Stricter laws

|

|

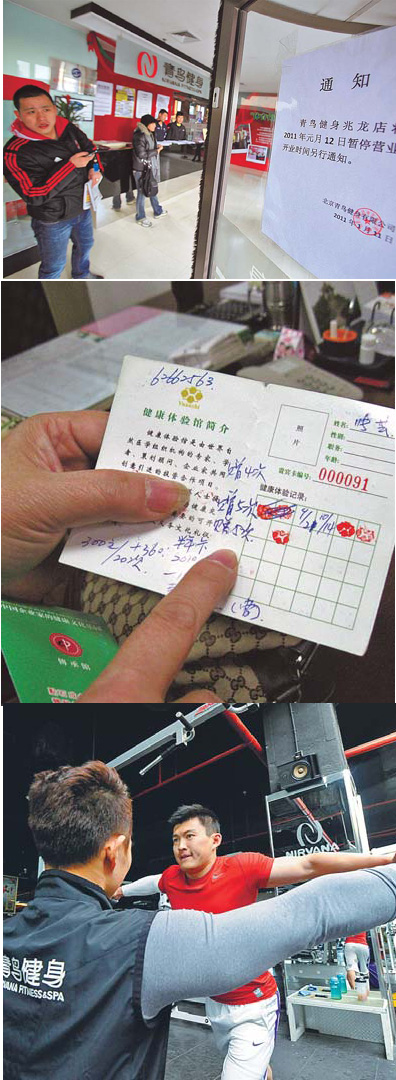

Members wait at the entrance of a fitness club in Beijing's Fengtai district on Jan 24 after hearing it was going to close. With police officers as witnesses, the gym boss promised it was not shutting. [Photo/CFP] |

Liu said he consulted lawyers about members filing a joint lawsuit but was told that, as the consumers were not related, they could only file actions separately.

"I've suggested (to policymakers) several times that they change the law and allow consumer associations to represent people in joint lawsuits against businesses," said Qiu Baochang, director of Beijing Lawyers Association's consumer rights protection committee. "So far the change hasn't happened."

In the meantime, Qiu is calling for stricter supervision of businesses that offer prepaid services.

In 1998, the People's Bank of China and the State Administration of Industry and Commerce introduced a membership card trial, which required issuers of such cards to have net assets of at least 50 million yuan. Fixed assets had to be at least 50 percent of total assets.

However, five years later, the central bank lost its regulatory function to approve membership cards in the revision of the Banking Law. The procedure was abolished in 2007, the same year the China Consumers' Association listed "prepaid traps" as a major difficulty in protecting consumer rights. Today, no regulations protect customers who sign up to prepaid services.

In Japan, where laws on prepayment are extremely strict, companies must deposit prepaid revenue in a special bank account that stops them disappearing with the money, said Wu Jingming, an associate professor of economic law at China University of Political Science. That way, if the company folds, customers are guaranteed compensation.

He also explained that, even though there is no national legislation on prepaid services in China, some cities have introduced regulations to protect consumers.

In Beijing, for example, rules introduced in October 2010 require businesses to inform customers before they relocate or cancel services, as well as offer reimbursement. Deputy Mayor Cheng Hong also recently told a meeting to discuss the government work report that the municipal authority is drafting laws to offer consumers more legal protection.

Officials and lawyers in Qingdao, a coastal city in East China's Shandong province, in January drafted a regulation that proposes the use of a third-party platform to limit the likelihood of businesses leaving customers out in the cold.

"We still need to explore the feasibility, such as when the money can be paid to the merchant," said Sun Peixu, general secretary of Qingdao's consumer protection committee. Future discussions with financial institutions are needed before the regulation comes into effect on Mar 15, the World Consumer Rights Day, he added.

|

|

From Top to Bottom: A man reads a closure notice posted outside Nirvana Fitness Club at Zhaolong Hotel in Beijing on Jan 12; A member of Pujiyushengtang, a health club in Shanghai which was closed suddenly on Dec 14 last year, shows her membership card; A man works out with his personal trainer at Nirvana's Parkson branch after the club's reopening on Jan 15. Provided to China Daily |