Keep things moving

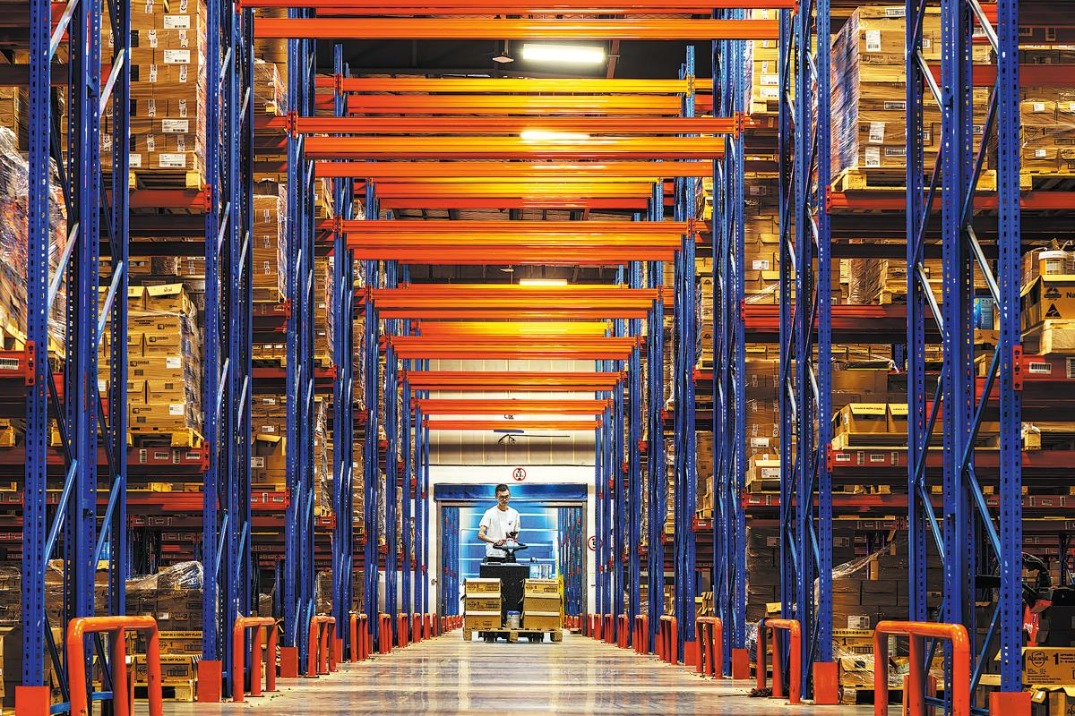

The smooth operation of logistics is an important factor for the development of trade

The Red Sea crisis has led to ship operators detouring vessels around the Cape of Good Hope in Africa. This has not only extended the shipping times, but also tightened the supply of shipment capacity and led to congestion at major ports worldwide. It has also markedly driven up insurance premiums for ships and their cargo, pushing up the prices of global maritime container freight in 2024. This has had an adverse impact on world trade and the global economic recovery and rung alarm bells warning us to value the construction of international logistics channels. In the future, as China strengthens its position as a key trading nation, it is necessary to accelerate the development of multiple logistics channels and strive to resolve and prevent risks and uncertainties in global trade logistics.

Since the beginning of 2024, the World Container Index (WCI) has been significantly higher than the same period in 2023. In mid-July, the WCI reached its height. Faced with such a situation, some shipping companies have increased their capacity. The index has fallen somewhat since July. Despite this, as of Dec 12, the latest WCI still rose by nearly 60 percent compared to the same period in 2023.

Just like the global increase in maritime container freight prices, China's export container freight index for the first 11 months of 2024 has risen by nearly 60 percent compared to the whole of 2023. Except for the routes to Japan and the Republic of Korea where the container index has decreased compared to 2023, the index for other routes has risen, with the Europe route seeing the largest increase, more than doubling compared to 2023.

