|

|

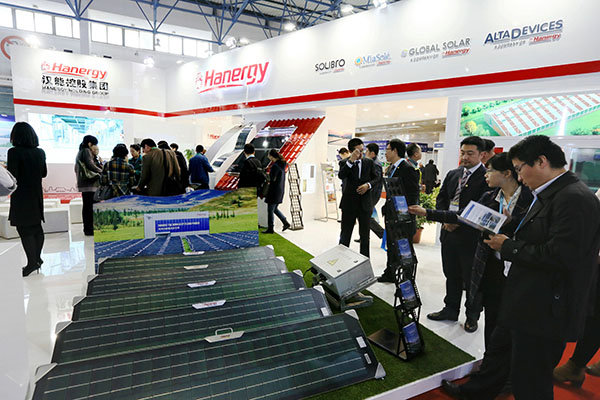

Solar panel products made by Hanergy Holding Group on display at an international expo in Beijing. The group's listed unit, Hanergy Thin Film Power, has been under investigation by the Hong Kong Securities and Futures Commission, which did not elaborate on the reasons. The company's shares have been suspended from trading since May. [Photo provided to China Daily] |

As part of the deal, HTF had planned to issue 1.5 billion new shares to Macrolink, a Beijing-based company covering real estate, petroleum and finance businesses, at HK$3.64 ($0.47) per share, giving it a 3.48 percent stake after the sale. In return, Hanergy should ship 600 megawatts of building-integrated photovoltaic products to Macrolink as part of the deal and provide services to maintain the equipment thereafter.

The announcement came close on the heels of Ikea, the world's biggest furniture retailer, dropping HTF as a supplier for a pilot project to sell solar panels in the United Kingdom, the Netherlands and Switzerland.

Ikea and HTF signed a contract in 2013 to sell solar systems to customers in the UK. It was subsequently expanded to the Netherlands and Switzerland.

Ikea said it would announce a new business model with new partners early next year.

HTF has been under investigation by the Hong Kong Securities and Futures Commission, which did not elaborate on the reasons, since May and its shares have been suspended from trading.

HTF said in a statement that it will maintain its offices, installation teams and after-sales teams in Europe so that it can continue to serve customers who have purchased or ordered its products.

"The partnership with Ikea has helped win thousands of customers in Europe, further enhancing the company's reputation in the market. We will actively expand other photovoltaic products in Europe, including the residential power-generating system," said a statement from the company.

HTF's market value, which rose to $40 billion at its peak, dropped to $18.6 billion in May after the probe announcement.

Li Hejun, chairman of Hanergy Holdings, the parent company of HTF, saw his personal fortune dropping from more than HK$248.6 billion to HK$131.9 billion. He was the richest businessman in China in January.

Lin Boqiang, director of the Energy Research Center at Xiamen University, said that the fluctuations in HTF's third-party collaborations will inevitably affect the company's performance in the near future. But the possibility that HTF will look for new partners cannot be ruled out, Lin said.

"The most important thing for HTF is to resume trading in the Hong Kong stock exchange. After all, the solar industry still has the government's strong backing. But the suspension has cast doubts over the company's credibility, which naturally generates distrust among its partners," said Lin.

HTF posted net loss of HK$59.34 million during the first six months of the year, down 103 percent from the same period a year ago.