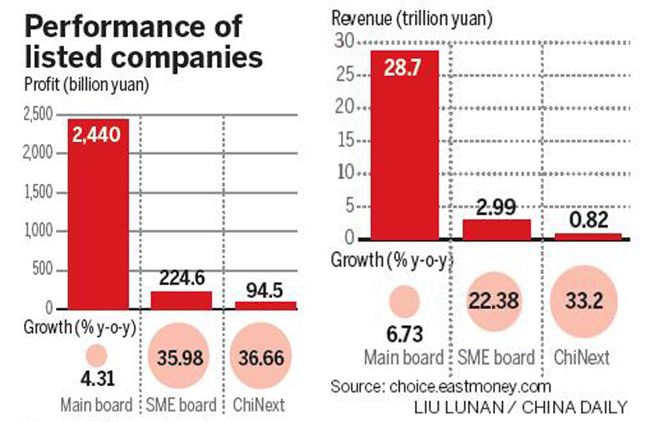

The performance of listed companies on the main board of the Shanghai and Shenzhen bourses was steady and good, and the revenue and net profit of companies on the small and medium-sized enterprise board and ChiNext board achieved high growth.

The revenue of main board companies last year totaled 28.7 trillion yuan, increasing 6.7 percent year-on-year; their net profit totaled 2.4 trillion yuan, increasing 4.3 percent year-on-year.

The revenue of SME board companies in 2016 increased 22.4 percent comparing with that in 2015, and their net profit increased 36 percent year-on-year.

ChiNext board companies achieved 33.2 percent growth in revenue and 36.7 percent growth in net profit.

Dong said the first-quarter performance of Chinese A-share listed companies in 2017 would be weaker than their overall performance in 2016 because of the new pressure on upstream companies and the slow growth of the Chinese banking industry.

Hong Hao, chief strategist at BOCOM International Ltd, said the revenue and net profit of Chinese listed companies would see slower growth in 2017, but internet companies with new technology would be bright spots in the economy.