Likely ETF connect set to boost liquidity

Updated: 2016-12-09 05:59

By Duan Ting in Hong Kong(HK Edition)

|

|||||||||

Experts bank on possible launch next year to cash in on staggering growth of Asian ETF markets

Monday's kick-off of the Shenzhen-Hong Kong Stock Connect has pushed the inclusion of exchange-traded funds (ETFs) in the mutual market mechanism one step closer to reality, with market experts predicting it could happen as early as next year.

The possible launch of the investment fund in the mutual market mechanism is likely to attract more investors from the Chinese mainland and inject liquidity into Hong Kong's equity market in the long term.

Charles Li Xiaojia, chief executive of Hong Kong Exchanges and Clearing Ltd, said at the launch of the second stocks "through train" between Hong Kong and the mainland on Monday that ETFs would be among a series of other financial rollouts to follow, including bonds and commodities.

ETFs - one of the most sought-after products of fund managers worldwide - are seen as one of the most important developments for investors and the industry in decades. The proliferation of ETFs stems from the fact that they offer investors a cost-efficient way to track an entire index, such as those in major emerging markets or for commodities around the globe, and reap the benefits in just one go.

According to Li, regulators on both sides had discussed a possible ETFs-trading link as early as August, although details have yet to be worked out. Regulators are studying issues concerning the purchase and redemption mechanism, and preparatory work has been intense.

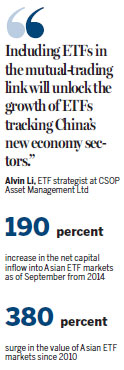

According to French investment bank Credit Agricole CIB, Asian ETF markets have seen a staggering 380-percent growth in the past five years, with assets under management swelling to $313.9 billion from $83.5 billion in 2010. As of September this year, net capital inflow into Asian ETF markets had reached $35.8 billion - up 190 percent from 2014.

Alvin Li, ETF strategist at CSOP Asset Management Ltd, said Hong Kong is an ideal place for asset allocation, and the possible inclusion of ETFs will surely provide more diverse asset products to meet the large allocation demand of mainland investors and make investors more aware of other markets.

He said a possible ETF connect would enable investors to approach A-share sector ETFs and money market funds on the mainland and allow mainland investors to reach large- and small-cap ETFs, oil and gold ETFs, as well as some overseas S&P, Nasdaq ETFs through Hong Kong.

On the other hand, it will create competition among ETF products and companies.

On Thursday, a new ETF product - CSOP S&P New China Sectors ETF - went public on the Hong Kong bourse, providing exposure to companies that benefit from the mainland's consumption-driven growth.

Alvin Li believes that including ETFs in the mutual-trading link will unlock the growth of ETFs tracking China's new economy sectors.

The newly launched stocks trading link saw nearly 14 percent of the daily northbound quota of 13 billion yuan ($1.9 billion) being snapped up on Thursday, with less than 10 percent of the daily southbound quota of 10.5 billion yuan used.

For the Shanghai-Hong Kong Stock Connect, just 5 percent of the daily northbound quota was used on Thursday, while the daily southbound investment saw net sales of 2.25 billion yuan.

Hong Kong's benchmark Hang Seng jumped 0.27 percent to close at 22,861.84 points on Thursday, while the Hang Seng China Enterprises Index gained 0.68 percent to 9,896.82.

|

The kick-off of the second stocks-trading link has prompted talk of the inclusion of exchange-traded funds (ETFs) in the mutual market mechanism. Experts believe a possible ETFs-trading link will attract more investors from the Chinese mainland and inject liquidity into Hong Kong's equity market in the long term. Justin Chin / Bloomberg |

(HK Edition 12/09/2016 page8)