Trump's gathering trade war bodes ill for all

|

|

US President-elect Donald Trump pauses as he talks to members of the media at Mar-a-Lago estate in Palm Beach, Florida, US, December 21, 2016. [Photo/Agencies] |

US president-elect Donald Trump has not moderated his anti-trade tone since winning the election. Instead, he has upped the ante and fired a series of early warning shots in what could turn into a full-blown global trade war, with disastrous consequences for the United States and the rest of the world.

Consider Trump's key personnel decisions. Industrialist Wilbur Ross, the commerce secretary-designate, has been vocal in his desire to abrogate the US' "dumb" trade deals. Peter Navarro, an economics professor at the University of California-Irvine, will be the director of the National Trade Council-a new White House policy shop to be set up on a par with the National Security Council and the National Economic Council. Navarro is one of the US' most extreme China hawks. The titles of his two recent books, Death by China (2011) and Crouching Tiger: What China's Militarism Means for the World (2015)-speak volumes about his tabloid-level biases.

Trump has made it clear that he will immediately withdraw the US from the Trans-Pacific Partnership Agreement-in keeping with Ross' criticism of the US' trade deals. And there seems little doubt that his administration will follow Navarro's prescription and take dead aim at China, the US' largest and most powerful trading partner.

Of course, Trump may simply be talking tough, in order to put China and the world on notice. But while such tough talk played well with voters, it fails a key reality check: the US' large trade deficit-a visible manifestation of its low savings-calls into question the very notion of economic strength. A significant domestic savings deficit, such as that which afflicts the US, accounts for the US' insatiable appetite for surplus savings from abroad, which in turn spawns its chronic current-account deficit and a massive trade deficit.

Dealmakers who try to address this macroeconomic problem one country at a time cannot possibly succeed: the US had trade deficits with 101 countries in 2015. Unless the source of the problem-a savings shortfall that is likely to worsen in the face of Trump's inevitable widening of federal budget deficits-is addressed, the US' current account and trade deficits will only widen. Squeezing China would merely shift the trade imbalance to other countries.

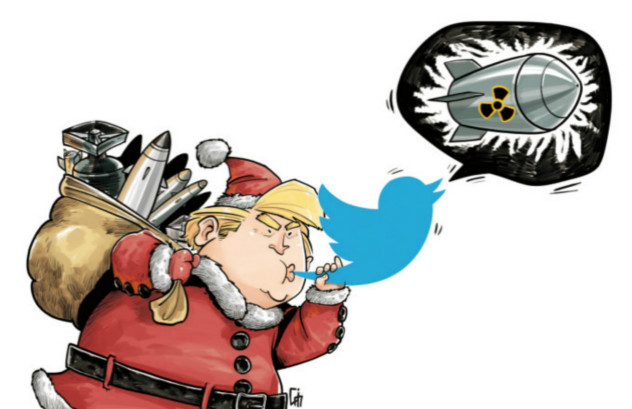

But the story doesn't end there. The Trump administration is playing with live ammunition, implying profound, global repercussions. Nowhere is this more evident than in the likely Chinese response to the US' new muscle-flexing. The Trump team is dismissive of China's reaction to its threats-believing that the US has nothing to lose and everything to gain.

Alas, that may not be the case. Like it or not, the US and China are locked in a codependent economic relationship. Yes, China depends on US demand for its exports, but the US also depends on China: the Chinese own over $1.5 trillion in US Treasury securities and other US dollar-based assets. Moreover, China is the US' third-largest export market and the one that is expanding most rapidly-h(huán)ardly inconsequential for a growth-starved US economy. It is foolish to think that the US holds all the cards in this bilateral economic relationship.

Codependency is a very reactive connection. If the US goes after China, it must also face the consequences. On the economic front, that spells the possibility of reciprocal tariffs on US exports to China, as well as potential ramifications for Chinese purchases of Treasuries. And other countries-tightly linked to China through global supply chains-may well impose countervailing tariffs of their own.

Global trade wars are rare. But, like military conflicts, they often start with accidental skirmishes or misunderstandings. More than 85 years ago, US Senator Reed Smoot and Representative Willis Hawley fired the first shot in sponsoring the Tariff Act of 1930. That led to a catastrophic global trade war, which many believe turned a serious recession into the Great Depression.

It is the height of folly to ignore the lessons of history. For today's savings-short, deficit-prone US economy, it will take far more than China-bashing to make the US great again. Turning trade into a weapon of mass economic destruction could be a policy blunder of epic proportions.

The author, a faculty member at Yale University and former chairman of Morgan Stanley Asia, is the author of Unbalanced: The Codependency of America and China.

Project Syndicate