Next generation of fitness Apps getting a workout

Whether helping users to get fit at home or to compete in an online marathon, developers don't want to skip a step in finding profits

Mobile fitness sharing apps are freeing users from committing to full-year gym memberships and their large upfront payments. The biggest concerns among these startup sharing services is how to make profits and maintain the traffic and equipment.

Further, the interest in fitness has led to development of training apps, which now number more than 1,000. These workout apps can be found in various app stores and attract users with free, detailed tutorials on almost any type of workout, from cardio to muscle development. Some even have video tutorials featuring social media celebrities to demonstrate the moves.

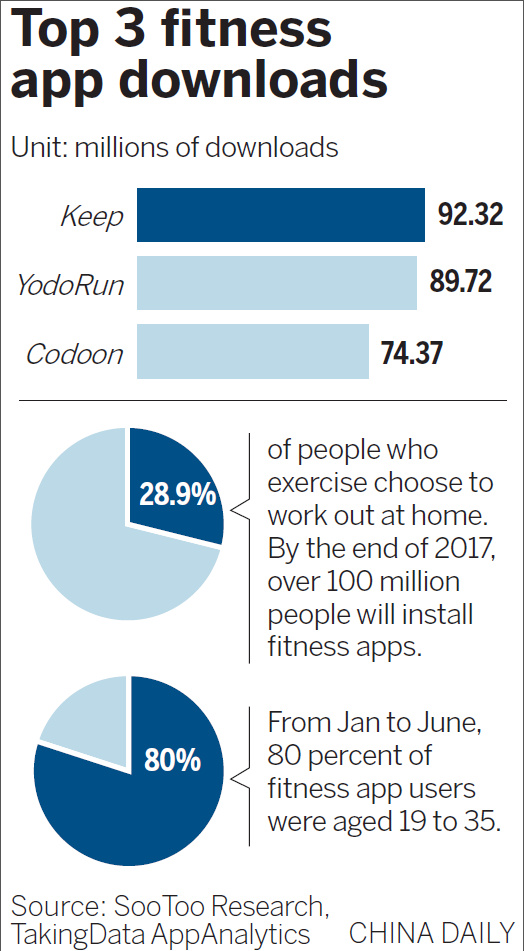

According to consultancy SooToo Research in Beijing, a growing number of people are working out using mobile apps as a guide. In its mobile fitness app report for 2016, it said although 37.2 percent of people chose gyms to exercise 28.9 percent stay at home for various reasons, such as avoiding city traffic and smoggy days.

This makes fitness instruction apps handy tools for those who stay at home.

The apps enable users to exercise with guidance whenever and wherever they want, even in the office during a lunch break.

Keep, the top free fitness app with over 110 million registered users through August, is designed for busy office workers with exercises that last around two to five minutes.

"Two minute workouts before getting off my work," one user commented on the tutorial page. "Life is busy but you always have a little bit of time to exercise."

Developer dilemma

Many users choose to use online apps because they are free. Then, as they grow familiar with the exercises, they become less dependent on the apps. This is the trouble some startup app developers face.

They are trying to make profits - beyond advertising - by maintaining user loyalty amid heavy competition, SooToo Research found out.

"Most apps focus on footstep counting and running. They are rather similar," SooToo's report noted. "By 2017, fitness sports will see over 100 million participants. With their exercise habit changing, the apps need to develop into different, specified categories targeting different age groups and sport varieties to maintain users."

Neil Wang, president of the Chinese arm of consultancy Frost & Sullivan, said many fitness apps imitate each other, causing vicious competition.

"The business is at a starting point. Many users can't tell the difference between various apps, and the app makers will soon lose their passion to create," he said.

"Most apps turn out to be profit-losing, as they don't have other ways to generate incomes other than membership and advertisements. And they also are restricted to a mobile phone's screen. Fitness app users are usually not so tolerant of constant pop-up ads. Too many ads will easily annoy them and make them lose interest."

He suggested e-commerce can be a smart way out of the dilemma app developers face.

"Based on its users' data, the fitness app can use algorithm to foresee what its users most likely need," he said.

Give what users need

To gain income from existing large user bases, Keep has already taken a step into e-commerce by selling its own designs.

"Fitness is an incremental market. The first step is workout, the second is healthcare," Wang Ning, chief executive of Beijing Calories Technology Co Ltd, which created Keep said. "We have launched products for yoga, sport supplements, clothing and workout equipment of our own brand."

