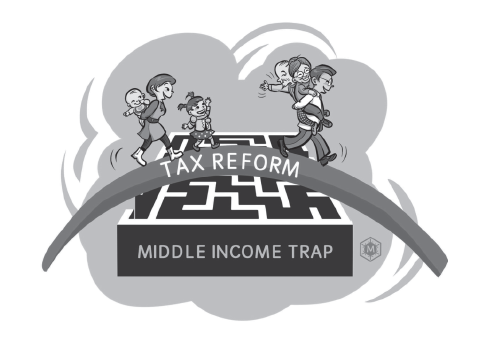

Income tax reform needs better homework

|

|

MA XUEJING/CHINA DAILY |

There is no truth in the news that "individuals whose annual income is above 120,000 yuan ($17,704) will have to pay higher income tax". Still, it has touched the nerve of many people in big cities, for they fear they may be forced to pay higher taxes.

Whether people earning 120,000 yuan a year belong to the "high-income group" or not is debatable. In first- and second-tier cities such as Beijing, Shanghai, Guangzhou, Shenzhen, Xiamen and Hangzhou, many people don't think that earning 120,000 yuan a year makes them part of the high-income group.

In 2006, the taxation authorities announced that individuals who earn more than 120,000 yuan a year should declare their incomes to the taxation authorities themselves to be appropriately taxed. This decision distinguished the so-called high-income group from the rest of the population. Comparatively speaking, people with an annual income of 120,000 yuan a year or more then accounted for a small part of the overall income tax payers, making them part of the high-income group.

But 10 years later how high an income is 120,000 yuan a year in a big city? Many people in big cities have taken very high housing loans because of the skyrocketing property prices. And for many, high housing rent accounts for almost a half of their income. So if individual income tax is raised, it will undermine the expansion of the middle class.

There is no doubt that China's individual income tax requires reform, but it should be launched after proper research.

China's Gini coefficient has been above 0.4 for a long time, which means the problem of unfair income distribution remains to be solved. To reform the income distribution system, however, the authorities should improve social security and public services, as individual income tax plays little role in this process.

The accumulated revenue from individual income tax in 2015 was 861.7 billion yuan, but it accounted for only 6.9 percent of China's overall tax revenue. This shows revenue from individual income tax, which accounts for only a small proportion of the government's overall tax revenue, can hardly play a key role in fair income re-distribution.

But it doesn't mean individual income tax should not be reformed any further. In fact, the aim of individual income tax reform should be to promote income fairness, for which the tax authorities should establish a new individual income tax regime combining classified and synthetical tax systems.

Equal tax should be imposed on salaries and remuneration for personal services.

In addition, the existing unified exemption of 3,500 yuan for individual income tax payers should be changed. Income tax exemption standard should be granted after taking into consideration some actual living expenses such as supporting senior citizens in the family, raising children and paying for their education, and family medical expenses.

The author is a researcher at the National Academy of Economic Strategy, Chinese Academy of Social Sciences.