Ignite trade to spark next wave of global growth

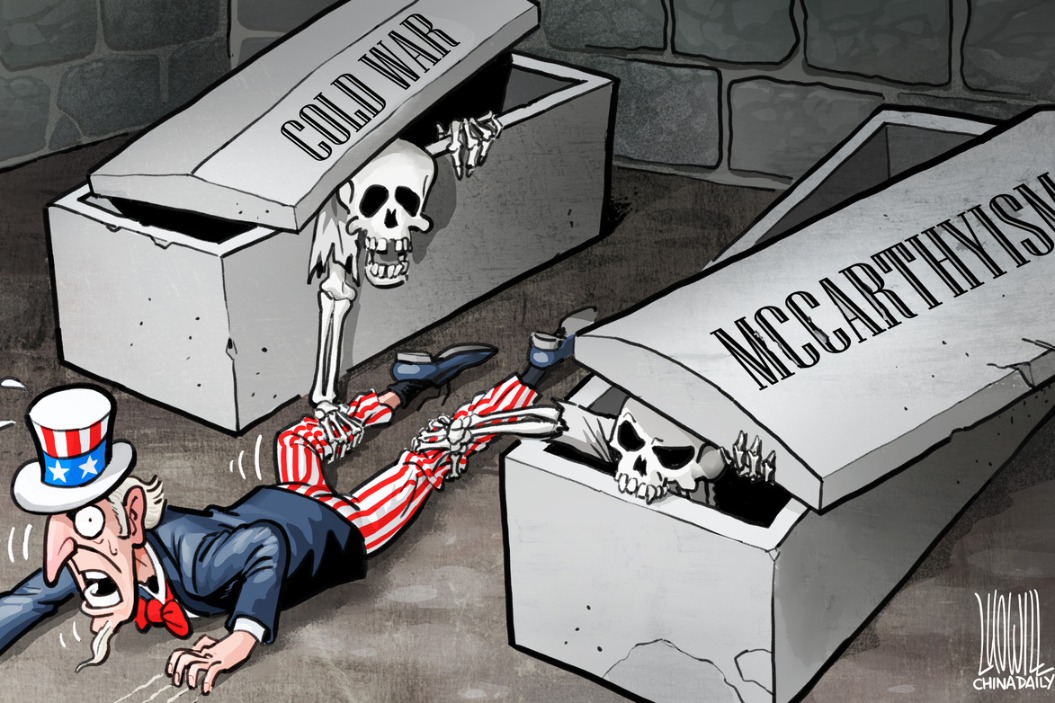

To acknowledge that global trade is threatened by the rise of protectionism and geopolitical fragmentation is neither provocative nor fashionable. But that does not lessen the need to address these challenges.

The COVID-19 pandemic, escalating geopolitical tensions and growing concerns over security have accelerated deeper trench lines pointing toward regionalization and balkanization, and countering decades of globalization. Rising trade frictions have resulted in more than 3,000 new restrictions being introduced on trade in 2023, up three times since 2019. Many restrictions include rules for export controls, tariffs and limitations on cross-border data flows. The most recent US election outcome, if anything, may further exacerbate what is already a very fractious state of global trade.

As a result, we have started to witness a profound re-wiring of supply chain and trade routes. The Global South increasingly acts as the intermediary between the east and the west. South-South trade has experienced significant growth — up more than 50 percent since the pandemic — and this process of fragmentation is only just beginning.

On the positive side, we are seeing constructive efforts to improve supply chain resilience, with increasing focus on reducing carbon footprints. However, fragmentation is inflationary. Against the backdrop of subdued global growth, costs are rising because of less efficient flows and lower levels of productivity. Shipping costs have also surged by 300 percent as container ships take longer routes to avoid the ongoing conflict in the Middle East.

These inefficiencies exact societal costs beyond price increases and shipping delays. The global trade finance gap — the shortfall between available financing and its actual funding needs — increased almost 50 percent to $2.5 trillion between 2020 and 2022. Unfortunately, most of this gap is shouldered by those least able to bear: micro, small and medium-sized enterprises (MSMEs), with many of them coming from developing markets. Our research shows a more inclusive trade finance ecosystem can help lift exports across emerging markets by about 8 percent, boosting growth and employment.

How do we get there? The B20 Trade& Investment Task Force, on which I serve as a co-chair, has recommended several solutions that could make a real difference.

A key to extending trade finance to MSMEs is greater digitalization. The current heavily paper-based system means small businesses are often disconnected from top-tier suppliers as well as trade finance providers, and banks are left struggling with cumbersome on-boarding processes for the vast numbers of small businesses.

Digitalization and making basic documents accessible would generate new, down-tier supply opportunities for MSMEs. Streamlining "know your customer" documents could improve transparency of overall trade finance needs, while tokenization can increase finance deeper into supply chains with greater visibility and at much reduced financing costs.

Separately, establishing global common standards can facilitate the use of these digital documents and data across borders, yet most countries are yet to adopt internationally aligned legislation providing a legal basis for digital trade documentation. Doing so would create new channels for trade to flow, and standardization permits' seamless use across jurisdictions.

Lastly, we must implement universally aligned rules that allow safe storage. Digital solutions will not meet their full potential if the data they create are restricted from international use. Such restrictions at best increase the costs of international commerce, and at worst prevent direct trade flows, reduce innovation and increase security risks. These are ultimately passed on in the form of increased consumer costs.

Over the past half century, trade has been a key driver in powering global economic growth, improving living standards and reducing household consumption costs. This unparalleled era of prosperity and growth has been underpinned by a strong system of multilateral cooperation. But the rise in protectionist forces is now threatening this very commitment to open and inclusive trade, with the bedrock of the rules-based global trade regime increasingly being eroded.

But there is time for us to arrest this situation. The above recommendations, among others, serve as a road map for G20 member states to foster a more frictionless trade environment. The world must adopt more sensible policymaking ways, recognize the value of a global trade system and re-establish the basis for multilateralism.

The clock is ticking. To ignite world trade and spark the next wave of global growth, we can and must rewrite this story now.

The author is president, International, at Standard Chartered Bank, and a co-chair of B20's Trade& Investment Task Force.

The views don't necessarily reflect those of China Daily.

If you have a specific expertise, or would like to share your thought about our stories, then send us your writings at [email protected], and [email protected].