Currently Keep sells around 50 types of products, with prices ranging from 20 yuan ($3) to 400 yuan, but sales were not particularly eye-catching. One top seller was a yoga mat, priced at 99 yuan. The app platform has sold about 80,000 since 2016.

But investors was not worried.

"How to gain cash from the traffic depends on how much value the app can provide to its users," said Wang Tianfan, vice president of Bertelsmann Asia Investment, one of Keep's major investors. "Keep doesn't have many varieties to offer at current stage but it is growing fast. The financial status of Keep is very promising and we expected the revenue will achieve 10 times the growth from last year."

According to Keep, it is generating profits and e-commerce is an efficient way of branding. As a very young product - just 2 years old - the app's emphasis is becoming more on maintaining user loyalty by giving them a handy choice to buy sport equipment. It also gives users a sense of being a part of a big community through logoed clothes.

"For the younger generation, wearing Nike or Adidas is not a cool thing anymore. Now we prefer brands like Under Armour," said Wang Ning. "We are not sure but we can't rule out the possibility of young people starting to buy Keep."

However, Liang Feng, chief executive of Joyrun, one of the most downloaded running apps in Chinese app stores, thinks differently.

"From my point of view, we can't count our profit on cashing out from the online traffic or e-commerce," Liang said. "Sport, after all, is an offline business. You can't expect your e-commerce business or online traffic can beat up big guys such as JD or Taobao."

An online marathon?

Liang put his bid on the sport itself - an online marathon.

During an online marathon, after runners pay the participant fees, users can start running anywhere they like and share their performance through the apps. After completing the run, users receive a real medal from the company so they can take pictures and share their participation, rather than a digital icon that only shows in their phones.

For users, the medal represents a sense of achievement and honor, but for the businessman, it shows how important a social function is in maintaining users and encouraging them to take part.

"Running is a very lonely thing to do," he added. "When I post a picture of this medal, I can let people know what I have achieved."

In 2016, the most successful marathon Joyrun hosted had over 450,000 participants.

"Profits from every online marathon can return over 1 million yuan in income from selling goods, medals, sponsorships and participation fees," Liang said.

In 2016, the company had over 45 million yuan in revenue.

The future of apps

It seems one thing that most successful fitness apps agree on is that the future lies offline.

FitTime, considered a rival to Keep, has started to offer paying personal trainers for its users. After purchasing the course, a personal trainer will be assigned and offer tailored diet and workout solutions.

One of the most popular courses costs 998 yuan. More than 100,000 users have signed up for the online tutorial and 30 percent of them are paying members.

According to its data, over 5,000 users are paying 1,000 yuan a month. Thus, such business can generate over 5 million yuan a month in revenue.

"We earned 10 million yuan via the newly established online weight-loss camp last year, accounting for 60 percent of total revenue," said Zhu Xiaoxiao, FitTime's chief executive.

Keep is also exploring the possibility of selling tailored classes for special needs, such as postpartum recovery.

A Dec 12 report by Sportbank, a Beijing based sport-related investment company, said the fitness app business is on the right track.

"Fitness apps help reduce the limits on the time, equipment requirements and space for users, and make it possible to exercise during their very limited free time," the report read. "It also provides online communities to fulfill the users' social needs. By providing a platform to share pictures and experience, it has made exercise much more fun, and that is why it's becoming so popular."

However, Zhong Bingshu, president of Capital University of Physical Education and Sports, expressed his concern over this much talked-about business.

"Those apps are too similar with the same content and service, such as blood pressure and heart beat monitoring," he said.

"People are reading it everyday but they can't get any other deeper information than the data itself."

The fitness app business is one reflection of the Chinese sports industry boom. According to a report by Analysys, a Beijing-based consultancy, the domestic market for the sports industry is likely to top 3 trillion yuan by 2020, with 1.5 trillion yuan for daily exercises practiced by the masses and the other half from competitive sports.

- Suspects charged with spreading giant panda rumors

- China's two new radio telescopes put into use to support deep space exploration

- Cross-border crackdown: law enforcement agencies collaborate for Mekong River exercise

- China's top procuratorate orders arrest of former vice-governor of Gansu

- World's smallest cat fossil found at ancient human site in China

- Xi urges making railway a new demonstration project for BRI cooperation