The World Trade Organization's Global Trade Outlook and Statistics report released in October predicted that the global merchandise trade volume would grow by 2.7 percent in 2024.Although the global trade growth rate of 2024 is better than that of 2023, the recovery foundation for global trade is still not solid. The increase in maritime container prices and the extension of transport time will affect the accurate delivery time of foreign trade enterprises' exports, burden foreign trade enterprises, and will inevitably have an adverse impact on the recovery of global trade. In addition, the rise in maritime container transport prices will also be passed on to consumers. The United Nations Conference on Trade and Development estimates that if the freight rate continues to rise, it will push up global consumer prices, and by 2025, the increase in transport costs will raise global consumer prices by 0.6 percent, which will hold back the recovery of the global economy.

The tightened supply and higher prices of global maritime container services serve as a warning for global trade development, highlighting the need to guard against uncertainties and risks in global trade logistics. Today's world is undergoing major changes, with the rapidly evolving international landscape and increasing geopolitical risks, which bring more unpredictable factors and risks to the global environment, posing threats to global trade logistics. Therefore, it is necessary not only to actively implement the Global Development Initiative and the Global Security Initiative, strengthen international security cooperation, promote world peace and regional stability, and create a favorable international environment for foreign trade and international economic and trade cooperation, but also to accelerate the development of various logistics methods, and create multiple logistics channels with a long-term perspective, to address and prevent risks on trade routes.

To develop more maritime transport channels, it's essential to actively explore Arctic cargo shipping routes and the development of the China-Europe Railway Express should be accelerated to help increase land transport channels. Air transport channels should also be expanded.

As the Belt and Road Initiative has advanced in recent years, the China-Europe Railway Express service has been developing rapidly. The number of China-Europe freight trains has grown from 1,702 in 2016 to 17,000 in 2023;the annual value of cargo transported by the service has increased from $8 billion in 2016 to $56.7 billion in 2023; and in 2024, the China-Europe Railway Express has already operated over 17,000 trains, with a cargo value reaching $58 billion. Although the cargo value transported by these trains does not yet account for a high proportion of China's foreign trade, as the BRI moves toward high-quality growth in the future, the number of trains will keep growing and reach more and more cities in Europe, and logistics efficiency will be further improved. The China-Europe Railway Express service will become an important logistics channel for economic and trade cooperation between China and European countries, playing an increasingly significant role in China's foreign trade development. At the same time, it's necessary to strengthen economic and trade cooperation with cities along the route, improve multimodal transport such as sea-rail combined transportation, and further promote the China-Europe Railway Express.

The Arctic lane primarily refers to the maritime routes that cross the Arctic Ocean, connecting the Atlantic Ocean and Pacific Ocean. If China exports goods to Europe via the Arctic lane, it is thousands of kilometers shorter and saves nearly half the time compared to the route through the Malacca Strait and the Suez Canal. The number of transit voyages through the Arctic lane in 2024 may set a new record, and China's Rizhao Port has begun trade through it. However, the global trade volume through the Arctic lane is still small. In the future, with climate change extending the navigable window period of the lane and the progress of ice-breaking technology, the development of the Arctic shipping lane for maritime cargo transport will accelerate, making it an important global trade logistics channel to address uncertainties in international shipping.

In recent years, digital technology has given rise to the rapid growth of cross-border e-commerce. The proportion of China's cross-border e-commerce imports and exports in its foreign trade has increased from around 4 percent in 2019 to 5.7 percent in 2023.Among these imports and exports, some goods requiring high timeliness are transported via air logistics. According to analysis by the International Air Transport Association, 20 percent of the global air cargo volume is cross-border e-commerce goods. As China's foreign trade undergoes transformation and upgrading, some exports also require more timely transportation. Therefore, it is essential to vigorously develop air logistics to meet the needs of cross-border e-commerce growth and the transformation and upgrading of foreign trade.

The author is a researcher of the State Council's Development Research Center. The author contributed this article to China Watch, a think tank powered by China Daily. The views do not necessarily reflect those of China Daily.

Contact the editor at [email protected].